Canada must change gears, move faster on sustainable finance, concludes expert report

October 7, 2021

Share

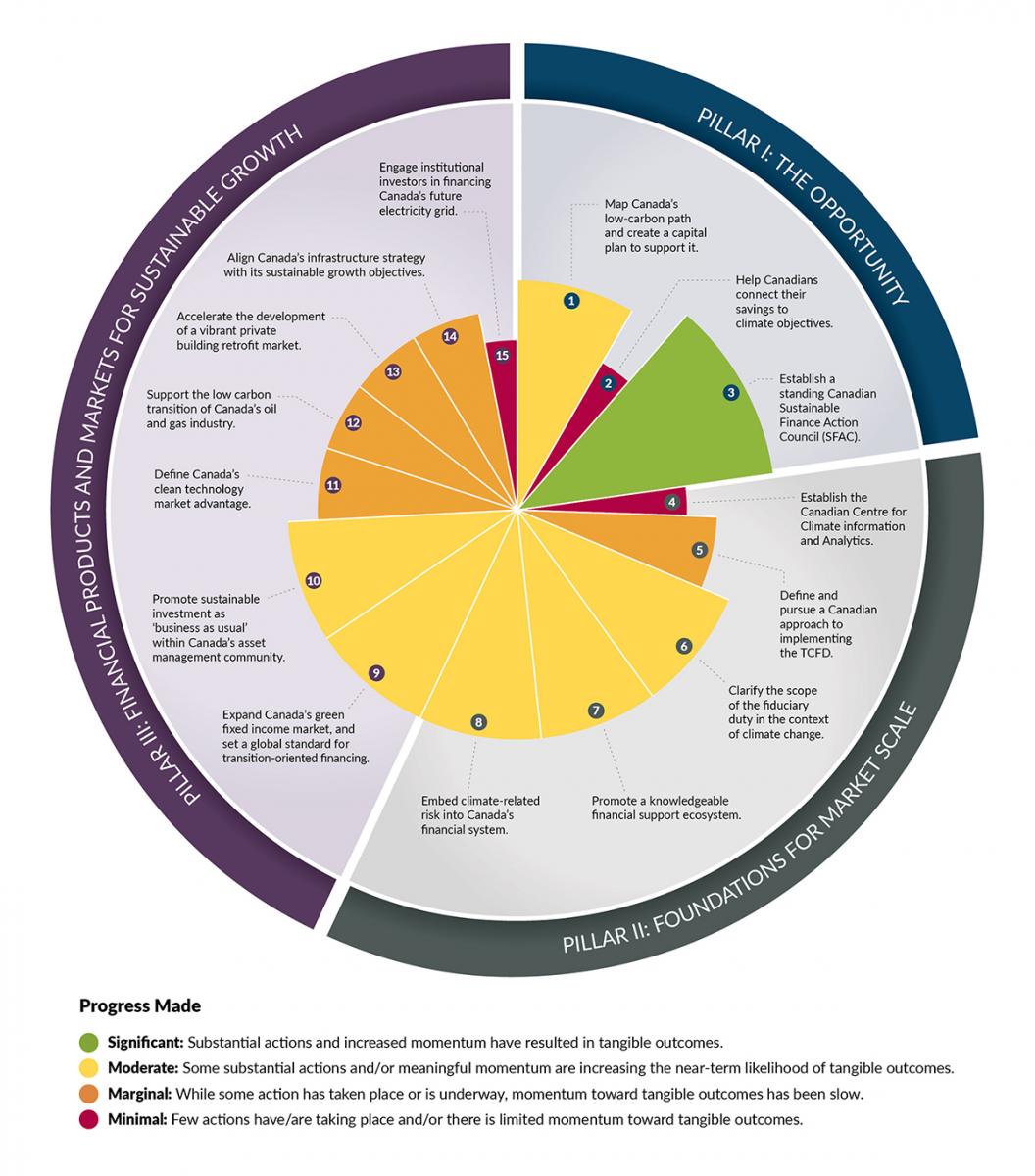

The Institute of Sustainable Finance launched a new report Thursday assessing Canada’s progress to scale sustainable finance and bolster Canadian competitiveness. The report, Changing Gears: Sustainable Finance Progress in Canada, uses the Expert Panel on Sustainable Finance’s 2019 recommendations as its starting point, and reveals that while progress has been made against the recommendations, Canada needs to move faster in aligning financial systems with a global low-carbon transition.

In his foreword to the report, Andy Chisholm, member of the Expert Panel and RBC Board Director, notes: “The central message from this ISF report is that we can and must do better; time is of the essence and Canada needs to up its game in its efforts to develop a competitive and sustainable economy, which supports an inclusive and successful transition to net-zero. This analysis is not a surprise, but it is another wake up call to the public and private sectors that timely implementation is critical.”

In his foreword to the report, Andy Chisholm, member of the Expert Panel and RBC Board Director, notes: “The central message from this ISF report is that we can and must do better; time is of the essence and Canada needs to up its game in its efforts to develop a competitive and sustainable economy, which supports an inclusive and successful transition to net-zero. This analysis is not a surprise, but it is another wake up call to the public and private sectors that timely implementation is critical.”

The report’s conclusion is informed by interviews with 35 leading Canadian experts in sustainable finance, including the Governor of the Bank of Canada, leaders from the “Big Five” Canadian banks, representatives from Canada’s largest insurance companies and pension funds, global market experts and investors. They note Canada is being outpaced globally – and its overly cautious approach has left the country in a “catch up” position. Meanwhile, public and private sector initiatives elsewhere continue to set the tone and direction for the sustainable finance policies and practices that are reshaping the global economic landscape.

“As the world rushes ahead, our public and private sector must shift into a higher gear,” says Sean Cleary, Chair of ISF and the report’s co-author. “By taking decisive action now, we can propel the Canadian-specific solutions that our industries need to thrive over the next three decades.”

According to the report’s findings, the next step is catching up fast on the table stakes – policy certainty and decision-useful information – which includes mandating disclosures and clarifying the scope of fiduciary duty in law and practice. This point is underlined by Margaret Childe, Head of Environmental, Social and Governance (ESG) for Manulife Investment Management, who notes in the report: “Wh(at still remains a challenge (for asset managers and investors) is the lack of clarity around what are the duties around the consideration of ESG factors in the investment process. Particularly on the asset owner side - pensions are looking for clarification.”

Simultaneously, the report underlines the importance of getting more investment flowing towards clean innovation in Canadian sectors, which will require cooperation between the public sector, private sector, and financial system.

“Our interviews reveal that from capitalizing on hydrogen and mineral-to-battery supply chain opportunities, to electrification, building retrofits, and building climate smart infrastructure – we know where money needs to flow to build the resilient economy and industries Canadian competitiveness depends on,” says Sara Alvarado, Executive Director for ISF.

The report also highlights Canada can step in and be the responsible supplier of choice for minerals. Andrew Hall, Director of Sustainable Finance for TMX Group, notes, “As a resource-based economy, Canada has a unique opportunity to be a major producer of low-carbon commodities and minerals contributing to a net-zero economy.”

The report outlines seven themes:

1. Accelerated action and execution is needed. Canada must catch up to Europe and the UK. The private financial sector is now moving faster than the government and regulators in Canada.

2. Our financial ecosystem needs to embrace change. There is strong support for Canada’s investment industry and financial institutions to shift their attitudes and behaviours.

3. Canadian-specific solutions are required. This includes sector-specific decarbonization pathways and transition scenarios that are supported by research within a Canadian context.

4. Sustainable finance must include more than climate. In the context of COVID-19 and Canada’s reckoning with the urgency of truth and reconciliation with Indigenous peoples, there is a need for a broader, more inclusive, and socially concerned sustainable finance conversation.

5. Canada’s net-zero transition requires a more unified approach and narrative. This means a more centralized voice and perspective for the country on sustainable finance and the net-zero transition, as well as strengthened communication.

6. While climate mitigation is critical, we need a greater focus on adaptation and resiliency. Climate resilience and adaptation have continued to be priorities as climate change impacts become more apparent.

7. Clean Innovation and other opportunities need more support. The importance of capitalizing on cleantech opportunities, as well as our lack of progress to date in doing so, is of utmost concern.

Visit the Institute for Sustainable Finance’s website to read the report, as well as review all past research projects.

___________________________________

About the Institute for Sustainable Finance

ISF was launched in 2019 as a Canadian-specific centre of expertise and collaboration for advancing sustainable finance. Housed at Smith School of Business at Queen’s University, ISF is independent and non-partisan. It focuses on developing research, education, and collaborations among academia, business and government that will improve Canada’s capacity for sustainable finance as the shift to a low-carbon economy occurs.

Sustainable finance is the integration of environmental, social and governance considerations into capital flows such as lending and investment, risk management, and financial processes including disclosure, valuations and oversight.

ISF’s work is generously supported by The Ivey Foundation (inaugural supporter), the McConnell Foundation, the McCall MacBain Foundation, the Chisholm Thomson Family Foundation, Smith School of Business, Queen’s University and Founding Contributors BMO, CIBC, RBC, Scotiabank and TD Bank Group.