We recognize a university education is a major financial undertaking. All Queen's students share the ability to excel academically, but many may not be able to fully finance their university education.

Queen’s is committed to helping reduce barriers related to financial need or personal circumstances so you can focus on your studies, achieve your goals, and prepare to make your positive impact on the world.

We continue to build on a long-standing tradition of promoting access to university with expanded undergraduate admission bursaries and awards that increase financial accessibility and bring the full Queen’s student experience within reach for students with high financial need.

- In addition to Government Student Financial Aid, current students may be eligible to apply for Queen's General Bursary and the Work Study program for need-based assistance

- Graduate, Professional, Law, and Medicine Students – review financial aid available to you

- All programs are designed to supplement, not replace, your and your family's contributions

Specific Student Groups

All students with an offer of admission should have the opportunity to attend and remain at Queen's, regardless of their personal financial circumstances. We offer many types of financial aid designed to fit the needs of a diverse student body, including: part-time students, consecutive education students, student athletes, Queen's alumnae, mature women students, Indigenous students, Black and racialized students, and students with disabilities.

Find specific financial aidInternational Students

Queen's attracts a community of outstanding student scholars from across the globe. There are a variety of financial aid programs available to assist international and U.S. students studying at Queen's.

Find international student financial aidHow Queen's Financial Aid is Paid

Financial Aid and Awards administers all Queen’s merit-based scholarships and awards for Undergraduate and Professional programs (Law/Medicine/Smith Master's Programs), as well as Queen’s need-based awards and bursaries for all undergraduate, professional, and graduate students. Select each type of financial aid to view details on how it will be paid.

Contact the School of Graduate Studies for financial aid they administer.

To align with Queen’s term-based tuition due dates, we pay all Queen’s undergraduate aid granted at the start of each academic year in two equal disbursements. This includes all first-year undergraduate, renewable, upper-year, and exchange awards.

- The first disbursement of your aid will be applied to your SOLUS student account in August prior to the September fall term tuition deadline

- The second disbursement will be applied to your SOLUS student account in December prior to the January winter term tuition payment deadline

Queen’s General Bursary, including named awards granted under the General Bursary program, will be applied to your Queen’s SOLUS Student Account in late December in one disbursement. This payment will include your need-based aid for all terms of study, if you are enrolled, for the current academic year.

If eligible for Queen’s General Bursary, your award will first apply to any balance on your SOLUS Student Account.

Should you be eligible for a refund for all, or a portion of your General Bursary, your refund will automatically transfer to your bank account in early February, once the Student Awards Office has verified that your course load has not changed after open enrolment. Please do not submit a refund request.

Bader College upper-year bursaries will be applied to your Queen’s SOLUS Student Account for the term in which you are studying at the Bader College.

Convocation awards will be applied to your Queen’s SOLUS Student Account at the time they are awarded in one instalment. These awards will automatically refund, a refund request is not required.

- Log into SOLUS Student Centre

- Select the Financial Aid tile

- Select the View Financial Aid navigation

- View a summary of Financial Aid awards for each academic year (Year, Institution, and Amount)

- Select a particular academic year to view additional details, including:

- Award Summary for Academic Year displays: Term, Award, Amount, Status

- Disbursement Information displays: Scheduled Date, Award, Amount, and Status for a particular disbursement

- Select an Award Summary row to view Award details, including: Terms of Reference, Eligibility, Donor Thank You, Additional Information, Contact

- Select Change to select a different year or select SOLUS Student Centre to return to the main page

For all aid administered by the Student Awards Office, payments will be held in your SOLUS student account to be applied to all current and future university charges (e.g. fall term tuition and ancillary fees, fall term residence fees, winter term tuition, and winter term residence).

Refunds will be processed automatically in February.

Exception, convocation awards will be refunded automatically when you receive the award.

Students experiencing extenuating circumstances where a refund is needed before February:

- The Office of the University Registrar will review each request on a case-by-case basis

- You can email refunds@queensu.ca if you need a refund prior to February with an explanation of your extenuating circumstances

Please ensure your banking information has been updated in SOLUS. This information will enable Queen’s to refund any unapplied credit from an award to you via electronic funds transfer (EFT) to your bank account. Without this information, your refund cannot be processed.

Queen's Donors

The generosity of Queen's donors makes a significant impact within the Queen's community and in the lives of our students. Over forty percent of the assistance provided by Financial Aid and Awards is made possible through the generous contributions of Queen's donors.

- Generally, it is the person/s that provided the funding to support the award. In other cases, the donor may be deceased, and therefore it may be a family member of the donor

- Many Classes will establish a fund (e.g. Science 1959). In these cases, the donor representative is generally 1-3 people who are part of the Class executive. Some Classes do provide a newsletter to their members where they will provide updates

- In some cases, the donor may be a company or an organization. In these cases, the donor representative is generally one person within the organization. Some companies or organizations share newsletters/updates with their boards, committees, or staff members

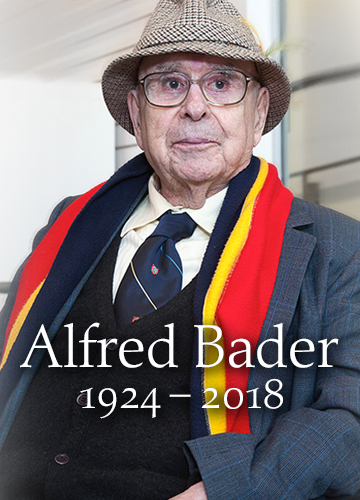

Queen’s remembers Dr. Alfred Bader, an accomplished student, dedicated alumnus, and one of the university’s most generous benefactors.

Queen's Student Financial Assistance Fund

This endowment fund enables the recognition and supports for the achievement and outstanding potential of Queen's students in all programs, all years, from acceptance to graduation. This fund enables Queen's to respond with agility to the changing needs and expectations of students today and in the future. Donations of all sizes are welcome and will be pooled in a common endowment to ensure maximum growth potential and impact on the quality of our students' educational experience. We encourage donors to consider this option as a way to maximize the impact of their giving.

Named Endowment

Endowed gifts ensure that the bursary, award, scholarship, or fellowship you establish lives on forever!

If you are interested in making a gift or pledge to Queen's University please visit the Giving to Queen's page.

If you are interested in learning more about our donors and their stories please visit the Donor Stories page.

Release of Information to Donors

We sometimes receive requests for information about award recipients from donors who generously support specific awards or from university departments who have contact with these donors. Although it is normal practice to release a recipient's name, we could be asked for your program of study, year, hometown, or Queen’s email address.

If you indicate “yes” to providing your information, in addition to your name, the following information is provided:

- Admission Scholarships and Bursaries: Degree Program, Hometown

- In-course Scholarships and Bursaries: Degree Program

- If a renewable award, the donor will be informed that the award has been renewed

If a donor requests for further information, we will provide them with your year of study, Queen’s email, and hometown (if applicable).

Donor or the Office of Advancement Requesting Your Email Address

- Sometimes a donor will be visiting campus and will want to meet the student/s who are benefiting from the award they support. In these situations, either the donor would like to personally invite you for a coffee or dinner, or alternatively, representatives of the Office of Advancement will be making appropriate arrangements for the donor’s visit to campus. These are always delightful opportunities for both the donor and the student

- In future years, after you have completed your degree you may be contacted as a past recipient of your award. You may be invited by the Office of Advancement to attend an event or consider giving a gift to further advance the award fund which helped to support your Queen’s education

Complete Privacy Restriction on Student Account

The donor will be informed the award has been granted, however, no personal information, including your name, will be provided to the donor.

Award Recipient Information: Posting on Websites, University Publications, or Media Releases

- Any information to be used in a broader public spectrum will require your explicit consent. Your consent will be sought in one of two ways:

- When you complete the Student Thank You to Donors Online Form you will be given the opportunity to consider this level of consent, or

- You will be contacted by the Office of The University Registrar (Student Awards) explaining the request and will be given the opportunity to consider this level of consent

- The only exceptions to this are convocation awards which are considered public information and are published in the appropriate convocation booklet/program

Queen's University is grateful for the generosity of donors who believe in the value of education. Our donors appreciate learning more about the student recipients who benefit from awards they have funded. The information you provide assists donors to understand the importance and positive impact of their generosity.