ESG Policies

1. Please provide your ESG‐related policies. Please provide a formal statement of your ESG-related policies if you have one.

TorQuest’s ESG Policy and Diversity & Inclusion Policy are publicly available on our corporate website at TorQuest | Responsible Investing.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

Yes. TorQuest believes that evaluating Environmental, Social and Governance considerations — for itself and each potential investment — is consistent with providing the best possible returns to its investors.

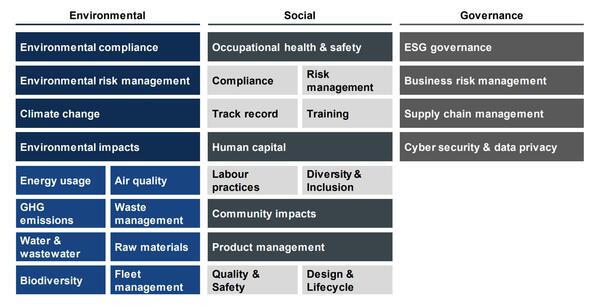

ESG is an effective lens for identifying risks and creating value throughout the investment lifecycle, across locations and markets, and in the transition to a low-carbon economy. Our ESG Policy includes additional detail about the most relevant ESG considerations for TorQuest. A high-level summary of those topics is presented here:

3.a. Are you a signatory to the UNPRI?

Yes

3.b. If you are signatory to other coalitions, please list them.

N/A

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

TorQuest’s ESG policy, strategy and practices are informed by several international standards, leading practices, and expert advice.

In particular, the TorQuest team and its advisors refer to guidance from the Sustainability Accounting Standards Board (“SASB”), Principles for Responsible Investment (“PRI”), Taskforce for Climate-related Financial Disclosures (“TCFD”) and, as required, industry-specific frameworks, such as the World Bank Group’s International Finance Corporation Environmental, Health and Safety Industry Guidelines. TorQuest aligns its sustainability measurement approach to the ESG Data Convergence Initiative (“EDCI”), while also identifying industry-specific KPIs at the asset level.

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

TorQuest’s Chief Legal Officer (CLO) and Chief Financial Officer (CFO) are accountable for the firm’s Responsible Investment Policy. The Company’s investment professionals and portfolio management team support ongoing engagement with portfolio companies on sustainability-related matters. All employees must familiarize themselves with the Responsible Investment Policy and adhere to its objectives in their work.

The Responsible Investment Policy is to be interpreted in accordance with (i) applicable local laws and regulations; and (ii) other relevant TorQuest policies and procedures, such as those set forth in the Firm’s Compliance Manual and Code of Ethics and Human Resources Policies & Procedures Manual.

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

For portfolio assets, TorQuest obtains ESG information/data directly from management teams (typically with guidance from third party experts) through an annual ESG data collection process and ongoing engagement through the Board of Directors.

For potential investments, TorQuest obtains ESG information/data through targeted information requests, dataroom reviews, Q&A sessions, site visits and advisor due diligence activities.

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

TorQuest communicates ESG-related information to clients via quarterly investor reports, annual general meetings, meetings with investors and responses to questionnaires. Other communications are publicly available on our corporate website.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

Yes. TorQuest regularly assesses the effectiveness of its ESG approach, considering evolving international standards, peer practices and investor feedback.

In some instances, TorQuest may have limited ability to control or significantly influence the integration of ESG considerations. This may occur where TorQuest is a minority shareholder or where other circumstances affect TorQuest’s ability to assess, set or monitor ESG-related performance. In these cases, TorQuest makes reasonable effort to encourage investment partners and portfolio company management to consider TorQuest’s ESG-related principles.

Climate

8. Describe how you identify, assess, and manage climate‐related risks, and whether climate-related risks and opportunities are integrated into pre‐investment analysis.

TorQuest believes that climate change presents diverse challenges and opportunities for the private equity industry, including physical and transition risks. TorQuest integrates climate change considerations across each stage of the investment lifecycle. For example:

- At the screening stage, we do not make investments directly in interests in oil, gas or mineral rights or commodities, or in issues where their primary business is in these areas.

- During ESG due diligence, TorQuest’s approach includes specific questions and data requests related to climate change mitigation and related topics, such as air emissions, energy consumption and fuel usage. ESG due diligence also includes consideration of climate-related physical and transition risks. Where additional subject matter expertise is appropriate, investment teams use external consultants, advisors and other resources to help mitigate risks related to sustainability and assess value creation opportunities.

- Key ESG due diligence findings, inclusive of climate-related risks and opportunities, are documented in a comprehensive memorandum presented to and deliberated by the Firm’s Investment Committee in the course of approving the investment.

- In asset management, TorQuest continues to lay the foundations for a climate initiative that is resilient to differing climate scenarios and market developments. The initial focus is on identifying and baselining ESG performance across TorQuest’s holdings, which includes an assessment of greenhouse gas emissions and carbon intensity. The initiative is led by TorQuest’s portfolio management and investment teams and includes direct engagement with portfolio company leadership. Similar to many private equity investors in the middle market, this will be a multi-year exercise tailored to the unique considerations of our portfolio companies.

- TorQuest further monitors the climate-related performance of portfolio companies through a combination of industry- and company-specific metrics as per the SASB industry standards, as well as industry agnostic-metrics like the KPIs aligned to the ESG Data Convergence Initiative (EDCI).

- TorQuest has also prioritized the sustainability and carbon intensity of our own operations. In particular, we have taken steps to reduce business travel where possible, encourage a paperless environment, replace the use of plastic water bottles with water stations, and minimize food waste.

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

Potential risks include acute and chronic hazards, both directly to portfolio company assets and indirectly to their value chains. Opportunities include the role our portfolio holdings can play in enabling the transition to a low-carbon economy and supporting economy-wide adaptation to physical climate impacts.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate‐related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

See response to item 8.

11. Do you track the carbon footprint of portfolio holdings?

Yes.

If yes, how frequently? Please provide the results as of December 31, 2023 and describe the methodology and metrics used, including whether you have set targets and/or a net zero objective for reducing the portfolio’s footprint, and comment on any related progress over the past year.

For calendar year 2024, TorQuest is still in the process of measuring GHG emissions (tonnes carbon dioxide-equivalent) across the portfolio. The metrics used are Scopes 1 and 2 location-based GHG emissions. TorQuest would be pleased to discuss these results once available.

12. What are your firm's emissions as of December 31, 2023? Please provide scope 1 and scope 2 emissions, and, separately, scope 3 emissions if available. Please demonstrate how/whether you are taking steps to reduce these emissions.

See response to item 11.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments? Please answer on both an equally‐weighted and market cap‐weighted basis.

N/A

14. How do you assess the credibility of a company’s emission reduction targets?

N/A

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

N/A

16. Has your firm produced a Task Force on Climate‐Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

N/A

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

N/A

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

TorQuest strives to be an inclusive employer and values the many benefits that diversity leads to for our Company culture, such as new ideas, fresh perspectives, employee wellbeing and a sense of belonging. TorQuest believes that the promotion of diversity makes prudent business sense and leads to better investment outcomes.

TorQuest has the following policies and procedures that promote a positive culture and an inclusive, equitable, and diverse workforce:

- Relevant policies include the Diversity & Inclusion Policy, Workplace Harassment and Discrimination Policy, Compliance Manual, Code of Ethics, and Human Resources Manual.

- TorQuest’s Diversity & Inclusion Policy maintains its strategic approach to attract, develop and retain a diverse team of employees.

- Diversity & Inclusion initiatives and achievements are included in the firms quarterly reporting.

- Communications to portfolio company leadership describing TorQuest D&I initiatives.

The Company has also established the TorQuest Scholars Program, a mentorship program aimed at providing black-identifying students in the Greater Toronto Area (GTA) with a transformational career experience that exposes them to various career paths in finance and the broader business sector. Beginning with a four-month in-person internship or co-op, TorQuest Scholars are provided with on-the-job mentorship and a unique career experience to work alongside and shadow the firm’s various business units, including the investments team, business development team, and value creation team. The program is designed to attract students that will benefit most from exposure to the firm’s business and external network, including students who may not have previously considered a career in finance or business within an academic setting. Following completion of their internship or co-op, TorQuest Scholars are provided with continuous support and guidance from the firm, with a view to establishing a long-term relationship with the TorQuest Scholars and supporting them in achievement of their career aspirations. Additional information on this program is available on our corporate website at https://torquest.com/scholars.

Monitoring

19. After making the decision to invest in a fund/company, what is your process for monitoring the investment’s ESG performance during your ownership period?

TorQuest’s process for monitoring ESG performance is based on active and continuous engagement with portfolio companies’ leadership teams and through our representation on boards of directors.

TorQuest works with each portfolio company to improve and optimize ESG value creation opportunities. TorQuest’s ESG workstream aims to: (i) understand material ESG factors related to the portfolio company’s business; (ii) conduct a baseline assessment of the portfolio company’s ESG approach to date; (iii) and identify possible next steps towards enhancing their ESG approach (e.g., ESG policy, framework, strategy).

In 2024, TorQuest continued the process of baselining ESG performance across holdings. Like many investors of TorQuest’s scale and given the middle-market, entrepreneurial nature of the portfolio companies TorQuest owns, this is a multi-year exercise tailored to the unique considerations of TorQuest portfolio companies.

This baselining of ESG performance includes collecting a minimum of six ESG performance KPIs from portfolio companies to monitor annually, each aligned with the EDCI. These are: (i) greenhouse gas (GHG) emissions; (ii) renewable energy consumption; (iii) health and safety performance; (iv) Board composition; (v) attraction, retention and employee engagement; and (vi) employee engagement. These metrics are measured across all TorQuest’s in-scope portfolio companies, with additional industry-specific metrics informed by SASB industry standards and tracked at management’s discretion with a view to company-specific business objectives.

Progress against ESG strategy and deployment is discussed regularly by company boards, with many portfolio companies reporting and tracking progress against quantitative metrics.

20. How do you ensure that your investments’ management devotes sufficient resources to ESG factors?

TorQuest’s evaluation of an investment company’s ESG approach, policies and practices begins in ESG due diligence at the transaction stage and continues throughout the hold period.

21. Do you engage with your investments’ management teams on ESG issues? If so, please provide a recent example including the ultimate outcome.

Yes. TorQuest actively engages with portfolio management teams through our representation on boards of directors. In addition, in the previous calendar year, we hosted an ESG roundtable among our portfolio companies’ leadership teams to share current practices, challenges and opportunities. The session was attended by 25+ representatives from 15 portfolio companies. TorQuest maintains an internal site dedicated to ESG that all management teams can access for ESG resources.

22. Does ESG performance influence your decision to exit an investment and/or reinvest with a fund manager?

ESG performance is among the considerations that influence our investment decisions.

23. Do you measure whether your approach to ESG affected the financial performance of your investments? If yes, please describe your approach.

Given the pervasive nature of ESG risks and opportunities, attributing overall financial performance to specific ESG factors is difficult. TorQuest more broadly ensures that its Board representatives and portfolio managers are knowledgeable about ESG and opportunities to integrate ESG into portfolio company strategy, governance, risk management and performance measurement.