ESG Policies

1. Please provide your ESG-related policies. Please provide a formal statement of your ESG-related policies if you have one.

The ESG Policy has been in place since 2014 and is updated periodically. 17Capital’s ESG policy is geared towards implementing controls to ensure awareness of and appropriately manage significant ESG risks in the investments at the time of acquisition, where it is possible to do so, and on an ongoing basis.

17Capital believes businesses that proactively manage ESG considerations will be better positioned to protect economic value, leading to future success and longevity. As a provider of NAV Finance, 17Capital invests in existing managers and funds rather than directly into underlying portfolio companies, which means it has a limited level of influence or control over most of the underlying portfolio companies. Without significant influence or control over underlying portfolio companies, 17Capital’s approach focuses on choosing to transact with managers that pursue appropriate ESG initiatives.

17Capital seeks to incorporate ESG at each stage of investing, from pre-screening through due diligence and ongoing monitoring consistent with and subject to its ESG policy and any applicable fiduciary or contractual duties.

17Capital is committed to reducing the impact of the firm’s activities on the environment, through a combination of reducing and offsetting greenhouse gas (GHG) emissions, reducing the waste the firm generates and increasing energy efficiency.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

17Capital incorporates ESG at each stage of investing, from pre-screening through due diligence and ongoing monitoring consistent with and subject to its ESG policy and any applicable fiduciary or contractual duties. Where possible, the emphasis will be on identifying key ESG risks raised by the target investment’s business model and industry sector (including the underlying portfolio companies) and ensuring (to the extent possible) that those risks are properly monitored and mitigated. 17Capital’s investment team, with the support of 17Capital’s ESG team, seeks to understand and assess the strength of ESG processes, policies, personnel and systems of the underlying fund managers.

For all potential investments, the firm identifies whether there are any material ESG issues associated with the investment. Please see an overview of the process below:

Pre-Investment Screening

During the screening phase, the investment team, in conjunction with the ESG team as required, consider a series of screening questions.

After screening questions have been answered, the Investment team produces an investment scorecard based on a proprietary scoring tool, which includes an assessment of responses to ESG screening questions. This scorecard is reviewed by the Investment Committee.

If any ESG issues are raised in the scorecard, further action may be taken to ensure any potential issues are properly investigated.

Pre-Investment Due Diligence

For all investments that pass screening, the team continues to further assess the manager’s ESG approach and capabilities. The 17Capital proprietary ESG questionnaire is used to guide the process.

The ESG questionnaire is distributed to potential counterparties and includes questions on ESG risks including:

- Environmental concerns (with specific questions on climate change).

- Social concerns (incorporating community, supply chain, human resources and health and safety-related issues).

- Corporate governance and ethical concerns.

After receiving the completed questionnaire from the underlying manager, the team assesses and rates the risk of each fund in combination with the initial screening information. Any significant ESG risks that are identified, including sectors with high ESG risks, may be discussed at interim Investment Committee meetings. An ESG section is also included within the Investment Memorandum.

The underlying portfolio of the investment is fully screened for any material ESG-related matters using RepRisk, an independent source of information. In case RepRisk discovers any material or significant results, these are communicated to the Investment team and followed up with the manager.

Finally, the Investment Committee will confirm that any ESG-related issues have been explicitly assessed and are considered when making the investment decision. Occasionally the Investment Committee may request specific ongoing monitoring actions to be taken following an investment.

3.a. Are you a signatory to the UNPRI?

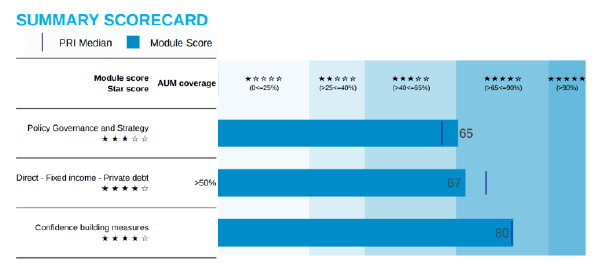

Yes, 17Capital became a signatory to the UN PRI in April 2021. 17Capital completed its first assessment and reporting cycle in 2024. In the Policy, Governance and Strategy module 17Capital’s score is 65 (3 stars), which places us above the PRI median and right on the cusp of achieving 4 stars for this category.

3.b. If you are signatory to other coalitions, please list them.

In addition to UNPRI, 17Capital is a member of the following coalitions/organizations and fully endorses and adheres to their respective codes of conduct:

- British Private Equity & Venture Capital Association (BVCA)

- Invest Europe

- ILPA Diversity in Action

- Initiative Climat International (iCI)

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

Please refer to question 3b). 17Capital published its first TCFD-aligned disclosures in June 2024. Please see link here.

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

As of February 2025, 17Capital has two dedicated ESG employees.

- Claire Hedley, Head of ESG, joined 17Capital in June 2022 and has over 16 years of experience in asset management and more than 7 years ESG experience across different alternative investment strategies.

- Carys Wright joined 17Capital in January 2024 as an ESG Associate. She has 3 years’ experience in sustainable finance, previously consulting financial services clients on their ESG strategies.

The ESG team are supported by the ESG Committee which comprises of senior team members from across the firm. Members of the ESG Committee are:

- Augustin Duhamel (Managing Partner)

- Claire Hedley (Head of ESG, Committee Chair)

- Fokke Lucas (Partner, Investments)

- Drew Fox (Head of Fundraising and Investor Relations, North America)

- Jack Mathew (Senior Counsel)

- Nicholas Evans (Director, Finance)

- Alex Walker (Head of Marketing & Communications)

- Myriam Vander Elst (Senior Advisor, Chief Engagement Officer at EPIC)

- Louisa Lambert (Director, People & Talent)

- Carys Wright (ESG Associate, Committee Manager)

The ESG Committee meets quarterly to discuss the progress of existing initiatives and any new ESG-related initiatives that could be implemented within the firm.

The Investment team is responsible for the ESG screening and due diligence. Any questions or concerns on ESG matters are escalated to the ESG team. ESG considerations are included in the investment committee memorandum for discussion at the Investment Committee as necessary.

The Risk & Portfolio Monitoring Committee meets quarterly, during which the ESG team presents updates on engagements with managers concerning portfolio companies with material ESG issues. If escalation is necessary, the matter is discussed within the Committee, and the ESG Committee is informed accordingly.

ESG and DEI objectives are included in the performance reviews and feedback for all employees, making ESG a formal part of roles and contributions to the firm. However, this is not formally linked to remuneration.

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

17Capital obtains ESG information through a comprehensive ESG due diligence and annual monitoring questionnaire. This includes questions on ESG risk assessment and management, governance, environmental management, climate change, and social performance. In 2024, 17Capital also launched the ESG Insights Report. The report was based on a detailed survey of 17Capital’s network of private equity GP’s, with 30 respondents spanning Europe, North America and the Middle East, representing a range of AUM and firm size. Please see link here.

The firm also uses a third-party service called RepRisk to monitor any potential issues on the manager and the underlying portfolio companies at the time of investment and on an ongoing basis. RepRisk monitors more than 800 underlying entities and in general the rate of ESG incidents or controversies is low across the portfolio. However, when material issues are flagged, the ESG team will engage with the manager for further details.

17Capital also uses external consultants and technology platforms on certain ESG projects, for example carbon accounting.

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

17Capital reports on its portfolio’s ESG approach on a quarterly basis as part of the quarterly investor report. ESG summaries are included in the quarterly fund reports as well as the following KPI's:

- Whether the managers have ESG policies in place

- Whether ESG is integrated into investment decisions

- Whether the manager is a UNPRI Signatory

- Whether the manager has made a net zero/Paris aligned commitment

- Whether the manager works with underlying portfolio companies on decarbonization

- Whether the manager works with underlying portfolio companies on DEI initiatives

Alongside this, the firm also publishes an annual ESG report and published its first TCFD-aligned disclosures in June 2024. Please see link here.

As mentioned previously, in 2024, 17Capital also launched the ESG Insights Report which is publicly available. This report identified prominent themes of the ESG landscape in private equity, with individual scorecards shared with each GP who contributed to the report. Please see link here.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? If so, how frequent are the reviews? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

17Capital reviews the ESG policy on an annual basis to ensure it is aligned with evolving industry standards and best practice. The last update in May 2024 included additional detail on engagement tools, such as ESG questionnaires, the ESG Accelerator programme, manager-specific interactions and industry collaboration. In 2024, 17Capital launched the ESG Accelerator programme in New York, with a session on labour standards. The Firm also held sessions in London focused on transition planning in private equity and CSRD double materiality assessments. Please see attached ‘17Capital ESG Policy’ for further information.

Climate

8. Describe how you identify, assess, and manage climate-related risks, and whether climate-related risks and opportunities are integrated into pre-investment analysis.

Climate change is considered as part of the ESG assessment throughout 17Capital’s investment process, from screening to monitoring post investment.

17Capital’s exclusions and sensitivities list ensures the investment strategy prohibits or limits exposure to underlying companies whose activities result in severe environmental damage and seeks to avoid exposure to underlying companies that are in some of the higher risk sectors such as fossil fuel exploration, extraction, mining or nuclear energy.

17Capital’s proprietary ESG questionnaire used to guide the due diligence process includes detailed questions on climate risk assessment, metrics and measurement at both the manager level and the underlying portfolio company level. These questions include:

- If any material climate risks or opportunities have been identified

- How climate risks are assessed, tracked and managed across the investment lifecycle (pre & post investment, including through engagement/ stewardship activities)

- The integration of physical and climate risk assessment in the investment process

- The measurement and reporting of carbon emissions

- The use of scenario analysis

Once 17Capital has received all responses to the ESG questionnaire, and followed up with managers as necessary, a proprietary risk assessment is completed, and a rating is assigned to the manager. This includes an environment score, which incorporates responses to climate specific questions, as well as an overall ESG score.

It is important for 17Capital to continue to monitor the management of ESG risks in its investments during their lifespan where practical. Any direct monitoring of portfolio companies regarding ESG management, including identification, mitigation and control of climate risks, is the responsibility of the underlying fund manager. 17Capital’s approach involves an annual ESG questionnaire and ensuring the underlying fund managers maintain their own ESG management processes, by reviewing the information published and ensuring the underlying fund manager communicates any key ESG risks, including climate risks, that arise. 17Capital sees engagement with underlying managers as an important part of the investment and monitoring process.

While 17Capital does not have control over the underlying managers or portfolio companies, it is able to use engagement to seek to influence progress and change. These engagements may include manager specific interactions such as a dialogue with underlying managers on a specific ESG topic, for example, a follow-up from the questionnaire or ESG reports, or industry-wide topics. 17Capital also uses its ESG Accelerator programme as a form of engagement, which has included voluntary carbon markets, biodiversity, transition planning in private equity and valuing carbon as environmental topics in the past.

Please refer to 17Capital’s TCFD report for further details.

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

Climate change considerations are embedded within 17Capital’s investment approach, forming part of the onboarding and monitoring due diligence process to identify, assess, and manage climate-related risks in our investments. 17Capital has also committed to aligning two funds to Article 8 of SFDR, across both our Strategic Lending and Credit funds, for which the environmental objective promoted is the implementation of decarbonization strategies.

17Capital has also undertaken an extensive desk-based review to assess climate related risks and any potential opportunities within underlying companies 17Capital has exposure to. The risks were assessed from both a qualitative and quantitative perspective, drawing from various climate risk databases and assigning risk scores. Climate risks were assessed using the risk drivers aligned with TCFD guidance.

Please refer to 17Capital’s TCFD report for further details.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate-related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

17Capital has not yet used scenario analysis. However, enhancing its ESG integration approach, including its climate strategy, to ensure a more thorough consideration of material topics throughout the investment process, is on the roadmap for 2025.

11. Do you track the carbon footprint of portfolio holdings?

Yes. 17Capital has collected portfolio company absolute emissions data for Fund 5 and Strategic Lending Fund 6 for the past two years. Where emissions data was not available from underlying managers, 17Capital used the GHG Protocol ‘top-down’ average data method, which involves using revenue data combined with environmentally extended input output (EEIO) data, following the PCAF methodology, to estimate the emissions from the portfolio company.

17Capital has recently onboarded Watershed, a carbon accounting platform, to support with financed emissions calculations for 2024.

If yes, how frequently? Please provide the results as of December 31, 2023 and describe the methodology and metrics used, including whether you have set targets and/or a net zero objective for reducing the portfolio’s footprint, and comment on any related progress over the past year.

Financed emissions are calculated on an annual basis. For more details on the methodology and results, please refer to the ‘17Capital Fund Level Financed Emissions Summary 2023,’ attached to this email. 17Capital has not set targets for reducing the portfolio’s carbon footprint.

17Capital’s investment strategy currently limits our ability to commit to net zero at this stage. 17Capital will however continue to monitor evolving industry standards and guidance.

12. What are your firm's emissions as of December 31, 2023? Please provide scope 1 and scope 2 emissions, and, separately, scope 3 emissions if available. Please demonstrate how/whether you are taking steps to reduce these emissions.

17Capital has measured and reported its operational emissions since 2021 and has purchased carbon offsets to become carbon neutral. Please see below the emissions for 2023:

- Scope 1: 57 tCO2e.

- Scope 2: 10 tCO2e (market based).

- Scope 3: 1,309 tCO2e (includes business travel, work from home and employee commuting emissions).

17Capital is committed to improving its environmental performance, through a combination of reducing and offsetting the firm's greenhouse gas (GHG) emissions, reducing waste and increasing energy efficiency, all at the firm level. 17Capital has been carbon neutral in its operations since 2021. The firm seeks to procure renewable energy for firm operations, and in 2023, 74% of the firm’s global electricity supply was from renewable sources.

Beyond the firm’s GHG emissions, 17Capital also carries out activities to reduce waste and increase energy efficiency. The 17Capital London and New York offices implement a number of initiatives, including, but not limited to:

- Paper reduction exercises and monitoring paper usage.

- Enhanced printer capabilities to reduce paper waste and unnecessary printing.

- Zero plastic bottles.

- Motion sensor lighting.

- iPads used for presentations to reduce printing.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments? Please answer on both an equally-weighted and market cap-weighted basis.

17Capital invests in managers and funds instead of directly into underlying portfolio companies, which means 17Capital has a limited level of influence regarding the direct management of ESG at the underlying portfolio company level.

17Capital does not currently collect this information systematically for Fund 4 and Fund 5, however we see efforts from our managers towards net zero, with a number of managers already measuring the carbon footprint of their management company. Several managers have set net zero reduction targets approved by the SBTi, committing their portfolio companies to also set SBTi validated targets by 2030.

14. How do you assess the credibility of a company’s emission reduction targets?

It is vital to 17Capital’s investment strategy to only invest alongside high quality, ESG-conscious organizations. We seek to assess ESG policies and procedures through our thorough due diligence and dedicated ESG review process (See question 2 for details).

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

Given the nature of the 17Capital investments (i.e. investments in existing fund managers), we are in the process of assessing the most meaningful approach with regards to forward-looking metrics on global temperature goals.

16. Has your firm produced a Task Force on Climate-Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

Yes. 17Capital published its first TCFD-aligned disclosures in June 2024. Please see link here.

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

N/A

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

The Board of Directors is 100% male, whilst 28% of senior leadership (director grade and above) are female.

17Capital has both a policy and various DEI initiatives in place. Please refer to the Equal Opportunities policy The DEI approach covers leadership, recruitment & selection, retention (development, promotion and pay) and culture. The topic is led by our People Director and Head of ESG, with continual support and input from Managing Partners, Partners, and senior leadership. Each component aims to encourage diversity of thought and inclusive ways of working. Please see details on different aspects of DEI policies and initiatives below, and refer to the DEI section of our ESG Report.

In 2021, the Firm became a signing signatory of ILPA Diversity in Action and as a result has created a formal policy towards improving diversity in the recruitment process.

In 2022, 17Capital was also one of the first sponsors of a UK programme called Access Alternatives, which aims to attract and recruit female and diverse candidates into the industry. The programme provides young female students from state schools or recent university joiners across the UK with a 1st and 2nd year internship, mentoring, coaching by an early careers coach and the CISI qualification. The program is designed to create a pipeline of potential candidates, that upon graduation are able to join the Firm.

We have partnered with a globally recognised DEI consultancy to provide advice and support on our DEI strategy and approach, they will also provide educational DEI workshops for all employees. In 2023 we introduced a DEI Leadership Council comprised of division heads globally, for collective responsibility on DEI. 17Capital has also introduced DEI events and awareness days throughout the year.

Monitoring

19. After making the decision to invest in a fund/company, what is your process for monitoring the investment’s ESG performance during your ownership period?

It is important for 17Capital to continue to monitor the management of ESG risks in its investments during their lifespan. Any direct monitoring of portfolio companies regarding ESG management is the responsibility of the underlying fund manager. 17Capital’s approach involves ensuring the underlying fund managers maintain their own ESG management processes, by reviewing the information published and ensuring the underlying fund manager communicates any key ESG risks that arise.

In particular:

- That the underlying fund managers provide updates on its ESG policies, implementation and any significant issues that arise annually.

- Follow up on any identified high-risk ESG issues as and when they arise through this reporting.

- The completion and review of the annual ESG questionnaire, which includes questions on risk assessment and management, governance, environmental management, climate change, and social performance.

- Monitor investments and external industry factors through the quarterly reporting and monitoring process and consider any ESG risks or impacts.

- Review RepRisk alerts for any material ESG related risks and issues and where applicable discuss with the underlying fund manager.

20. How do you ensure that your investments’ management devotes sufficient resources to ESG factors?

17Capital invests in underlying funds and managers and does not interact with the underlying portfolio companies. The firm will assess the ESG capabilities of the fund manager during the investment due diligence process and ensure their approach to ESG across portfolio companies is adequate. The assessment also includes team and resources dedicated to ESG.

21. Do you engage with your investments’ management teams on ESG issues? If so, please provide a recent example including the ultimate outcome.

As 17Capital typically lends to fund managers, it has little oversight on the underlying portfolio ESG factors. The Firm has explored the use of ESG-linked loans to encourage managers to improve on ESG; in 2022, 17Capital structured its first ESG-linked loan within 17Capital Fund 5 to incentivize the manager to make progress on ESG within their organisation. The firm believes thoughtful and selective use of ESG-linked loans in its financing will be an important tool for 17Capital to seek to drive change while also enabling our underlying managers to demonstrate their commitment to ESG.

As previously mentioned, the team will also often share ESG best practices and engage with managers on key ESG topics. The 17Capital ESG Accelerator program, which was launched in 2023, is also an important part of our engagement program with underlying managers. This is a unique program that draws together ESG leaders from across 17Capital's managers to network, share insights and collaborate, to put ESG at the core of private equity investing. In the past, 17Capital has hosted ESG Accelerators on topics including advanced carbon strategies, human rights, biodiversity, transition plans and CSRD double materiality assessments.

22. Does ESG performance influence your decision to exit an investment and/or reinvest with a fund manager?

As the firm provides financing, exits are defined as the repayment of financing. Due to this strategy, no ESG considerations are currently taken into account at the point of exit.

23. Do you measure whether your approach to ESG affected the financial performance of your investments? If yes, please describe your approach.

Due to the nature of 17Capital's strategy and the fact it is not directly investing in portfolio companies, 17Capital does not analyse whether ESG incorporation affects the financial returns of portfolio companies.