ESG Policies

1. Please provide your ESG-related policies. Please provide a formal statement of your ESG-related policies if you have one.

BlackRock's approach to Sustainability and the Low-Carbon Transition:

BlackRock’s role is to offer choice to help meet our clients’ objectives, transparency into how those choices could impact portfolios, and our research-based perspective on how structural trends could impact asset prices and investments over time. We continue to innovate for and with clients. As a result, our policy is to work with clients to help them meet their unique investment goals and objectives. For more information on how we approach sustainability as a fiduciary, please visit: https://www.blackrock.com/corporate/insights/our-approach-to-sustainability

BlackRock’s approach to ESG Integration:

BlackRock’s role as a fiduciary to our clients is to help them navigate investment risks and opportunities. The money we manage is not our own – it belongs to our clients, many of whom make their own asset allocation and portfolio construction decisions. BlackRock considers many investment risks in our processes. In order to seek the best risk-adjusted returns for our clients, we manage material risks and opportunities that could impact portfolios, including financially material Environmental, Social and/or Governance (ESG) data or information, where available.

BlackRock’s clients have a wide range of perspectives on a variety of issues and investment themes. Given the wide range of unique and varied investment objectives sought by our clients, BlackRock’s investment teams have a range of approaches to considering financially material E, S, and/or G factors. As with other investment risks and opportunities, the relevance of E, S and/or G considerations may vary by issuer, sector, product, mandate, and time horizon. Depending on the investment approach, this financially material E, S and/or G data or information may help inform due diligence, portfolio or index construction, and/or monitoring processes of our portfolios, as well as our approach to risk management. For additional information see our full ESG integration statement:

https://www.blackrock.com/corporate/literature/publication/blk-esg-investment-statement-web.pdf

BlackRock’s approach to Investment Stewardship:

As stewards of our clients' assets, BlackRock engages with companies and vote at shareholder meetings to promote sound corporate governance and business practices that support companies in delivering durable, risk-adjusted financial returns over time.

BlackRock’s stewardship policies are developed and implemented by two independent, specialist teams, BlackRock Investment Stewardship (BIS) and BlackRock Active Investment Stewardship (BAIS). While the two teams operate independently, their general approach is grounded in widely recognized norms of corporate governance and shareholder rights and responsibilities.

BIS (60+ professionals) is responsible for engagement and voting in relation to clients’ assets managed by certain index equity portfolio managers. BAIS (10+ professionals) partners with BlackRock’s active investment teams on company engagement and voting in relation to their holdings. Both teams may engage companies on material sustainability-related risks and opportunities in their business models.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

BlackRock’s ESG investment statement, which is published on our website (at

https://www.blackrock.com/corporate/literature/publication/blk-esg-investment-statement-web.pdf) for full transparency, details our commitment to integrate sustainability insights—often referred to as ESG, or environmental, social and governance, insights—into our investment processes as a tool to identify risks and opportunities that are often not captured by traditional financial metrics. It explains our ESG integration philosophy, discusses the roles and responsibilities for ESG integration work and the governance structure for these activities, and provides an overview of our approach to ESG integration. This statement applies to all investment divisions and investment teams at the firm,and therefore applies to all assets under management and assets under advisory. The statement is reviewed at least annually and is updated when necessary to reflect changes to our approach or our business.

All investment groups within BlackRock have developed strategy-level and platform-level sustainable investment or ESG integration policies or statements covering their investment activities. Our global statement underpins these and provides a cohesive structure for sustainable investing at BlackRock.

For more details, kindly refer to our ESG Statement given in Question 1 above.

3.a. Are you a signatory to the UNPRI?

Yes.

BlackRock has been a signatory to the United Nations supported Principles for Responsible Investment (PRI) since 2008. As a signatory, BlackRock supports PRI’s aspirational and voluntary principles, where consistent with our fiduciary duties. They are:

- Principle 1: Signatories will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: Signatories will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: Signatories will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: Signatories will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: Signatories will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: Signatories will each report on our activities and progress towards implementing the Principles.

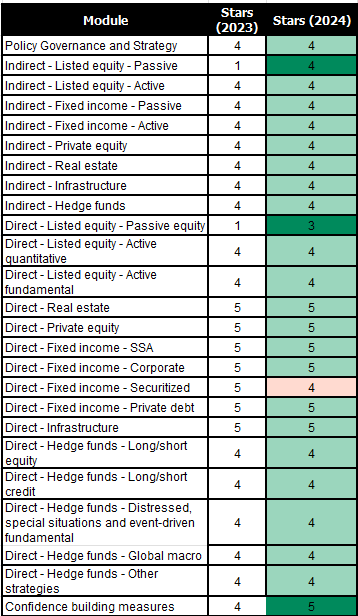

2024 Assessment Report Results:

Overall, BlackRock excelled in the majority of this year’s PRI assessment, maintaining or improving its scores across more than 95% of this year’s assessment and receiving a four- or five-star rating for more than 95% of all PRI modules.

Please refer to our full Transparency Report (Appendix A) and Summary Scorecard (Appendix B) for additional information.

The table below summarizes BlackRock’s 2024 PRI Assessment Scores:

Red = decrease in rating, light green = no change, dark green = improvement:

3.b. If you are signatory to other coalitions, please list them.

BlackRock is a member of several industry associations, including those that are related to sustainability and the transition to a low-carbon economy, so that we can participate in dialogue with governments, companies, and financial institutions on matters that may impact our clients’ portfolios. By being part of these forums, we are able to represent clients’ interests and engage in conversations on their behalf. We do not make commitments, set targets or coordinate our votes or investment decisions with any external group or organization. BlackRock’s investment decisions are governed strictly by our fiduciary duty to clients.

BlackRock will continue to review its external memberships as ordinary course of business. The list below reflects updated organizations and initiatives as of January 2025. Please note that this list is not exhaustive. initiatives as of 31 December 2023. Please note: this list is not exhaustive.

| 100 Women in Finance | 2017 | Impact Investing Institute (III) | 2019 |

| Abu Dhabi Sustainable Finance Declaration | 2020 | Institutional Investors Group on Climate Change (IIGCC) | 2004 |

| American Clean Power Association | 2016 | Integrity Council for the Voluntary Carbon Market(ICVCM) | 2020 |

| American Council on Renewable Energy | 2013 | Intentional Endowments Network (IEN) | 2016 |

| Ascend Foundation's 5- Point Agenda | 2021 | International Corporate Governance Network (ICGN) | 2008 |

| Asian Corporate Governance Association | 2011 | Investor Group on Climate Change (IGCC) | 2004 |

| Better Building Partnership | 2020 | Investor Stewardship Group | 2017 |

| Black Women in Asset Management | 2022 | Italian Alliance for Sustainable Development (ASviS) | 2022 |

| Black Young Professionals | 2023 | IWEA Ltd- Wind Energy Ireland | 2012 |

| Broadridge Independent Steering Committee | 1999 | LGBT Great | 2020 |

| Business for Social Responsibility | 2020 | Management Leadership for Tomorrow | 2020 |

| Business Roundtable | 2019 | Mexico Green Finance Consultative Council | 2023 |

| Canadian Coalition for Good Governance | 2005 | National Minority Supplier Development Council | 2021 |

| Catalyst | 2018 | One Planet Asset Managers Initiative | 2019 |

| CEO in Action | 2017 | Out & Equal | 2009 |

| Ceres Investor Network on Climate Risk and Sustainability | 2008 | Out Leadership | 2022 |

| Chief Executives for Corporate Purpose | 2021 | Paris Institute for Sustainable Finance | 2022 |

| Climate Action 100+* (CA100+) | 2024 | Partnership for Carbon Accounting Financials (PCAF) | 2021 |

| Climate Bonds Initiative Partnership | 2015 | Responsible Investment Association Australasia (RIAA) | 2011 |

| Council of Institutional Investors | 2006 | Singapore Sustainable Finance Association (SSFA) | 2023 |

| Denmark's Sustainable Investment Forum | 2021 | Solar Energy UK | 2019 |

| Disability In | 2021 | Spain Sustainable Investment Forum | 2020 |

| Dutch Association of Investors for Sustainable Development (VBDO) | 2018 | Sustainable Markets Initiative (SMI) | 2021 |

| Dutch National Climate Agreement | 2019 | Sweden Sustainable Investment Forum | 2021 |

| Ellen MacArthur Foundation | 2019 | Swiss Sustainable Finance (SSF) | 2020 |

| Eumedion Corporate Governance Forum | 2010 | Tanenbaum | 2022 |

| Focusing Capital on the Long Term (FCLT) | 2013 | Taskforce on Nature-related Financial Disclosures (TNFD) | 2021 |

| Glasgow Financial Alliance for Net Zero (GFANZ) | 2021 | The Diversity Project | 2018 |

| Global Impact Investing Network (GIIN) | 2020 | The Equity Collective | 2021 |

| Global Real Estate Sustainability Benchmark (GRESB) | 2011 | The Robert Toigo Foundation | 2018 |

| Green and Sustainable Finance Cluster Germany | 2022 | Transition Pathway Initiative (TPI) | 2021 |

| ICMA Green Bond Principles | 2015 | UN Principles for Responsible Investing (UN PRI) | 2008 |

*BlackRock has transferred its membership in CA100+ to our international business, BlackRock International, and BlackRock Inc. is no longer a member of CA100+

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

BlackRock provides meaningful information to stakeholders via its disclosures. As part of this, BlackRock’s voluntary sustainability reporting framework includes the firm's

TCFD Report and GHG Emissions Report for its corporate operational emissions. BlackRock also periodically publishes a SASB-aligned Sustainability Disclosure, which the firm is working to update based on 2024 data. BlackRock also makes available sustainability-related disclosures in line with regulatory requirements in certain jurisdictions where it operates. As sustainability-related disclosure frameworks, data and risk management methodologies evolve, BlackRock will continue to review its approach to sustainability-related disclosures.

For further information, please see the following websites:

Corporate Sustainability Website

Environmental Sustainability Website

Additionally, please refer to our response to Question 3b above.

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

ESG Oversight

Board oversight

BlackRock’s Board engages with senior management on near- and long-term business strategy and reviews management’s performance in delivering on BlackRock’s framework for long-term, financial value creation on behalf of clients. Sustainability, including climate-related issues is a critical component of the firm’s overall business strategy and the objectives of senior management over which the Board has oversight.

The Nominating, Governance & Sustainability Committee of the Board ("NGSC”) oversees investment stewardship, public policy, corporate sustainability, and social impact activities. The NGSC periodically reviews corporate and investment stewardship-related policies and programs, as well as significant publications relating to environmental (including climate), social, and other sustainability matters.

BlackRock’s Board is responsible for overseeing risk management activities. The Risk Committee of the Board (“Risk Committee”) assists the Board in overseeing, identifying, and reviewing enterprise, fiduciary, and other risks, including those related to climate and other sustainability risks, that could have a material impact on the firm’s performance.

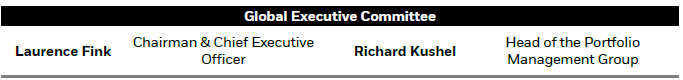

Management oversight

BlackRock’s senior management oversees progress towards BlackRock’s strategic objectives, including climate- and sustainability-related objectives. The below management committees that share responsibility for management of various climate and other sustainability-related risks and opportunities.

Global Executive Committee: Led by the CEO and consisting of BlackRock’s senior leadership team, the GEC sets the strategic vision and priorities of the firm and drives accountability at all levels. It is actively involved in the development of, and receives updates on, BlackRock’s sustainability strategy.

The Investment Sub-Committee of BlackRock’s Global Executive Committee (GEC) oversees firm wide investment processes, including ESG integration. Members of the Sub-Committee include the firm’s President, Head of Portfolio Management and Chief Risk Officer as well as global heads or sponsors of all of BlackRock’s major investment platforms. The RQA Sustainability Risk team reports on ESG integration to the GEC Investment Sub-Committee at least annually.

BlackRock employs a three-lines of defense approach to managing material investment risks in client portfolios.

- BlackRock’s investment teams and business management are the primary risk owners, or first line of defense.

- BlackRock’s risk management function, the Risk and Quantitative Analysis (RQA) group is responsible for BlackRock’s Investment and Enterprise risk management frameworks and serves as a key part of the second line of defense along with BlackRock Legal and Compliance. RQA evaluates investment risks, including financially material E, S and/or G risks as part of regular investment risk management processes and, where applicable, during regular reviews with portfolio managers. This helps to ensure that such risks are understood, deliberate, and consistent with client objectives. RQA also has a dedicated Sustainability Risk group that partners with risk managers and businesses to oversee sustainability risk across the platform.

- The third line of defense, BlackRock’s Internal Audit function, operates as an assurance function. The mandate of Internal Audit is to objectively assess the adequacy and effectiveness of BlackRock’s internal control environment to improve risk management, control, and governance processes.

ESG Compensation

BlackRock awards discretionary annual bonuses related to the performance of the firm, its business units and individual performance. The funding methodology is linked to the firm's operating income, as adjusted, and further allocated based upon a business' annual financial and non-financial results in a process that includes reference to sustainability-related objectives and outcomes. Annual compensation outcomes for select senior-most corporate leaders, including BlackRock's CEO and President, are determined using an annual performance evaluation framework where performance towards Organizational Strength objectives, which includes certain corporate sustainability objectives, are considered and this performance is weighted as 25% of the total evaluation (financial results are weighted 50%, and Business Strength objectives -including certain client-oriented sustainability objectives- are weighted the final 25%).

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

We are continuously expanding access to high quality data and information sources through Aladdin for public market securities. BlackRock’s investment teams have access to a range of third-party data sets and internal materiality-focused ratings across core Aladdin tools, allowing investors to identify appropriate data or information for their unique investment process. Examples of third-party data providers we leverage include MSCI ESG, Sustainalytics, and Clarity AI*.

The Aladdin platform also offers a set of analytic tools, including Aladdin Climate, which amongst other analytics, provides investors with scenario analysis capabilities to help identify financially material investment risks and opportunities associated with the physical impacts of a changing climate and the uncertain transition to a low-carbon world.

In private markets, which inherently have less availability and standardization of financially material E, S and/or G metrics relative to public markets, we continue to progress multiple efforts to better collect, aggregate, evaluate and measure financially material E, S and/or G data or information from private companies and third parties.

Given the evolving nature and significant growth of the Sustainable data landscape, BlackRock continuously conducts diligence on both new and existing sustainable datasets. Our approach considers both qualitative and quantitative factors as well as a data provider’s operating model. This approach enables an impartial substantiation of dataset usefulness, and evaluation of the data for risks, availability, effective use, and governance processes.

*BlackRock has a minority investment in Clarity AI.

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

BlackRock’s Performance on Material Sustainability Issues

BlackRock provides meaningful information to stakeholders via its disclosures. As part of this, BlackRock’s voluntary sustainability reporting framework includes the firm's TCFD Report and GHG Emissions Report for its corporate operational emissions. BlackRock also periodically publishes a SASB-aligned Sustainability Disclosure, which the firm is working to update based on 2024 data. BlackRock also makes available sustainability-related disclosures in line with regulatory requirements in certain jurisdictions where it operates. As sustainability-related disclosure frameworks, data and risk management methodologies evolve, BlackRock will continue to review its approach to sustainability-related disclosures.

For further information, please see the following websites:

Corporate Sustainability Website

Environmental Sustainability Website

Sustainable Reporting

Blackrock is committed to enhancing transparency and availability of reporting around sustainable investing. Today, BlackRock products (regardless of sustainability objectives) have the following data publicly available on our websites, where sufficient and reliable data is available:

- Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and/or governance characteristics.

- Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

- ESG integration statement for the fund. BlackRock considers many investment risks in our processes. In order to seek the best risk-adjusted returns for our clients, we manage material risks and opportunities that could impact portfolios, including financially material Environmental, Social and/or Governance (ESG) data or information, where available. See our Firm Wide ESG Integration Statement for more information on this approach and fund documentation for how these material risks are considered within this product, where applicable.

- Regulatory disclosures, such as for SFDR.

- Implied Temperature Rise (ITR), where sufficient and reliable data is available. The ITR metric incorporates both current emissions intensity and forward-looking assessments of projected emissions to produce a temperature indication, expressed in half-degree Celsius bands. ITR can help shed light on whether indexes and portfolios are progressing toward the temperature goal of the Paris Agreement, which calls for countries to limit global warming to well below 2°C, and ideally 1.5°C.

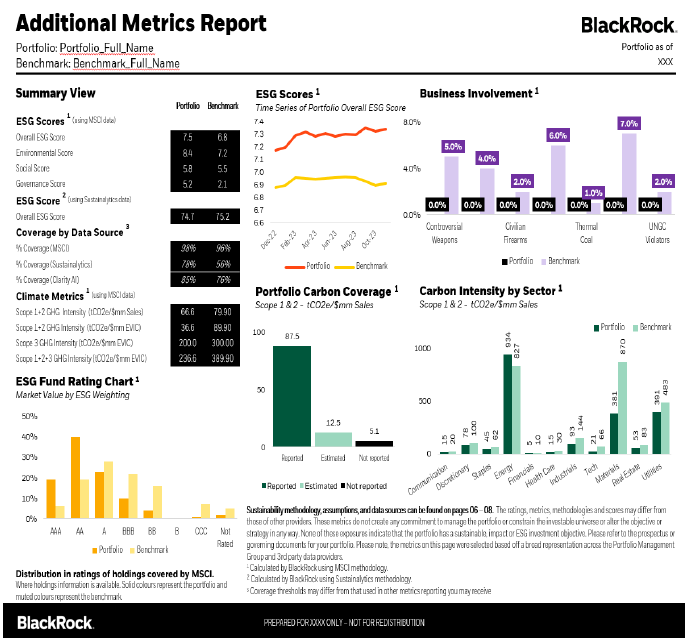

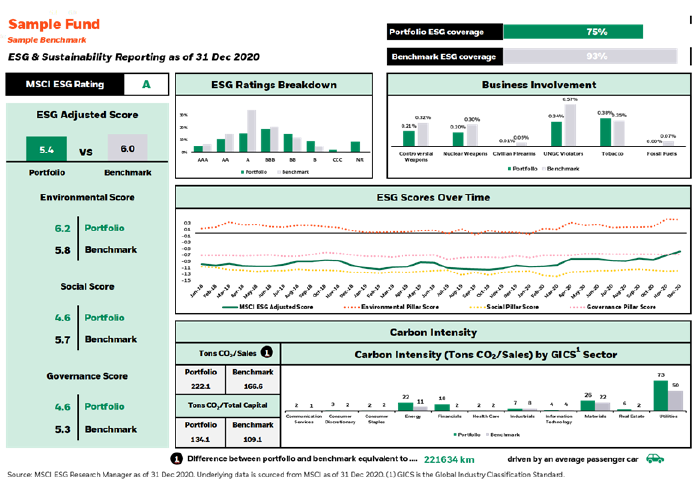

For clients who are invested in actively managed funds on our sustainable product platform, we may also be able to provide additional reporting which covers metrics such as time series of portfolio ESG scores, portfolio carbon coverage, carbon intensity by sector, and scope 1,2, and 3 emissions metrics, among others. An example of this reporting is shown below. For more information on this reporting and if it is available for your investments, please contact your relationship manager.

For clients who are invested in impact funds, additional impact reporting may be provided. Metrics and KPIs may vary by strategy but are grounded in industry best practices. In addition, BlackRock is a signatory to the Operating Principles of Impact Management. Our disclosure statement can be found here.

Example reporting for sustainable products. Please contact your relationship manager for further information.

Thought Leadership From The Blackrock Investment Institute:

Investment perspectives - BlackRock Investment Institute Transition Scenario (BIITS):

In July 2023, the BlackRock Investment Institute published our framework for tracking the transition to a low-carbon economy to help assess the investment opportunity and risks it may bring, ‘Tracking the low-carbon transition.’

The report can be found here.

In February 2025, BII released the paper “Evolving energy transition, evolving opportunities”, building on the outlook we outlined in 2023. This paper takes stock of key recent developments, including the impact of colliding mega forces, intensifying public subsidies, and shifting policies, and how these may alter the transition path and investment opportunity set from here.

Capital at risk: nature through an investment lens:

In August 2024, BlackRock released ‘Capital at risk: nature through an investment lens’. As natural resources come under growing strain, we see new risks and opportunities emerging for investors. An expanding data landscape will be key to tracking both. The report can be found here.

Climate Resilience: An Emerging Investment Theme:

In December 2023, Blackrock Investment Institute published ‘Climate resilience: an emerging investment theme'. This paper focused on moving beyond risk assessments to climate resilience as an investment theme.

The report can be found here.

Emerging markets: financing the transition:

In November 2023, BlackRock released our emerging markets focused transition paper. Emerging markets are pivotal to the global transition to a low-carbon economy. Reforms to plug the shortfall in investment could present both opportunities and risks for investors. The report can be found here.

Investment implications of U.S transition policy:

In January 2023, the BII published ‘Investment implications of U.S transition policy. This paper focused on the U.S Inflation Reduction Act, passed in August 2022, containing a range of measure to spur the transition. Please refer to the link.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? If so, how frequent are the reviews? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

Firmwide

BlackRock’s firmwide ESG Integration Statement is reviewed at least annually to reflect changes within our business. The last review was done in June of 2024 and can be found here.

Strategy

Specifically, for the Fixed Income Global Opportunities (FIGO) fund, there is nothing that would cause us to disregard ESG issues in our investment/analysis decisions.

Climate

8. Describe how you identify, assess, and manage climate-related risks, and whether climate-related risks and opportunities are integrated into pre-investment analysis.

An integral part of BlackRock’s identity is the core belief that rigorous risk management is critical to the delivery of high-quality asset management services. BlackRock employs a three-lines of defense approach to managing investment risks in client portfolios. BlackRock’s investment teams and business management are the primary risk owners, or first line of defense. Portfolio managers and research analysts are responsible for evaluating the financially material environmental (as well as social and governance) risks and opportunities for an industry or company consistent with the portfolio’s investment guidelines, just as they consider other potentially material economic issues related to their investments. Examples of climate-related risks taken into account include risks from regulatory change or litigation and exposure to physical impacts such as flooding or other extreme weather events or changes in temperature. In addition, BlackRock has developed a framework to monitor exposure to carbon intensive assets to support the understanding and management of potential climate-related risks.

BlackRock’s risk management function, Risk and Quantitative Analysis (RQA), serves as the second line of defense in BlackRock’s risk management framework along with BlackRock Legal & Compliance. RQA is responsible for BlackRock’s Investment and Enterprise risk management framework, which includes oversight of sustainability-related investment risks. RQA evaluates investment risks, including financially material sustainability-related risks, on an ongoing basis as part of regular risk management processes and, where applicable, during regular reviews with portfolio managers. This helps to ensure that such risks are understood, deliberate, and consistent with client objectives, complementing the first line monitoring. RQA also has a dedicated Sustainability Risk group that partners with risk managers and businesses to oversee sustainability risk across the platform. The third line of defense, BlackRock’s Internal Audit function, operates as an assurance function. The mandate of Internal Audit is to independently assess the adequacy and effectiveness of BlackRock’s internal control environment to improve risk management, control, and governance processes.

For more information on BlackRock’s management of climate-related risks and opportunities, please see page 29 of BlackRock's 2023 TCFD Report

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

Please refer to the response to Question 8 above.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate-related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

BlackRock does not expect ESG to be the sole consideration for making investment decisions and assesses a variety of factors to build and monitor a portfolio of appropriate investments for clients, including the degree of market risk priced into any given security. We believe companies that effectively manage ESG risks and opportunities perform better over time, and a body of evidence has emerged to support our view. Additionally, we acknowledge that there are factors traditionally considered “non-financial” that are becoming more material to investments financial returns as consumers, regulators and investors pay more heed to sustainability themes.

We consider material ESG information as it relates to an issuer’s creditworthiness and engage proactively with global entities to address ESG and financial concerns. We do this in conjunction with members of the BlackRock Investment Stewardship team on behalf of clients invested in both active and passive strategies. As a signatory to the Principles for Responsible Investment, we seek to use ESG integration to enhance returns, manage risks, and encourage the issuers we invest in to disclose meaningful ESG information. When clients seek to incorporate sustainability considerations into portfolio construction outside financial return materiality windows or agnostic to market pricing, we offer focused commingled vehicles and screening options for separate accounts.

11. Do you track the carbon footprint of portfolio holdings?

Yes

If yes, how frequently? Please provide the results as of December 31, 2023 and describe the methodology and metrics used, including whether you have set targets and/or a net zero objective for reducing the portfolio’s footprint, and comment on any related progress over the past year.

BlackRock is focused on providing greater transparency to our clients particularly around the ESG and temperature characteristics of their portfolios. All public passive funds publish an Implied Temperature Rise metric for our public equity and bond funds, for markets with sufficiently reliable data.

Significant research is underway into temperature alignment and sectoral pathways which will aim to provide a proprietary, intellectually honest, and industry-leading temperature alignment methodology. This work is led by a cross-sectional team of data scientists, climate specialists, programmers, and investors from across the firm.

These efforts in transparency and reporting build on the ESG reporting efforts we have undertaken in the last few years. Our website fund pages contain information on a range of sustainability characteristics such as Weighted Average Carbon Intensity, ESG Quality score, a fund ESG rating, and business involvement metrics for the Funds. This data is available for all BlackRock mutual funds and ETFs globally, through our website and fund webpages.

To further enhance this reporting at the Fund level we also included ESG integration statements on product pages and, where possible, engagement and voting statistics.

We are also working to deliver this data to our institutional or separate account clients through their regular reporting. To do this we leverage the ESG and Carbon reporting template that we have been providing clients on request.

Standard ESG & Carbon Reporting Template

A standard ESG & Carbon Exposure report is also available to clients upon request. This report helps our clients understand the sustainability characteristics of their portfolios and run a carbon footprint relative to a benchmark.

Aladdin supports BlackRock’s ESG and Carbon reporting capabilities at a portfolio level based on underlying security ESG and Carbon data sourced from MSCI. The report provides portfolio exposure analysis, with a view of ESG and carbon emission scores by sector, ESG Ratings by market value and decomposition of Active Risk by ESG Ratings.

We have provided a sample template of an ESG and carbon exposure report below.

BlackRock continually seeks to increase the flexibility and scope of our reporting capabilities to meet the demands of our clients and the evolving nature of the ESG data landscape. In 2024 this includes establishing an internal metric approval and usage process for client reporting whilst also enhancing our ability to produce variations of reports for varied client segments. This reporting template development is overseen by a governance process to aid consistency and appropriacy of metrics across our varied investment teams.

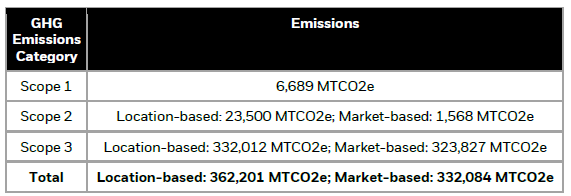

12. What are your firm's emissions as of December 31, 2024? Please provide scope 1 and scope 2 emissions, and, separately, scope 3 emissions if available. Please demonstrate how/whether you are taking steps to reduce these emissions.

Please see BlackRock’s 2023 GHG Emissions Report for further details.

In operating its own business, BlackRock pursues a sustainability strategy that is focused on reducing GHG emissions associated with its facilities, data centers, and upstream value chain and addressing emissions it otherwise cannot reduce yet through investment in market solutions such as SAF and carbon credits.

In 2023, BlackRock made progress in its operational sustainability strategy by employing energy efficiency strategies, achieving its 100% renewable electricity match goal, establishing processes to enhance its approach to SAF and carbon credit procurement, and establishing a Supplier Sustainability Program.

Please see the "Operations" section in BlackRock's 2023 TCFD Report for more information on the firm’s environmental sustainability strategy, including goals and progress.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments? Please answer on both an equally-weighted and market cap-weighted basis.

Given that this is a fixed income-based strategy, the fund had approximately 1.72% Notional Market Value (NMV) % exposure to equities as of 12/31/2024. Of the fund’s equity exposures, 0.58% NMV is in names that have climate commitments per our Fixed Income Climate Scoring framework. The Fixed Income Climate Scoring framework is a proprietary framework to assess companies based on their net-zero transition alignment. It includes inputs from various third-party data sources at the issuer level and BlackRock green bond assessments at the issuance level.

14. How do you assess the credibility of a company’s emission reduction targets?

Certain active BlackRock funds have climate and decarbonization objectives in addition to financial objectives. Consistent with the objectives of those investment strategies, our stewardship activity in relation to the holdings in those funds differs in some respects from the BlackRock Active Investment Stewardship (BAIS) benchmark guidelines. Specifically, for those funds’ holdings, we look to investee companies to demonstrate that they are aligned with a decarbonization pathway that means their business model would be viable in a low-carbon economy, i.e., one in which global temperature rise is limited to 1.5⁰C above pre-industrial levels.

The decarbonization stewardship guidelines focus on companies which produce goods and services that contribute to real world decarbonization or have a carbon intensive business model and face outsized impacts from the low carbon transition, based on reported and estimated scopes 1, 2, and 3 greenhouse gas emissions.[1] Under the decarbonization stewardship policies, we ask companies to provide disclosures that set out their governance, strategy, risk management processes and metrics and targets relevant to decarbonization. These disclosures should include an explanation of the decarbonization scenarios a company is using in its near- and long-term planning, as well as its scope 1, scope 2 and material scope 3 greenhouse gas (GHG) emissions and reduction targets for scope 1 and 2 emissions. As with the BAIS benchmark policies, we consider the climate-risk reporting standard issued by the International Sustainability Standards Board, IFRS S2, a useful reference for such reporting.

Under these climate- and decarbonization-specific guidelines, BAIS may recommend a vote against directors or support for a relevant shareholder proposal if a company does not appear to be adequately [addressing/disclosing/accounting for] material climate-related risks. We may recommend supporting shareholder proposals seeking information relevant to a company’s stated low-carbon transition strategy and targets that the company does not currently provide and that would be helpful to investment decision-making. As under the BAIS benchmark approach, the active portfolio managers are ultimately responsible for voting consistent with their investment mandate and fund objectives.

[1] These companies may already be low-carbon operators or be demonstrating momentum in reducing emissions in their operations, providing key inputs or goods and services that support real world decarbonization, or pivoting their current business model to contribute to the transition to the low-carbon economy.

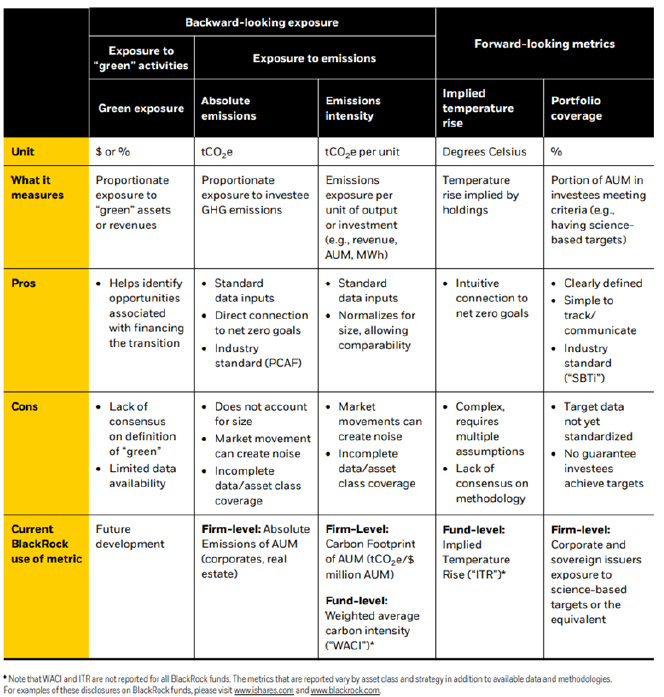

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

In BlackRock’s view, there is no single metric that provides full insight into a portfolio’s trajectory or exposure as it relates to the transition to a low-carbon economy. Moreover, some metrics are more appropriate for disclosure at the portfolio or fund level, and others are more appropriately reported at a firm or institution level. Exhibit M.3 from BlackRock’s TCFD report shows a summary of key climate-related and portfolio alignment metrics, including uses and limitations. BlackRock continues to evaluate existing climate-related and portfolio alignment metrics and methodologies, with the goal of reporting aggregate statistics (where sufficient data and methodologies exist) for BlackRock’s AUM.

Overview of key climate-related and portfolio alignment metrics and incorporation into BlackRock reporting

More information is available beginning on page 30 in our annual TCFD report

16. Has your firm produced a Task Force on Climate-Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

Yes. BlackRock makes available TCFD reporting and was an early advocate of the TCFD Recommendations. Please see BlackRock's 2023 TCFD Report for more information.

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

As mentioned above, BlackRock provides meaningful information to stakeholders via its disclosures. As part of this, BlackRock’s voluntary sustainability reporting framework includes the firm's TCFD Report and GHG Emissions Report for its corporate operational emissions. BlackRock also periodically publishes a SASB-aligned Sustainability Disclosure, which the firm is working to update based on 2024 data. BlackRock also makes available sustainability-related disclosures in line with regulatory requirements in certain jurisdictions where it operates. As sustainability-related disclosure frameworks, data and risk management methodologies evolve, BlackRock will continue to review its approach to sustainability-related disclosures.

For further information, please see the following websites:

- Corporate Sustainability Website

- Environmental Sustainability Website

2023 SASB Disclosure: Please refer to Appendix C for our firmwide Sustainable Accounting Standards Board (SASB) sustainability disclosure for 2023.

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

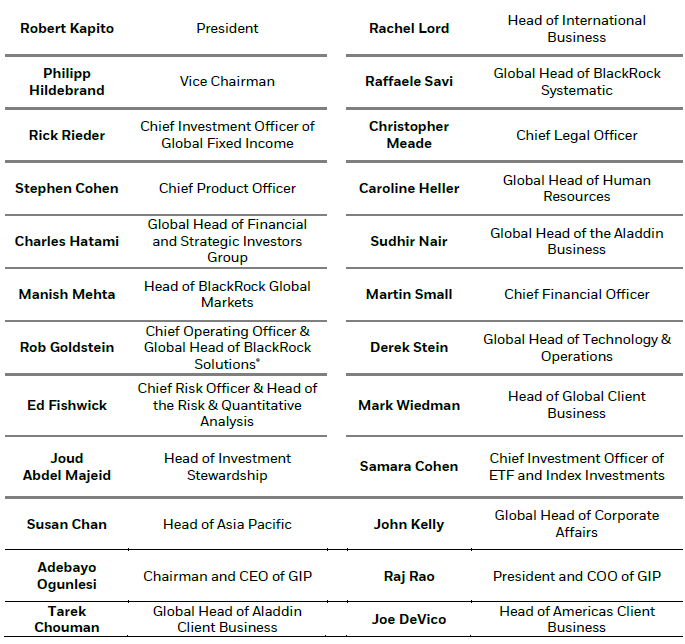

BlackRock Global Executive Committee (“GEC”)

The BlackRock Global Executive Committee (“GEC”): sets and communicates the strategic vision of the firm; defines, implements and instills the firm’s culture; and overseas operations and business performance. The GEC also works to identify and develop a strong, diverse bench of future leaders and to strengthen and promote the firm’s reputation, regulatory posture and relations with strategic stakeholders. Members of the GEC include:

Biographies for members of the GEC are available at Global Executive Committee - Our Leadership | BlackRock.

Board Of Directors Membership

BlackRock’s Board of Directors has 17 members, 14 of whom are independent.

| Name | Title | Board Director since |

| Laurence D. Fink | Chairman and CEO of BlackRock | 1999 |

| Pamela Daley1 | Former Senior Vice President of Corporate Business Development, General Electric Company | 2014 |

| William E. Ford1 | Chairman and CEO of General Atlantic | 2018 |

| Fabrizio Freda1 | President and CEO of Estée Lauder Companies Inc. | 2012 |

| Murry S. Gerber1, 2 | Former Chairman and CEO of EQT Corporation | 2000 |

| Margaret “Peggy” L. Johnson1 | CEO of Agility Robotics | 2018 |

| Robert S. Kapito | President of BlackRock | 2006 |

| Cheryl D. Mills1 | Founder and CEO of BlackIvy Group | 2013 |

| Amin H. Nasser1 | President and CEO of Saudi Arabian Oil Co. (Aramco) | 2023 |

| Gordon M. Nixon1 | Former President and CEO of Royal Bank of Canada | 2015 |

| Kristin Peck1 | CEO of Zoetis, Inc. | 2021 |

| Charles H. Robbins1 | Chairman and CEO of Cisco Systems, Inc. | 2017 |

| Marco Antonio Slim Domit1 | Chairman of Grupo Financiero Inbursa, S.A.B. de C.V. | 2011 |

| Hans E. Vestberg1 | Chairman and CEO of Verizon Communications, Inc. | 2021 |

| Susan L. Wagner1,3 | Former Vice Chairman of BlackRock | 2012 |

| Mark Wilson1 | Former CEO of Aviva plc and former President and CEO of AIA | 2018 |

| Adebayo Ogunlesi | Chairman & CEO of Global Infrastructure Partners | 2024 |

Biographies for current Board members are available on our external website:

BlackRock, Inc. - Governance - Board of Directors

Board Diversity at BlackRock

BlackRock’s Board of Directors believes that diversity in thought, experience, backgrounds, skills and viewpoints contributes to and enhances its capabilities. Moreover, the Board views diversity among its members as critical to the success of the Company and the Board’s ability to create long-term value for our shareholders. The diverse backgrounds of our individual directors help the Board better oversee BlackRock’s management and operations and assess risk and opportunities for the Company from a variety of perspectives. Diversity among the Board’s members enhances its oversight of our multifaceted long-term strategy and inspires deeper engagement with management, employees and clients around the world.

Our current Board consists of 17 members, 14 of whom are independent. The Board includes five women and seven Directors who are non-U.S. or dual citizens. Four of our 17 directors self-identify as racially/ethnically diverse, with two identifying as Black/African American, one identifying as Hispanic/Latin American and one identifying as Middle Eastern/North African. Several of our Board members live and work overseas in countries and regions that are key areas of growth and investment for BlackRock, including Canada, Mexico, the Middle East and Europe.

As BlackRock’s business has evolved, so has our Board of Directors. Today, our Board consists of senior leaders (including 14 current or former company CEOs) with substantial experience in financial services, consumer products, manufacturing, technology, pharmaceuticals, and banking and energy. Over 20% of BlackRock’s independent directors have joined the Board in the past five years, reflecting the company’s commitment to continually evolving and benefiting from fresh perspectives.

To learn more about our Board of Directors, we encourage you to visit:

BlackRock, Inc. - Governance - Board of Directors

Proxy Voting

19. Do you use an external proxy voting service such as ISS or Glass Lewis? If yes, please specify.

Proxy research firms provide research and recommendations on proxy votes as well as voting infrastructure. BlackRock contracts with the independent third-party proxy service provider Institutional Shareholder Services and leverages its online platform to supply research and support voting, record keeping, and reporting processes. The BAIS team also uses Glass Lewis’ services to support research and analysis.

It is important to note that, although proxy research firms provide important data and analysis, we do not rely solely on their information or follow their voting recommendations.

BlackRock Active Investment Stewardship’s vote recommendations to active equity portfolio managers are informed by its in-depth analysis of company disclosures, engagement with boards and management teams, input from active equity investment colleagues, independent third-party research, and comparisons against a company’s industry peers. Where BlackRock has been authorized by clients to vote proxies, BAIS casts vote in accordance with our Global Engagement and Voting Guidelines or as instructed by an active equity portfolio manager in the context of their investment objectives.

BlackRock Active Investment Stewardship closely monitors the proxy research firms and service providers it contracts with to ensure that they are meeting the team’s service level expectations and have effective policies and procedures in place to manage potential conflicts of interest.

This oversight includes regular meetings with client service teams, systematic monitoring of vendor operations, as well as annual due diligence meetings:

- Each week, BlackRock meets with the client service team at Institutional Shareholder Services (ISS) to review service levels, account set-ups, vote execution, on-going projects, ad hoc events, and other developments that might affect the team’s ability to vote thoughtfully and accurately on behalf of clients. In the weekly meetings, BlackRock also escalates any previously reported issues on research, data, or reporting.

- Each year, BlackRock also has an in-person, due diligence meeting with an extended group, including Institutional Shareholder Services (ISS) senior leadership. We cover a range of issues, such as research quality, vote execution, operational processes and controls, conflicts management, business continuity, product improvements, corporate developments (e.g. ownership, key personnel, and resources) and the regulatory landscape.

For the year 2024, BlackRock determined that its independent third-party service providers – including contracted research firms and proxy voting service providers – met BlackRock service level expectations.

20. If the answer to the previous question is no, please describe your proxy voting guidelines. (If the answer to the previous question is yes, please indicate “not applicable” and move on to the next question.)

Yes, the BlackRock Active Investment Stewardship Global Engagement and Voting Guidelines are available on our website at:

BlackRock Active Investment Stewardship Global Engagement and Voting Guidelines

21. If you use an external proxy voting service, do you customize your guidelines for proxy voting? If yes, describe your customized guidelines. If you use the default service guidelines, describe how often and in which situations you deviate from the external proxy voting service recommendations. (If you do not use an external proxy voting service, please indicate “not applicable” and move on to the next question.)

Please refer to our response to Question 19.

22. What proportion of the time do you vote with or against management on shareholder resolutions, board appointments, and auditor appointments? What proportion of the time do you vote with or against management on ESG issues? How does this break down for climate, diversity, and remuneration issues?*

BlackRock Active Investment Stewardship (BAIS) often engages to inform our voting analysis and decisions. We typically raise governance issues of concern in our engagement with company board members and management teams. We may vote with management following engagement if we are convinced that our concerns were unfounded, or a company’s management indicate they are addressing the issues raised. If we remain concerned that a company is not acting in the interests of BlackRock’s clients as investors, we may escalate our concerns through a vote against management at future shareholder meetings.

BlackRock Active Investment Stewardship (BAIS) was formed in January 2025 so does not have its own voting record for 2024. Post the first quarter of 2025, BAIS’ voting record on behalf of clients will be available on the BlackRock website through our Global Vote Disclosure tool. BAIS will provide/provides a quarterly update of our vote instructions on behalf of clients for all proposals voted at individual meetings globally. When votes cast differ from a company board’s voting recommendation, BAIS will provide/provides a voting rationale. Additionally, we will/publish quarterly stewardship statistics reports to the BlackRock website.

BlackRock’s voting statistics for the most recent past year are available on the BlackRock website. These reflect stewardship activity prior to the formation of the BlackRock Active Investment Stewardship team.

Engagement

23. What are your engagement goals? Are these goals outcome/action-based (e.g. decreases in emissions or increases in number of women on the board) or means-based (reporting on emissions or number of women on the board)?*

Engagement with public companies is the foundation of our approach to stewardship within fundamental active investing. Through direct dialogue with company leadership, we seek to understand their businesses and how they manage risks and opportunities to deliver durable, risk-adjusted financial returns. Portfolio managers and stewardship specialists may engage jointly on substantive stewardship matters. Our discussions focus on topics relevant to a company’s success over time including governance and leadership, corporate strategy, capital structure and financial performance, operations and sustainability-related risks, as well as macro-economic, geopolitical and sector dynamics. We aim to be constructive investors and are generally supportive of management teams that have a track record of financial value creation. We aim to build and maintain strong relationships with company leadership based on open dialogue and mutual respect.

BlackRock Active Investment Stewardship (BAIS) seeks to understand how companies manage the risks and opportunities inherent in their business operations. In our experience, sustainability-related factors1 that are relevant to a company’s business or material to its financial performance, are generally operational considerations embedded into day-to-day management systems. Certain sustainability issues may also inform long-term strategic planning, for example, investing in product innovation in anticipation of changing consumer demand or adapting supply chains in response to changing regulatory requirements.

We recognize that the specific sustainability-related factors that may be financially material or business relevant will vary by company business model, sector, key markets, and time horizon, amongst other considerations. From company disclosures and our engagement, we aim to understand how management is identifying, assessing and integrating material sustainability-related risks and opportunities into their business decision-making and practices. Doing so helps us undertake a more holistic assessment of a company’s potential financial performance and the likely risk-adjusted returns of an investment.

In our view, companies should understand and take into consideration the interests of the various parties on whom they depend for their success over time. It is for each company to determine their key stakeholders based on what is material to their business and long-term financial performance. For many companies, key stakeholders include employees, business partners (such as suppliers and distributors), clients and consumers, regulators, and the communities in which they operate. Companies that appropriately balance the interests of investors and other stakeholders are, in our experience, more likely to be financially resilient over time.

1 By material sustainability-related risks and opportunities, we mean the drivers of risk and value creation in a company’s business model that have an environmental or social dependency or impact. Examples of environmental issues include, but are not limited to, water use, land use, waste management, and climate risk. Examples of social issues include, but are not limited to, human capital management, impacts on the communities in which a company operates, customer loyalty, and relationships with regulators. It is our view that well-managed companies will effectively evaluate and manage material sustainability-related risks and opportunities relevant to their businesses. Governance is the core means by which boards can oversee the creation of durable financial value over time. Appropriate risk oversight of business-relevant and material sustainability-related considerations is a component of a sound governance framework.

24. What is your policy around the escalation of engagement; how and why might this happen and what is the ultimate tool you might use (e.g. voting against board re-election, etc.)?*

As one of many minority shareholders in public companies, BlackRock cannot and does not try to direct a company’s strategy or its implementation – nor does it set deadlines or direct management on how to address any concerns identified.

One size does not fit all, and engagement is not necessarily about effecting change. Each company and issue are assessed individually, and many factors will determine how BlackRock Active Investment Stewardship (BAIS) assesses a company’s response to feedback from investors, including BlackRock. These two-way conversations help investors understand how companies are navigating issues likely to impact their financial performance over time and how they are making progress against targets and metrics, as determined by management.

BAIS and active investors track active stewardship engagement activities in a database, which helps us assess whether companies have met their stated targets and made any governance changes they had planned. Where companies do not deliver on their commitments without a credible explanation in their disclosures, we may escalate by seeking a meeting for a more senior member of the leadership team and potentially signaling our concerns through votes against management.

25. Describe a specific example of your firm’s engagement with a company over the past year, including the outcome and any lessons learned.

As mentioned earlier, BlackRock Active Investment Stewardship (BAIS) was formed in January 2025 so does not have its own voting record for 2024. Post the first quarter of 2025, BAIS’ voting record on behalf of clients will be available on the BlackRock website through our Global Vote Disclosure tool. BAIS will provide/provides a quarterly update of our vote instructions on behalf of clients for all proposals voted at individual meetings globally. When votes cast differ from a company board’s voting recommendation, BAIS will provide/provides a voting rationale. Additionally, we will/publish quarterly stewardship statistics reports to the BlackRock website.