ESG Policies

1. Please provide your ESG-related policies. Please provide a formal statement of your ESG-related policies if you have one.

We believe that delivering the best investment outcomes for our clients over the long term depends on securing a prosperous and sustainable future.

Our primary responsibility is to help our clients to achieve their long-term investment goals. We believe this is only possible if we secure a prosperous and sustainable future into which to invest. This is why our purpose as a firm is to invest and to advocate for a better tomorrow – to achieve better returns for our clients as well as a better future for our planet. For us, sustainable investing means delivering what we call sustainability with substance. In other words, our approach to sustainability and addressing environmental, social and governance (ESG) risks and opportunities must be evidence-based and purposeful.

There are two policies which govern the ESG space at Ninety One.

Ninety One's Sustainability Policy describes our approach to sustainability. It covers the full sustainability framework at Ninety One, which comprises three core components: Invest, Advocate and Inhabit.

Invest: We integrate the assessment of ESG risks into our portfolios by deepening our understanding of externalities and improving our analysis and assessment of the risk they present.

Advocate: We seek to raise awareness of the need to fund the transition to a sustainable net-zero future in a fair and inclusive way, particularly in emerging markets.

Inhabit: We work to improve the sustainability of our operations and to support charities and community projects that are important to the team at Ninety One.

Ninety One's Stewardship Policy and Proxy Voting Guidelines sets out our stewardship principles and approach to active ownership, including engagement and proxy voting. Our engagement approach is driven by our goal to preserve and grow the real value of the assets entrusted to us by our clients over the long term. We take a targeted approach, prioritizing engagements where we can exert influence. Where we believe engagement is ineffective or companies are not committed to change, we may use the ultimate lever we have as an investor, which is to reallocate our capital. Ninety One votes at shareholder meetings throughout the world as a matter of principle.

Both policies are reviewed and updated biennially or more frequently as required.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

Our commitment to incorporate ESG at Ninety One is ‘investment-led’; each of our investment teams integrates and prioritizes ESG considerations in accordance with its investment philosophy and processes. Within 4Factor, we believe that non-financial information should be analyzed in a consistent manner in the same way as traditional financial data, and ESG integration within the process has therefore up to this point been most robust during fundamental analysis.

In our sustainability integration, we aim to unlock the alpha potential these opportunities may represent or mitigate risks on the downside, be it financial or reputational. The assessment of ESG materiality in companies is then incorporated into our decision making and portfolio construction processes. We believe there are limits on what can be achieved without fundamental analysis with respect to understanding and, where possible, pricing sustainability risks into investment decision making.

Alpha model

While we monitor third party ESG ratings, we have not incorporated them into our alpha model up to this point as we believe doing so would lead to an anchoring bias and offer limited utility as sources of uncorrelated alpha, as they are backward looking, lagged and to some extent subjective. Furthermore, exclusionary screens based on ESG ratings at this stage of the investment process could also reduce the available investment opportunity set, and risks exacerbating behavioral biases such as crowding, saliency and anchoring. We are actively exploring, however, if and to what extent non-financial information can add value in our alpha model.

Fundamental analysis

ESG integration in our process is most effective during fundamental analysis, where subjective ESG factors are assessed and incorporated into the investment research and case, where relevant. We believe there are limits on what can be achieved without fundamental analysis with respect to understanding and, where possible, pricing sustainability risks into investment decision making. We integrate sustainability to unlock the alpha potential these opportunities may represent or mitigate risks, be it financial or reputational.

To systematically analyze ESG information, we prioritize materiality and impact for both opportunities and risks. Our ESG assessments leverage a materiality matrix through three-pillars across ten key sustainability challenges, ranked high, medium or low, depending on the level of perceived risk.

This process is guided by a bottom-up sector sustainability framework informed by our team’s specialist sector knowledge. Recognizing the breadth and specificity of challenges and opportunities inherent to each sector, we tailor our approach to ensure relevance. For example, carbon is an obvious challenge for sectors like materials and energy, but it’s far less of an issue for, say, healthcare. In healthcare, we are far more concerned about ethics and integrity.

We have found that insights generated from our materiality matrix help us to identify areas where financial returns could be under threat or improved, and we utilize these within our fundamental research. The framework also provides a basis for guiding the investment team on engagements on the most material sustainability challenges for companies in each sector, to help catalyse a positive alpha outcome or otherwise mitigate risk, be it financial or reputational.

The ESG considerations considered most material in our investment process vary by sector but broadly include environmental issues such as carbon emissions and climate transition risks, social factors like ethics, labor conditions, and customer safety, and governance elements such as board oversight and executive compensation. ESG analysis is an ongoing part of our fundamental research and due diligence on both potential and current investments.

Transition Plan Assessment

Alongside our materiality matrix, another key development for us has been the development of our Ninety One Transition Plan Assessments that scores our heaviest emitters on three key principles: level of ambition, credibility of plan, and implementation of plan. This is used to assess heavy emitting companies within the portfolio.

When committing to net zero as a firm, we were conscious that most companies globally, but particularly in emerging markets, did not yet have a clear plan on how they are going to decarbonize by 2050. Therefore, we were keen to ensure, in our role as shareholders, we could encourage, engage and measure the high emitters in our portfolios on the progress of their transition to Net Zero. Where possible, we want to go on the journey of transition alongside the heavy emitting companies that we hold across our firm. Given the bias of these companies towards emerging markets, this is particularly relevant for this mandate.

To ensure that we do this with integrity, we have developed an in-house, firm wide, ‘Transition Plan Assessment’ (TPA) that scores our heaviest emitters on three key principles: level of ambition, credibility of plan, and implementation of plan. This is used to assess heavy emitting companies within the portfolio. It helps to inform and prioritize our company engagements with those where climate is likely to be a material risk, as well as deepening our understanding of their business and its vulnerability to a disorderly transition.

We undertake TPAs for all securities in a high-emitting sector, as defined by The Institutional Investors Group on Climate Change (IIGCC) as well as those, once invested, that contribute to the top 50% of firm-wide financed emissions.

Engagement

As active stewards of our client's capital, we believe it is not only our duty to engage with companies, but that these engagements can form a critical input in our fundamental research.

Our engagement strategy targets specific holdings and material ESG themes that are significant to the firm, the investment team, and our clients. We do not engage with every company in our portfolio. We are also realistic with how much influence we can have, as this can be dependent on our shareholding in the company. Therefore, the trigger to engage with a company is if we believe that our involvement will mitigate a material risk (financial or reputational) and/or catalyze an alpha-positive outcome. Our approach to engagement therefore prioritizes companies that have experienced a development that could potentially materially impact their intrinsic value or proactive engagement where we believe we can add to shareholder value. For instance, the work undertaken through our TPAs combined with the deep, subjective understanding of our investment analysts, can help us to pre-empt potential issues through engagement. We document dialogue with companies, and monitor and report on engagements, measuring success and outcomes against initial objectives, such as commitment to, or enactment of, actual changes by management in strategy or reporting, disclosure and transparency. We also report on goal progress to our clients.

Portfolio construction

In part, portfolio size is determined by a sustainability analysis. Sustainability considerations, which inform our fundamental conviction, can potentially influence position sizes. Ultimately, we will not own a company where there are sustainability risks that materially affect the investment case, and any increase in such risks will trigger a reassessment of our broader investment position in the company.

ESG Risk monitoring

It is worth noting that while our portfolio managers have ultimate responsibility for monitoring and maintaining an optimum risk/reward balance in their portfolios, including ESG risks, further guidance and support is provided by the Ninety One Investment Risk team (including dedicated ESG specialists), which oversees and challenges the investment process.

Ninety One’s ESG risk framework seeks to monitor, assess and challenge on ESG risks in investment portfolios, including reputational risks. The purpose of the ESG risk process is to ensure ESG integration is in place within investment processes and strengthen existing integration efforts by testing its robustness through appropriate challenge. Note that the aim is not to expunge ESG risk from Ninety One portfolios, rather to ensure it is identified and understood, and that relevant exposures are justified and risks mitigated in terms of overall client and stakeholder outcomes. ESG risk reporting forms part of the monthly Investment Risk Committee (IRC), which oversees the governance of all aspects of investment risk. ESG risk reporting also forms part of the reporting to the Sustainability Committee which oversees the overall response by the business to its commitment to ESG integration, including the effectiveness of the risk component.

3.a. Are you a signatory to the UNPRI?

Yes.

3.b. If you are signatory to other coalitions, please list them.

As a global business, we welcome the development of stewardship codes across the world. We believe that these codes are key to enhancing the long-term success of companies, through a better quality of engagement and improved transparency in regional markets. We are currently an endorser/signatory to the following codes:

- UK Stewardship Code

- Code for Responsible Investment in SA (CRISA)

- Singapore Stewardship Principles

- ISG (Investor Stewardship Group) US Stewardship Principles

- Hong Kong Principles for Responsible Ownership

- Japanese Stewardship Code

- Korean Stewardship Code

Please refer to Appendix 2 within our attached Sustainability and Stewardship Report for further details.

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

We seek to contribute meaningfully to the conversation on sustainability and to encourage a deeper focus on sustainability-related issues in all of the jurisdictions where we invest. We may collaborate with other investors as part of an engagement strategy if it can contribute to achieving our engagement objectives. Our membership of regional and global organizations facilitates this.

The table below details our firmwide collaborative partnerships and our role:

| Organization | Start date |

Key focus | Our role |

|---|---|---|---|

| Access to Medicine Foundation |

2023 | To have a positive impact on expanding access to medicine and encourage essential healthcare companies to do more to reach people in low- and middle-income countries. |

Ninety One has pledged support to the Foundation’s research and signed the Access to Medicine Index Investor Statement. |

| Assessing Sovereign Climate related Opportunities and Risks (“ASCOR”) project |

2021 | Develop an assessment framework for sovereigns’ performance and governance as they transition – this includes the consideration of a just transition. |

We are working with the ASCOR project to better assess sovereign alignment and sovereign carbon transition risks. Over the year, we contributed to the development of the ASCOR tool. |

| Association for Savings and Investment South Africa (ASISA) |

2008 | To ensure that the South African savings and investment industry remains relevant and sustainable into the future in the interest of its members, the country and its citizens. |

We actively participate in collaborative engagements and working groups and serve on the Responsible Investment Committee.Thabo Khojane, Managing Director for our South African business, is a member of ASISA's board and several committees, include the Executive Committee. |

| The Carbon Disclosure Project (CDP) |

2010 | To enable companies, cities, states and regions to measure and manage their environmental impacts. | We are involved in engagements with companies regarding their disclosure to CDP. In 2022, 30% of the companies we engaged with on climate committed to disclose to CDP. |

| Chatham House Asia-Pacific Programme |

2018 | The programme provides objective analysis of the key issues affecting South Asia, Southeast Asia, East Asia and the Pacific, engaging decision-makers and undertaking original research with partners in the region to inform and influence positive policy decisions. | We aim to actively contribute to conversations with academics, diplomats and policymakers. |

| Climate Action 100+ | 2018 | An investor initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. | We are involved in collaborative engagements with companies to ensure they are minimizing and disclosing the risks presented by climate change. We co-lead on four companies and participate in one more. Our Sustainability Director, Daisy Streatfeild, is also on the Steering Committee of CA100+. |

| Climate Bonds Initiative |

2021 | An international organization working to mobilize the bond market, for climate change solutions |

We contribute to advocacy aligned with our investment thinking, policy advocacy and industry collaboration |

| Crisis Group | 2014 | The International Crisis Group is an independent organization working to prevent wars and shape policies that will build a more peaceful world. Crisis Group sounds the alarm to prevent deadly conflict. |

We leverage Crisis Group’s expertise in our investment decision-making and engagements. We work to create |

| Emerging Markets Investor Alliance |

2019 | Enables institutional emerging market investors to support good governance, promote sustainable development, and improve investment performance in the governments and companies in which they invest. |

We support the initiative and are involved in its working groups, particularly relating to fiscal transparency, leading on some and participating in others. |

| Farm Animal Investment Risk and Return) FAIRR |

2019 | To raise awareness of the material ESG risks and opportunities caused by intensive livestock production | We participate in collaborative conversations to identify and engage on material ESG risks and opportunities in global protein supply chains. We are a member of the Salmon Aquaculture engagement. |

| Glasgow Financial Alliance for Net Zero (GFANZ) |

2021 | Brings together firms from the leading net zero initiatives across the financial system to accelerate the transition to net zero emissions by 2050 at the latest. |

We are active members of multiple working groups: ‘private capital mobilization’; ‘managed phase-out’ and ‘portfolio alignment metrics’ and contributed to multiple public engagements as thought leaders on emerging market transition investing. |

| Global Climate Finance Centre (GCFC) |

2023 | By collaborating to develop and scale key policy and regulatory frameworks, prudent management systems and deep green finance expertise, the GCFC will drive the transformation of the UAE’s financial markets and its institutions towards a greener and more sustainable future. | Ninety One is a founding member and part of the Governance working group as the GCFC sets up its operational structure and have been contributing to the build out of the workstreams and deliverables of the center. |

| Global Investor Commission on Mining 2030 |

2023 | A multi-stakeholder Commission, which recognizes the mining industry’s role in the transition to a low carbon economy, and the need for the industry to manage systemic risks which threaten its social license to operate. |

We participate through the investor steering committee. |

| Institute of International Finance (IIF) |

2021 | Supports the financial industry in the management to risks, to develop sound industry practices and to advocate for regulatory, financial and economic policies that are in the broad interest of its members and foster global financial stability and sustainable economic growth. |

We participate in global membership meetings and collaborative efforts on global financial policy and regulatory matters. |

| Institutional Investors Group on Climate Change (IIGCC) |

2018 | To provide investors with a collaborative platform to encourage public policies, investment practices and corporate behavior that address long-term risks and opportunities associated with climate change. |

We are a participant in the organization, which includes taking part in engagements and providing information for thought papers. We continue to co-chair the Investor Practices program and participate in the net zero implementation and corporate bond stewardship working groups. |

| The Investment Association (UK) |

2002 | To help the industry support the economy with stable, long-term finance, ensuring investors have access to fair and effective markets and embedding the highest standards of sustainable governance in the UK. |

We are full members and take part in various working groups. |

| The Investor Forum | 2017 | To position stewardship at the heart of investment decision-making by facilitating dialogue, creating longterm solutions and enhancing value. | We regularly meet with the forum and participate in targeted strategic governance engagements. We have participated in several collective engagements over the year. |

| Investor Leadership Network |

2022 | A collaborative platform for investors interested in addressing sustainability and long-term growth across three workstreams: sustainable infrastructure, diversity in investment and climate change. |

We contribute to the three workstreams: private capital mobilization, diversity equity and inclusion and climate change |

| Impact Investing Institute |

2019 | Works to increase awareness and interest in impact investing. Provide research and tools to support investors and advocate for policy and regulation that make it easier to invest with impact, alongside financial return. |

We were a founding supporter of the initiative and in the last year we have participated in the development of the Just Transition label criteria. |

| National Business Initiative |

2022 | To work towards sustainable growth and development in South Africa and shape a sustainable future through responsible business action. | We contribute to the working groups focused on South Africa’s net-zero transition and transition finance. We sponsored the NBI South African pavilion at COP27. |

| Nature Action 100 | 2023 | To drive greater corporate ambition and action to reverse nature and biodiversity loss. | We have joined collaborative engagements looking to improve nature related disclosures across a list of focus companies. |

| Net Zero Asset Managers Initiative (NZAMI) |

2021 | The Net Zero Asset Managers initiative is an international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5 degrees Celsius; and to supporting investing aligned with net zero emissions by 2050 or sooner. |

We are a signatory to the initiative and have set firmwide net zero targets. We have submitted our targets to the initiative and report on progress annually. |

| PRI | 2008 | To understand the implications of ESG factors and to support investor signatories in incorporating them into the investment process. |

We are a signatory, participate in workstreams and present at UNPRI events. We have taken part in various collaborative engagements. |

| Responsible Investment Association (RIA) Canada |

2021 | To promote responsible investment in Canada’s retail and institutional markets. | We aim to support the RIA to deliver on its mandate of advancing responsible investment in Canada. |

| Say on Climate | 2020 | It is a collaborative effort between asset managers, asset owners, companies and other stakeholders to encourage companies to voluntarily submit their Climate Risk Transition Plan to a vote at their annual general meeting. We believe the ‘Say on Climate’ initiative will improve dialogue between companies and investors allowing shareholders to better assess the strength of the companies’ plans to address climate risk in their businesses. |

In 2020, Ninety One became the first listed asset manager to become a signatory on the ‘Say on Climate’ initiative. We advocate for the uptake of an advisory resolution on transition plans at AGMs. |

| SOAS China Institute |

2021 | The Institute promotes interdisciplinary, critically informed research and teaching on China; it channels the unrivalled breadth and depth of expertise across a wide spectrum of disciplines on China to the wider worlds of government and business. |

We aim to actively contribute to conversations with academics, diplomats and policy makers. |

| Sustainable Markets Initiative (SMI) |

2021 | It aims to lead and accelerate the world's transition to a sustainable future by engaging and challenging public, private and philanthropic sectors to bring economic value in harmony with social and environmental sustainability. |

We are participants in the transition working group under the Asset Manager/Asset Owner Taskforce. This year we led the development of the Transition Categorization framework. |

| Sustainable Trading Initiative |

2021 | It aims to transform ESG practices within the financial markets trading industry. The network brings firms together to devise practical solutions to industry specific ESG issues as well as providing a mechanism for self-assessment and benchmarking. |

We are part of the Founder Member Group and attend meetings and working groups. Ninety One’s Global Head of Trading is an active board member. |

| Task Force on Climate-related Financial Disclosures (TCFD) |

2018 | To develop consistent climaterelated financial risk disclosures for use by companies, banks, and investors in providing information to stakeholders. |

We are a supporter of the recommendations and produce a TCFD report, which can be found within our Integrated Annual Report. |

| Task Force on Nature-related Financial Disclosures (TNFD) Forum |

2022 | To develop and deliver a risk management and disclosure framework for organizations to report and act on evolving nature-related risks, with the ultimate aim of supporting a shift in global financial flows away from naturenegative outcomes and toward nature-positive outcomes. |

We have supported consultative work to develop the TNFD recommendations and are looking to disclose in line with the recommendations. |

| Thinking Ahead Institute |

2019 | To mobilize capital for a sustainable future. Its members comprise asset owners, asset managers and other groups motivated to influence the industry for the good of savers worldwide. |

We are a founding member. We participate in the Institute’s working groups. In 2022 we took an active part in working groups covering ‘Investing for Tomorrow – Environment’, ‘Investing for Tomorrow – Society’ and made contributions to research white papers on these topics. We also campaigned for emerging markets to be treated separately to developed markets in working towards a fair transition in the global energy system. |

| Transition Pathway Initiative (TPI) |

2019 | To assess companies’ preparedness for the transition to a low-carbon economy, supporting efforts to address climate change. |

We support the initiative and use the data it produces to assist our efforts to better understand climate risks and opportunities. |

| World Benchmarking Alliance (WBA) |

2017 | WBA has set out to develop transformative benchmarks that will compare companies' performance on the SDGs. |

Our Chief Executive Officer, Hendrik du Toit is a Champion, and we participate in working groups contributing to the benchmark work. We contribute to the ‘Just Transition’ benchmark collective impact coalition. |

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

The following chart provides an overview of the governance of our sustainability approach across Invest, Advocate and Inhabit:

1DLC: Dual Listed company

Our Sustainability team is the central custodian of the firm-wide sustainability framework and ecosystem. They report into the Sustainability Committee which is responsible for the internal oversight of sustainability, including monitoring progress and ensuring alignment of focus, strategy and integrity through the business. The Sustainability Committee reports to the Executive Management team, which in turn reports to the Ninety One Board and the Sustainability, Social and Ethics Committee (SS&E).

A detailed description of each of the functions mentioned above and how they assist with ESG integration and analysis across the firm is given in the following table:

| Roles | Function |

| Sustainability, Social and Ethics Committee |

The Board has ultimate responsibility for ensuring that the business is managed in the best interests of its stakeholders, which include our shareholders, our clients, our people, the communities we operate in, and the natural environment. Sustainability is one of Ninety One’s five strategic priorities. Ninety One’s Board considers the contribution of Ninety One to sustainable development, including addressing climate change, a priority. A key element of this is overseeing and reviewing risks and opportunities that may have a material impact on Ninety One. |

| Chief Executive Office |

Ninety One’s executive management team is responsible for developing and implementing business strategy, under the direction of the Chief Executive Officer (CEO). This will include assessing Ninety One’s exposure to sustainability risks. These risks in our portfolios are overseen by the Chief Investment Officer (CIO) office alongside Ninety One’s investment risk infrastructure. |

| Chief Sustainability Officer |

Ninety One's Chief Sustainability Officer (CSO) is responsible for overseeing our firmwide sustainability initiatives. This includes investment integration, advocacy, corporate transition to net zero and developing and implementing efforts to mobilise dedicated funding for an inclusive net zero transition. The CSO reports directly to the CEO and Co-CIOs signalling the importance of the invest dimension to sustainability. |

| Sustainability Committee |

The Sustainability Committee was established in 2010 and is responsible for the internal oversight of sustainability, including monitoring progress and ensuring alignment of focus, strategy and integrity through the business. Ultimately, the committee endeavours to drive a cohesive response to our sustainability priorities, set by the executive leadership by Ninety One. The Committee is chaired by the Chief Sustainability Officer and is comprised of senior leaders from the business, including Ninety One’s CEO, Co-Chief Investment Officers, Chief Commercial Officer, Head of Risk & Performance, and Sustainability Director. Investment team heads are required to report to this committee on a regular basis. They meet quarterly to review progress and activities in relation to: • review and approval of new and existing policies |

| Sustainability team |

The Sustainability team sets the overall sustainability strategy, including our firm-wide net-zero targets and our advocacy priorities; aligns teams on strategic engagements; and provides specialist knowledge and guidance on issues like transition-plan assessments, just transition, governance frameworks, engagement approaches and voting. |

| Sustainable Investment Advisory Forum |

The Sustainable Investment Advisory Forum (SIAF) is the internal review and guidance forum for issues in relation to sustainable investment and Ninety One’s Sustainable Strategies and Sustainable Mandates. These are the Ninety One funds and mandates that fall in to the sustainability classification framework by Ninety One (sustainable or impact) and would correspond to either a category 8 or category 9 as per the EU sustainable finance regulations. The forum is chaired by Nazmeera Moola, Chief Sustainability Officer, and is typically attended by members of the Sustainability team and the portfolio managers for the sustainability strategies. The forum bears the responsibility for reviewing and guiding the organisation around the sustainability standards for new and existing portfolios. It has no formal powers but plays a critical role in its advice and guidance to other formal groups and committees including the SRB, the Sustainability Committee and Global Product Committee. The forum and its members serve as a central point of excellence and insight when it comes to sustainability strategies and what constitutes a sustainable investment. |

| Investment teams |

Ninety One’s investment teams have ultimate responsibility for managing sustainability risks and opportunities, through their own integration frameworks. Each of our investment capabilities uses a distinctive investment process that reflects its investment philosophy. Heads of each of the investment capabilities at Ninety One are ultimately responsible for driving the ESG agenda within their strategies and portfolios. They frequently attend and report into the Sustainability committee. Portfolio managers as well as analysts are responsible for ESG considerations in respect of their Strategies. This means building a holistic understanding of the ESG risks in each of their positions and how to price these risks. Then through strategic engagements identify areas that we can improve or mitigate these risks over time. In addition, informal ESG champions are embedded in investment teams. |

| Investment Risk |

The Investment Risk team includes a dedicated ESG Risk function that monitors firm and portfolio-level sustainability risks. They perform a ‘safety net’ function to identify, and challenge objectively on, ESG issues. The ESG risk-monitoring framework assumes that ESG risks are identified, analysed and acted upon by investment teams. The purpose of the ESG-risk process is to ensure this integration is a systematic part of the investment process and to strengthen existing integration efforts by testing their robustness through dialogue and challenge. The Investment Risk team test the robustness of the ESG integration within investment processes with an internal ESG risk-monitoring framework. At the firm level, they monitor exposure to investments that flag on various third-party ESG metrics. |

| Proxy Voting specialists and data support |

Within operations, a dedicated team administers proxy voting. Within IT, a team supports the investment teams by integrating and surfacing ESG data. |

| Investment Institute |

Ninety One’s Investment Institute is an engagement platform that delivers strategic investing insights and analysis to our clients across asset classes, investment strategies and borders. They provide in-depth analysis and research on key geopolitical, economic and investment trends. Their work draws on our firm’s investment capabilities and partnerships with leading academics and external practitioners and seeks to empower our clients with insight and knowledge. With this collaboration, central themes of the Investment Institute’s work have been portfolio resilience, sustainability and the application of ESG principles to investing. These have culminated in the publication of annual journals and papers. They seek to play a full and active role in the global conversation on sustainable investing. From aligning a portfolio with the decarbonisation growth trend to ensuring a fair clean energy transition for all, Ninety One’s portfolio managers and analysts explore sustainable investing across asset classes and investment approaches. |

| Client group |

Client groups help to lead the sustainability conversation. They look to help provide thought-provoking content, training, events and partnerships, with the aim to help our clients tackle the issues that are impacting their investments. |

| Human Capital team |

The Human Capital team help to ensure we are looking after our people. They look to help create a culture where we can collectively achieve together, as teams, without losing the sense of individual identity. They cover topics such as workforce engagement, organisational and talent development, diversity and inclusion, wellbeing, equality and health & safety. |

| Workplace teams |

The workplace team look to ensure that we are running our business responsibly and acting sustainability within our operations. They oversee our corporate sustainability strategy across five focus areas: energy, waste, water, sustainable travel and responsible procurement — with the aim of reducing and mitigating our carbon footprint. |

| Corporate Social Investment team | The CSI team is responsible for our corporate social investment strategy which spans three pillars: conservation, education and community development. |

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

Our sustainability team and investment risk team look to ensure that the business has appropriate access to ESG data, so that investment teams are equipped with the knowledge, research and tools to fully integrate ESG into their investment processes. The data that we have access to is used to support understanding of material information. We use a combination of proprietary and external research, which is integrated and considered in various ways depending on the investment team process for example through scorecards, through use of investment data platforms, and use in research reports.

The table below summarises the primary ESG data sources that we make use of:

| Provider | Product | How we use the research and data |

|---|---|---|

| MSCI ESG | Company ESG research providing characteristic view of the business, rating, controversy flag, and thematic data such as carbon data | We make use of the data in different ways including analysis of company reports and ratings, as well as consideration of raw data |

| CDP (formerly Carbon Disclosure Project) | Carbon emissions data and qualitative assessment of company activities | We use the data to assess and understand exposure to climate change related risks, and analysts may use company disclosures on the CDP platform |

| ISS ProxyExchange | Voting recommendations and governance research around company Annual General Meetings | We make use of ISS research to inform our voting decision |

| RepRisk | Monitoring platform for negative ESG news flow | RepRisk reports are distributed to analysts on request, and RepRisk data is made available to analysts, highlighting news flow contributing to reputational risk |

| Bloomberg | Bloomberg collects, verifies and continually updates ESG data from published company disclosures | We use various Bloomberg ESG data points to support our integration work |

| Clarity AI | Tech-based reporting tool to ensure compliance with relevant regulatory frameworks | We leverage the data to assist us with assessing and complying with our regulatory obligations i.e. SFDR requirements |

| In-house investment data platform (Jasmine) | Our proprietary investment data platform aggregates data from several sources to give investment teams direct access to a range of portfolio management metrics, which include ESG metrics for individual securities and portfolios alongside financial data. |

We use the platform for: • Surfacing specific data points i.e. carbon data, MSCI data o ESG data distribution for portfolios |

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

Transparent reporting and communication with clients and stakeholders are key features of our “sustainability with substance” approach. We believe that being transparent about our stewardship approach is important, and this is reflected in our reporting to clients. We publish several regular and bespoke reports, which include:

Sustainability and Stewardship report

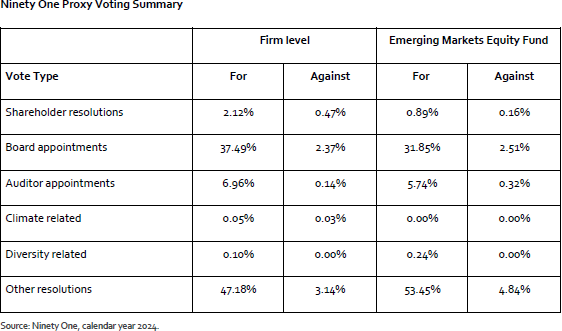

The Sustainability and Stewardship Report includes progress on integration across the investment teams over the year, engagement details, advocacy work, voting data, case studies and market trends and is published annually covering the previous year to 31 March.

PRI Transparency and Assessment reports

As a signatory, it is mandatory to report annually on our responsible investment practices through the PRI Transparency report. Our latest PRI reports can be found on our website via the following link: https://ninetyone.com/-/media/documents/stewardship/91-pri-public-transparency-report-en.pdf

Task Force on Climate-related Financial Disclosures (TCFD)

Ninety One formally pledged its support for the TCFD in September 2018 and this report sets out how we disclose our exposure to and management of climate risk, using the TCFD framework. Our TCFD report can be found within our Integrated Annual Report (pages 38-51)

Online voting disclosure

Voting decisions are disclosed publicly on a monthly basis on the Ninety One website and can be found our website via the following link: https://ninetyone.com/en/united-states/sustainability/invest-advocate-inhabit/invest/proxy-voting-results.

Annual Sustainability Reports

With regard to our sustainability-focused products, our annual sustainability reports present significant developments throughout the year, including environmental and sustainability metrics for the portfolios and underlying holdings, details on proxy voting (where applicable), as well as engagement goals and progress:

- Global Environment Impact Report

- Global Sustainable Equity Sustainability Report

- Emerging Markets Sustainable Equity Sustainability Report

- Emerging Markets Sustainable Blended Debt Sustainability Report

Quarterly Sustainability Reports

For our non sustainability-focused products, our quarterly sustainability reports provide an outline of the key sustainability risks and opportunities and cover the investment team's approach to sustainability integration; key engagements; proxy voting activity; portfolio climate risk analysis and portfolio characteristics.

Other sustainability disclosures

We publish various sustainability disclosures on our website as per regulatory requirements i.e. SFDR disclosures.

Planetary Pulse

This report reveals the findings from new primary research into transition finance. It is based on a survey of 300 senior professionals at asset-owner institutions and advisors around the world, including pension funds, insurers, endowments, foundations, central banks, sovereign wealth funds, and consultants.

Investment Institute

Our Investment Institute is an engagement platform that delivers strategic investing insights and analysis to our clients across asset classes, investment strategies and borders.

The Investment Institute provides in-depth analysis and research on key geopolitical, economic and investment trends. Its work draws on our firm’s investment capabilities and partnerships with leading academics and external practitioners, and seeks to empower clients with insight and knowledge.

Portfolio resilience, sustainability, and ESG applied to investing have been central themes of the Institute’s work and have culminated in the publication of annual journals and papers. Below are just a few of our research, reporting and thought leadership papers relating to Sustainability that we have produced. All are both, internal and public-facing communications.

The Investment Institute mobilizes Ninety One’s firm-wide expertise and our substantial global network of specialist partners to generate proprietary insights on the global economy, markets, geopolitics and asset allocation. The Institute seeks to play a full and active role in the global conversation on sustainable investing. From aligning a portfolio with the decarbonization growth trend to ensuring a fair clean-energy transition for all, Ninety One’s portfolio managers and analysts explore sustainable investing across asset classes and investment approaches.

An important feature of our Investment Institute is the direct link between the research insights it generates, and portfolios managed across the firm. The Institute works closely with all the firm’s investment capabilities and has strong Executive Management support for its work.

Podcasts

Through our ‘The Big Picture’ podcast channel we provide interviews and viewpoints on various ESG related topics.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? If so, how frequent are the reviews? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

Despite never deviating from our philosophy we always look to enhance and evolve each stage of our investment process through constant review, to provide the best possible outcomes for our clients. The 4Factor team hold an annual off-site conference, typically held in September, during which they review the 4Factor framework, including the approach to ESG integration, and its effectiveness over the past year.

Oversight for responsible investing lies with our internal Sustainability Committee. This robust and transparent governance structure is necessary for effective stewardship and oversees all activities with respect to stewardship and ESG at Ninety One. The Sustainability Committee meets quarterly to review our progress and activities in relation to ESG integration, stewardship, engagement, advocacy, sustainability and climate risk, regulation and other related matters. This committee also reviews and approves new policies as well as changes to existing policies. Investment team heads are required to report to this committee on a regular basis.

A comprehensive assessment of E and S and G is considered and wholly integrated within each of our investment capabilities, ensuring these factors are duly considered when any investment decision is made. Therefore, any decision to buy or sell due to an ESG issue would not be made on ESG assessments alone, but rather as a result of a thorough investment process of which ESG analysis is a part.

If any investment decisions are to be vetoed the decision would be made by the Sustainability Committee (and/or the Sustainable Investment Advisory Forum for our sustainability-focused products) after a thorough due diligence process.

Climate

8. Describe how you identify, assess, and manage climate-related risks, and whether climate-related risks and opportunities are integrated into pre-investment analysis.

As an active global investment manager, we need to think about transition risk and physical risk from climate change in the context of all our stakeholders. This means our staff, our clients, our shareholders and the companies in which we invest. The greatest risk to our business is a material destruction of value in the underlying companies to which we allocate our clients’ capital; for this reason, deep integration of climate change risk in our investment process is the most important protection for our business in the long term.

We look to integrate climate change considerations, including both transition and physical risks where material, within the investment decision making process. This includes developing ways to assess climate change risk exposure of our investments and portfolios, engage with investee companies on climate change, and support industry initiatives that encourages especially greater and higher quality disclosure of climate change data. Our internal focus is currently on integration of climate change considerations within our various investment strategies.

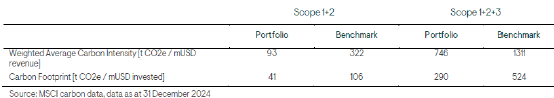

We have also developed the ability in house to measure portfolio carbon metrics aligned with the recommendations of the Taskforce for Climate-related Financial Disclosures (TCFD), and the Partnership for Carbon Accounting (PCAF) standard. After development of a proprietary Portfolio Climate Risk Tool, which helped us understand the nuances, methodologies, and data challenges, we have transitioned to integrating carbon data with our portfolio management tools.

The TCFD metrics include:

- Weighted Average Carbon Intensity, measured in tons of carbon dioxide equivalents per million USD revenue

- Portfolio Carbon Footprint, measured in tons of carbon dioxide equivalents per million USD invested

Using carbon data from MSCI as a starting point, the tools support identification of companies that are material contributors to portfolio carbon metrics, allowing investment teams to focus their analysis on exposure to transition and physical risk. Importantly, the tool provides detailed coverage of scope 1, 2 and 3 emissions and, where data doesn’t exist for a company, it will provide an estimate based on an industry average. Additional data we are integrating includes qualitative metrics to support in understanding companies' climate-related targets, and indicators of the quality of climate strategy.

In summary, the tools and data help us understand:

- Highest emitters and largest contributors to portfolio emissions

- How the portfolio compares relative to the benchmark

- Details on corporate climate-related targets and progress on transitioning to a low carbon world

The emphasis is always on using the available tools for an integrated understanding of the risks, including

identifying companies that are least prepared for a transition to a low carbon world.

Transition Plan Assessment

At a firm level, we have developed a process to assess the transition risk of the biggest emitting companies in our house portfolio. When committing to net zero, we were conscious that most companies globally, but particularly in emerging markets, do not yet have a clear plan on how they’re going to decarbonize by 2050. Therefore, it is our role as shareholders to encourage, measure and engage the high emitters in our portfolios on their transition and to go on the journey of transition alongside them, with a special focus on emerging markets. To ensure that we do this with integrity, we have developed an in-house ‘Transition Plan Assessment’ (TPA) that scores our heaviest emitters on three key principles: level of ambition, credibility of plan, and implementation of plan.

Our TPA tool uses indicators derived from best-in-class disclosure and measurement frameworks, including the

Climate Action 100+ benchmark, Transition Pathway Initiative, CDP climate data, InfluenceMap and IIGCC guidance. We have built on these frameworks to incorporate, or emphasize, factors that we consider imperative for a successful transition, such as the financial viability of the plan or the approach to just transition. We explicitly seek to avoid rewarding companies using divestment to achieve their emissions targets.

Three companies within the Emerging Markets Equity Strategy - Samsung Electronics, Vale, and WH Group— are also among the firm’s top emitters. Transition Plan Assessments (TPAs) have now been completed for all four. Over the past year, we have also engaged with an additional ten portfolio companies on climate change and their transition strategies.

Our current 4Factor investment process includes comprehensive analysis of the carbon emissions and transition pathways for all securities in a high-emitting sector, as defined by The Institutional Investors Group on Climate Change as well as those, once invested, that contribute to the top 50% of firm-wide financed emissions. Carbon transition is highlighted as a material risk for many sectors, necessitating both a stock and portfolio-level approach. We are now working on ways to expand from our portfolio carbon risk profile analysis to place greater emphasis on transition alignment and the quality of companies’ transition plans. Last year, many of our investment professionals participated in a bespoke program with Imperial College that focused on climate risk. This has helped intensify debate organization-wide and within our investment team leading us to begin developing our own transition alignment frameworks at a strategy level. There will continue to be a central effort from Ninety One’s dedicated Sustainability team to support and guide all investment teams on this. This will feed into the objectives of individual strategies and guide engagement with clients around their own net zero agendas. Our approach to addressing climate change includes a clear focus on materiality.

The 4Factor specific Transition Plan Assessment for high portfolio emitters then provides a holistic assessment looking at emissions intensity, reduction targets if these are science based, TCFD reporting alignment, net zero ambitions, transition pathways, and alignment of management incentive structure linked to achievement of goals. We categorize these high emitters into five categories, to align with the IIGCC energy transition criteria: “Achieving Net Zero”, “Aligned”, “Aligning”, “Committed” or “Not aligned” as appropriate.

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

Our approach to assessing climate change sits within our Sustainability policy. There have been no significant updates over the period, however we are focused on making progress with our strategic engagements through carefully developed engagement plans, clear objectives and milestones, prudent escalation strategies and thoughtful advocacy work to improve the enabling environment.

We recognise that climate change presents opportunities and risks to our products, investment strategies and business. We believe climate change is likely to be one of the greatest commercial challenges that our organisation has faced in its lifetime. Our strategy has always centred around delivering strong returns for our clients through innovative and targeted products. We therefore put sustainability with substance, with a focus on climate risk, at the core of our business strategy.

Our general aim is to ensure that robust ESG integration processes highlight material climate risks (both physical and transition risks) and prompts our investment teams to analyse and address them as part of their fundamental research. Our approach is based on the belief that over time, the market will increasingly price negative externalities into the value of securities. We believe that with better informed analysis to price climate risk our allocation of capital will favour companies and countries working the hardest to tackle climate risk. The strength of our investment outcomes benefits from a deep understanding of material climate-related risks and their potential to affect value.

We joined the Net Zero Asset Managers Initiative in 2021. We publicly disclose our targets under Net Zero Asset Managers Initiative in our Sustainability and Stewardship Report. We know this is not an easy road to travel and will be tested in the pursuit of this ambition. Wherever there are constraints, we shall, with determination and ambition, challenge and seek to overcome them.

As an asset manager, we have approached the implementation of this commitment in two ways:

- The first is our footprint: Our own operations, Scope 1, 2 and 3 (category 6). We intend to decarbonize our operations over time by investing in low-carbon energy, encouraging behavior change and supporting initiatives that credibly contribute to a lower-carbon world.

- The second is our handprint: The impact of the portfolios we manage for our clients (Scope 3 - category 15). Our targets cover our entire corporate portfolio. We are engaging with our portfolio companies to set targets and transition plans consistent with a science-based net-zero pathway

At a firm level, we have developed a process to assess the transition risk of the biggest emitting companies in our house portfolio. When committing to net zero, we were conscious that most companies globally, but particularly in emerging markets, do not yet have a clear plan on how they’re going to decarbonize by 2050. Therefore, it is our role as shareholders to encourage, measure and engage the high emitters in our portfolios on their transition and to go on the journey of transition alongside them, with a special focus on emerging markets. To ensure that we do this with integrity, we have developed an in-house ‘Transition Plan Assessment’ (TPA) which is described above.

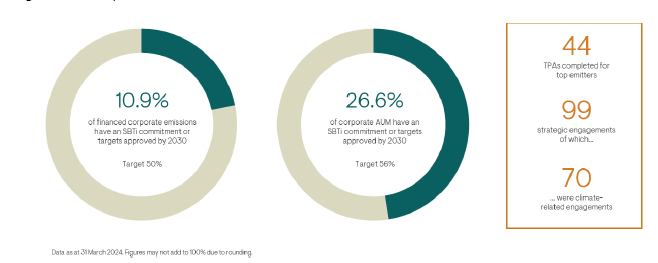

We are now pleased to have completed 44 TPAs for our highest-emitting investee companies and have established a strategic-engagement process for our highest-emitting companies, linked to the output of these assessments. We have also made good progress against our net zero targets with 10.9% of financed emissions and 26.6% of corporate AUM having Science Based Target initiative (“SBTi”) commitments or targets approved as at 31 March 2024.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate-related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

Ninety One conducts an analysis of the impact of climate risk from the three TCFD scenarios based on the GHG emissions pathways and the inferred carbon prices developed by the Intergovernmental Panel on Climate Change (IPCC) at a firm level, and for our OEIC fund range. These are the three scenarios and their assumptions:

- Orderly net zero transition scenario: Emissions are reduced in a measured way to meet global climate goals through strict climate policies and via innovation. The outcome includes the impacts of both climate related risk and opportunities. Assumes an average global temperature increase of 1.5ºC in 2100. Model is based on Very low emissions’ IPCC scenario (SSP1-RCP1.9).

- Disorderly transition scenario: Minimal progress is made to reduce emissions by 2030 which results in a delayed knee-jerk reaction from governments, regulators and companies to reduce emissions in the period thereafter. Higher transition risks pervade with policies diverging across countries and sectors creating disorderly

characteristics companies will need to deal with. The need for innovation and large capital investments albeit at a later stage could impact the profitability of carbon-intensive companies. Assumes an average global temperature increase of 1.5ºC in 2100. Model is based on Very low emissions’ IPCC scenario (SSP1-RCP1.9). - Hothouse-world scenario: The hothouse-world scenario will materialize if the world continues on its current path over a longterm trajectory. Extreme weather events are more frequent, weather pattern changes will harm food supply leading to vast human migration. Assumes an average temperature increase of 4.3ºC by 2100,

high emissions’ IPCC scenario (SSP3-RCP7.0).

The corresponding portfolio level impacts are inferred from the exposure to carbon intensive assets in the context of their underlying revenue exposure to physical climate and transition risks. Data from Clarity AI supports this qualitative and quantitative analysis of climate risk impact (physical and transition risks) on our portfolios under an orderly transition, disorderly transition, and a hot-house world scenario.

However, given the impact of physical and transition risk vary considerably depending on a range of factors including sector, location, vulnerability, risk management plan, competitiveness, political context, price elasticity, pass through costs, technology costs over time etc, in general we do not consider mechanistic outputs of scenario modelling to give a full and dynamic picture of the potential risks and impacts over relevant time horizons for different investment strategies. Therefore, we consider the optimal approach for individual companies with potential exposure to manage their risks is through a forward-looking plan for transitioning to net zero and managing climate impacts.

Ultimately, we continue to believe that portfolio managers, supported by their investment teams, are responsible for analyzing climate risks and opportunities within their portfolios and determining how these risks might affect portfolio holdings. We also believe that exposure to climate risks and opportunities should be considered alongside the companies’ ability to manage physical and transition risks and adapt their existing business operations and products to a lower-carbon economy.

11. Do you track the carbon footprint of portfolio holdings? If yes, how frequently? Please provide the results as of December 31, 2023 and describe the methodology and metrics used, including whether you have set targets and/or a net zero objective for reducing the portfolio’s footprint, and comment on any related progress over the

past year.

Yes.

The analysis below is based on all assessable securities held directly within the portfolio as at the end of the quarter as estimated using the methodology described above. For the purposes of this analysis, where only a percentage of the portfolio is covered as at 31 December 2024, the assessable securities have been reweighted to 100%. This only affects the carbon intensity measure. Therefore, the carbon intensity reflects only the emissions of companies where we have data and may not be reflective of the emissions of the entire portfolio. This quarter we’ve changed the Carbon Footprint measure to align with observed changes in the industry. Using the Partnership for Carbon Accounting Financials (PCAF) guidance, we now use Enterprise Value including Cash (EVIC) to determine the allocation of emissions.

Scope 1 & 2 emissions provide a good proxy for how efficiently a company is managing the carbon emissions directly under its control. Data for Scopes 1 & 2 has decent coverage and is relatively consistent quarter on quarter reflecting portfolio and benchmark changes. However, for many sectors, like oil & gas or automotive companies, Scope 3 accounts for the bulk of emissions. This includes the carbon emissions in both the company’s supply chain and those generated by the company’s products as they are used. Therefore, we also provide Scope 3 data, when this accounts for the most significant portion of a company’s emissions. We would caution that the quality of Scope 3 data is less advanced, it is not reported by all companies and where it is, it may not be calculated on a consistent basis. We use estimates based on sector averages where it is not available or incomplete and are regularly refining the modelling underpinning Ninety One’s climate-risk tool to improve accuracy. This leads to greater variability in the Scope 1, 2 & 3 columns for both the portfolio and benchmark. This means that it is difficult to compare Scope 3 emissions quarter-to-quarter. However, as we aim to have an impact on real world emissions, we believe that engagement priorities can only be set including Scope 3 emissions.

Carbon reduction targets

We do not manage the Strategy to explicit climate related targets. However, as mentioned above, Ninety One's net zero targets currently incorporate our entire portfolio of corporate assets. These targets aim for 56% of AUM and 50% of financed emissions have science based targets and net zero transition plans by 2030 and are applied across the firm's overall portfolio of investments, as opposed to individual strategies. Therefore, the corporates held in this portfolio are part of the scope of these overall targets. We also engage with companies guided by areas identified in their TPAs to influence real-world carbon reduction.

In our drive for low-emitting portfolios, we intend to do more than reduce ‘portfolio carbon’ by simply constructing portfolios that exclude high-emitting companies. If we mechanistically apply an exclusionary process to achieve net zero targets, a consequence is likely to be the creation of portfolios concentrated in asset-light industries without the transition focus on the remainder. As a side-line, we might see certain companies, regions and sectors abandoned to their own devices.

12. What are your firm's emissions as of December 31, 2023? Please provide scope 1 and scope 2 emissions, and, separately, scope 3 emissions if available. Please demonstrate how/whether you are taking steps to reduce these emissions.

Our commitment to sustainability extends beyond integrating it into the way we invest. The third pillar of our sustainability framework 'inhabit', drives our ambition to inhabit our own ecosystem in a manner that ensures a sustainable future for all. This includes the way in which we look after our people and the way we govern our firm. As a long-term investor on behalf of our clients, we are aware of our broader responsibility to society.

Change starts with us, and we are committed to walking our talk in terms of our own sustainability footprint. We enthusiastically take on the responsibility for ‘inhabiting’ our ecosystem in a manner that ensures a sustainable future for all. From the Ninety One Green Team at our offices, through to our work in conservation and communities both globally and in our original homeland of Africa, we support the preservation of our natural world, creating a better tomorrow for future generations.

Running our business responsibly

Ninety One joined the Net Zero Asset Managers Initiative in 2021, committing to reach net zero emissions by 2050 or sooner. We published our transition plan in 2022, which includes 2030 targets for our investments and operations.

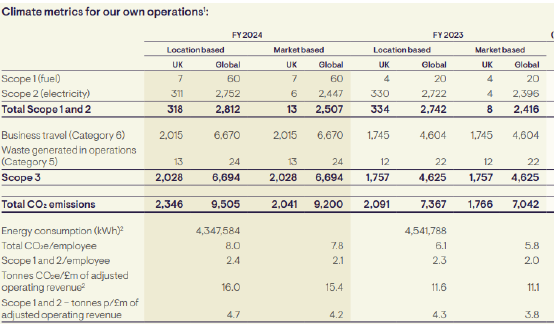

As an investment manager, the largest contribution to our carbon footprint is from the investments that we make on behalf of our clients. At the same time, in line with our purpose, we want to contribute to a better world and aim to run our business sustainably. We are committed to reducing emissions across our own operations and locations and have set a 2030 target to reduce absolute Scope 1&2 emissions by 46%. In financial year 2024, our Scope 1 and 2 emissions increased by 3%. However, compared with 2019, our baseline year, our Scope 1 and 2 emissions have decreased by 25%, and we remain on track for our 2030 target.

We recognize our responsibility to play our part in reducing global emissions, and we support the long-term goal of the Paris Agreement to keep the global average temperature increase to below 1.5°C. We use an environmental data collection system to track and manage our direct operational impacts. Over the year, we further improved the accuracy and thoroughness of our data, based on updated carbon emission factors, improvements in data quality and adjustments to previous estimates.

- This table shows our total operational GHG emissions and energy data and is line with the Streamlined Energy and Reporting requirements. Global includes UK emissions. Numbers may not total exactly due to rounding. Base year in 2019 is calculated for the calendar year. FY 2023 and FY 2024 are aligned with Ninety One’s financial year from 1 April to 31 March.

- Energy consumption in kWh for Scope 1 and Scope 2.

Our carbon footprint was calculated in accordance with the international Greenhouse Gas (“GHG”) Protocol’s Corporate Accounting and Reporting Standard (revised edition). We measure and report our carbon using both location- and market-based methodologies. We believe this provides the most transparent and accurate view of our operational carbon footprint.

Key carbon numbers FY 2024

- Total tCO2e per £million of adjusted operating revenue, our intensity metric, increased by 37%.

- Global Scope 2 electricity emissions increased by 1% on a location basis. Over half of our Scope 2 emissions relate to our Southern Africa offices, a more carbon intensive location for electricity.

- Our global Scope 3 emissions, which include paper, waste and business travel, increased by 45% to 6,694 tCO2e. This was mostly due to changes in the greenhouse gas conversion factors applied to travel, with some increase in business travel (specifically air travel). A certain amount of travel is required to run our global business, both to meet with clients and engage with colleagues. However, we continue to look at less emissions intensive options for air travel. This will be a focus over the coming period.

- Carbon neutral on a Scope 1, 2 and 3 (Category 6) through our partnership with BioCarbon Partners (see page 70 in our Sustainability and Stewardship Report for details)

- Agreed to establish first-of-a-kind ‘wheeling’ arrangement for our Cape Town office in South Africa. ‘Wheeling’ involves the transfer of privately generated renewable energy across the national grid to meet our electricity needs.

Current initiatives

Our employee resource group, Ninety One Green, continued looking at how to implement sustainability initiatives across the business. We maintained our partnership with Giki Zero to engage and educate our employees on their carbon footprints. This included campaigns on COP28 and explaining what it means for individuals rather than corporates and governments.

While decarbonizing our operations remains our focus, we maintained our long-term partnership with BioCarbon Partners (“BCP”) to mitigate 100% of our Scope 1, 2 and 3 (business travel) carbon emissions. BCP is a for-profit social enterprise founded in 2011, working to make forests and wildlife valuable to rural communities in the Luangwa and Lower Zambezi areas of Zambia. BCP does so primarily through the development and sale of carbon offsets, generating revenue used to conserve natural forests in some of Africa’s most important ecosystems. The projects are deeply integrated into local communities, which share in the revenue from the sale of the verified carbon offsets.

We continue to assess viable options for sourcing energy from renewables. This remains a challenge in South Africa, where we have sizeable operations. Nevertheless, we continue to seek to improve our energy efficiency. This has included entering into an agreement with Growthpoint Properties to wheel renewable solar energy from the Constantia Village shopping center in the suburbs of Cape Town for use at Ninety One’s refurbished offices once the refurbishment is complete. This will significantly improve the carbon footprint of this office.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments? Please answer on both an equally-weighted and market cap-weighted basis.

We do broadly aim to build portfolios which exhibit lower WACI than the benchmark. However, we also recognize there is more to this topic than current emissions metrics. A critical part of our fundamental investment process it to understand the direction of travel; by assessing the credibility of our target companies’ own commitments and proposed transition pathways.

As a percentage of NAV, 7.4% of the portfolio consists of companies with SBTi commitments, while on an equally weighted basis, this figure is 8.1%. These are commitments demonstrate an organizations’ intention to develop targets and submit these for validation within 24 months. This would be the first step in setting a science-based target.

As a percentage of NAV, 19.9% of the portfolio consists of companies with validated SBTi targets, while on an equally weighted basis, this figure is 16.3%. These companies have clearly defined pathways to reduce greenhouse gas (GHG) emissions, which have been validated by the SBTi.

14. How do you assess the credibility of a company’s emission reduction targets?

As mentioned above, at a firm level, we have developed a process to assess the transition risk of the biggest emitting companies in our house portfolio. When committing to net zero, we were conscious that most companies globally, but particularly in emerging markets, do not yet have a clear plan on how they’re going to decarbonize by 2050. Therefore, it is our role as shareholders to encourage, measure and engage the high emitters in our portfolios on their transition and to go on the journey of transition alongside them, with a special focus on emerging markets. To ensure that we do this with integrity, we have developed an in-house ‘Transition Plan Assessment’ (TPA) that scores our heaviest emitters on three key principles: level of ambition, credibility of plan, and implementation of plan.

Our current 4Factor investment process includes comprehensive analysis of the carbon emissions and transition pathways of our prospective investments that are material to the net zero transition. Carbon transition is highlighted as a material risk for many sectors, necessitating both a stock and portfolio-level approach. We are now working on ways to expand from our portfolio carbon risk profile analysis to place greater emphasis on transition alignment and the quality of companies’ transition plans.

The 4Factor specific Transition Plan Assessment for high portfolio emitters provides a holistic assessment looking at emissions intensity, reduction targets if these are science based, TCFD reporting alignment, net zero ambitions, transition pathways, and alignment of management incentive structure linked to achievement of goals. We categorize these high emitters into five categories, to align with the IIGCC energy transition criteria: “Achieving Net Zero”, “Aligned”, “Aligning”, “Committed” or “Not aligned” as appropriate.

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

As an organisation, we believe in transition alignment, and in SBTi as the gold standard for companies to comply with. As a signatory to NZAMI, we are committed to setting out a plan to reach net zero by 2050 or sooner. We are committed to ensuring that 100% of our corporate asset pool (debt and equity) achieves Net Zero by 2050.

At a firm level, we have sought to design net-zero targets for our investment teams aimed at driving real-world carbon reduction and allowing emerging markets to transition in a fair and inclusive manner. To this end, we have set the following target for our investments:

- At least 50% of the corporate emissions financed by Ninety One will be generated by companies with Paris-aligned science-based transition pathways by 2030.

- The proportion of our corporate assets under management covered by Paris-aligned science-based transition pathways will meet the SBTi requirements for Ninety One to obtain a verified SBTi. We calculate this requirement to be 56% of our corporate assets under management with science-based transition pathways by 2030.

- In practice, we will be engaging actively with our highest emitters and largest holdings to maximise the proportion of our corporate AUM with science-based transition pathways.

Whilst the portfolio has no explicit net zero target, we should note that the transition alignment evaluation, enables us to monitor the portfolio from a climate risk analysis perspective, and allows us to actively engage with the companies that are top emitters in the portfolio.

We would expect more of the portfolio through time to be aligned to a net zero pathway.

16. Has your firm produced a Task Force on Climate-Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

Yes, Ninety One formally pledged its support for the Task Force on Climate-related Financial Disclosures (TCFD) in September 2018, reinforcing our commitment to climate change.

We have now merged our TCFD reporting within our Integrated Annual Report (pages 38-50) - so that our non-financial reporting sits alongside our financial reporting in preparation for the impending ISSB reporting requirements. Please refer to the recommendations table from page 40, which outlines our progress on each of the TCFD recommendations. The table shows both areas in which we have made good progress and areas where we believe more work is required to fulfil a disclosure requirement to a high standard.

In this reporting period, we made further progress on our disclosures including detailed work on transition finance, TPAs and scenario analysis. We believe this work is crucial to generate meaningful changes in the real world and a just transition for emerging markets.

As per FCA requirements, we have also included additional metrics where required for the assets in scope of the FCA’s UK entity level requirements, which include the AUM of Ninety One Fund Managers Limited and investments managed by Ninety One UK Limited.

To meet new FCA product level requirements, we have also begun reporting TCFD metrics for our UK domiciled OEIC fund range. The TCFD Climate Report outlines how Ninety One’s investment funds within Ninety One’s OEIC series I-IV align to the TCFD disclosures.

As part of the FCA requirements, we have also begun providing specific information on scenario analysis within the Ninety One Fund Series I-V OEIC Report and Accounts documents (as and when they are published). Ninety One has based its analysis of the impact of climate risk on the three TCFD scenarios for greenhouse gas (GHG) emissions pathways and the inferred carbon prices developed by the Network for Greening of the Financial System (“NGFS”) – an orderly transition scenario, a disorderly transition scenario and a hothouse-world scenario.

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

Not applicable

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

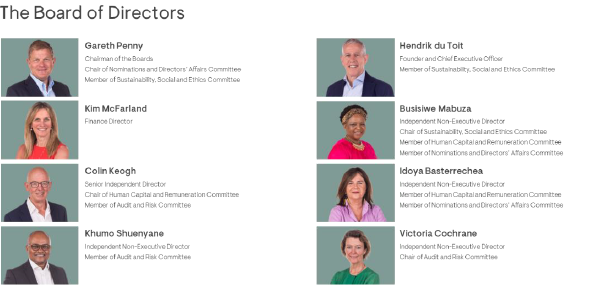

Across the firm, we have a diverse, experienced and stable leadership team.

Board of Ninety One Ltd and Ninety One plc

The Board of Ninety One Ltd and Ninety One plc (“the Board”) is responsible for, inter alia, the approval and review of the Ninety One Ltd and Ninety One plc group of companies’ (“Ninety One Group”) long term objectives and strategy, approving any dividend payments, ensuring maintenance of a sound system of internal control and risk management and oversight of financial position, investment performance and operations.

The Boards consist of six Non-Executive Directors and two Executive Directors.

The ‘Terms of reference’ for the board committees (which includes a description of the committee’s decision making powers, responsibilities, and name and position of attendees) are available from our website on the following link.

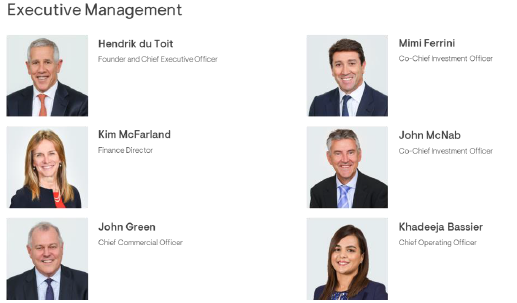

Executive Management

The Board, with Executive Management, agree the strategy for the business and ensure the right structures are in place to achieve success. Executive Management regularly reviews and monitors progress against Ninety One’s strategic objectives. Where factors arise which may impede (or accelerate) the execution of these priorities, they are carefully considered and appropriate action is taken. The Board is kept abreast of progress on Ninety One’s strategy, including material developments which may arise, so they may opine on new developments, including risks.

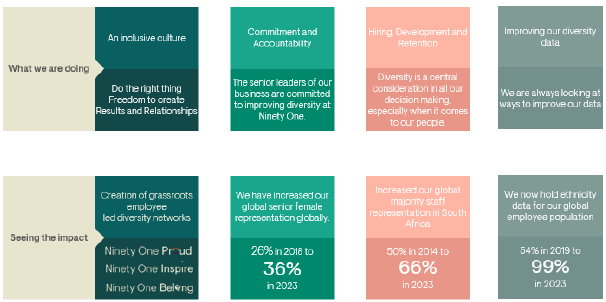

In terms of key operating decisions, different topics are discussed at meetings per set agendas.