Thank you for making a difference.

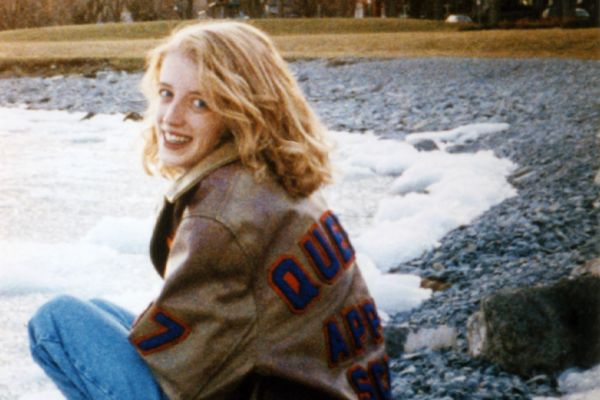

From supporting the leaders of tomorrow to funding world-changing research, your generosity is helping to make a difference at Queen’s and beyond. Here, we share the stories of donors like you and the students whose lives have been changed by your generosity.

Do you want to share your story? Contact us.