No offering is being made by this material. The products and services provided by PIMCO Canada Corp. may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose.

Report date: March 18, 2025

ESG Policies

1. Please provide your ESG-related policies. Please provide a formal statement of your ESG-related policies if you have one.

PIMCO has a Sustainable Investment Policy Statement that details PIMCO’s commitments to: the integration of ESG factors broadly into our research process, sustainable investment solutions offered to our clients, our engagement with issuers on sustainability factors, and the evaluation of climate change and related risks in our investment analysis. PIMCO formalized our Sustainable Investment Policy Statement originally in 2012 with continuous enhancements and evolutions over the years.

This statement is designed to apply broadly to our firm’s long-term investment process and to our PIMCO sponsored funds that follow sustainability strategies and guidelines.

PIMCO’s Sustainable Investment Policy Statement is reviewed periodically by the Sustainability Leadership team who provides feedback on PIMCO’s sustainability capabilities and platform.

The Sustainability Leadership team is comprised of: Kimberley Stafford, Managing Director; Julie Meggers, Managing Director; Grover Burthey, Executive Vice President; Gavin Power, Executive Vice President; Del Anderson, Executive Vice President; Kwame Anochie, Executive Vice President; Jelle Brons, Executive Vice President; and Samuel Mary, Senior Vice President. The team meets bi-weekly with presentations and regular updates among the team leaders. In addition, the group has rotating members from the ESG Analyst team and Product Strategy Group and regularly invites external speakers to present their expertise in this field.

See the “Important Information” section at the top of this questionnaire for additional details related to PIMCO sustainability strategies and guidelines.

Please note the PIMCO Canada Canadian CorePLUS Bond Trust does not pursue specified sustainability strategies or guidelines; however, ESG is integrated across our investment process as detailed herein.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

Please note the PIMCO Canada Canadian CorePLUS Bond Trust does not pursue specified sustainability strategies or guidelines. At the firm level, PIMCO integrates material ESG factors into the investment research process where applicable to better assess issuer risks as part of our standard investment process.

At PIMCO, we define ESG Integration as the integration of material ESG factors into investment research. We believe incorporating ESG factors should be part of a robust investment process. We recognize that ESG factors are increasingly material inputs into our understanding of global economies, markets, industries and business models. Whether climate change, income inequality, shifting consumer preferences, regulatory risks, human capital management or unethical conduct, ESG factors are important considerations when evaluating long-term investment opportunities. These factors are evaluated across markets and asset classes where applicable. Our commitment to ESG integration was one of the main drivers that led PIMCO to become a signatory to the Principles of Responsible Investment (PRI) in September 2011.

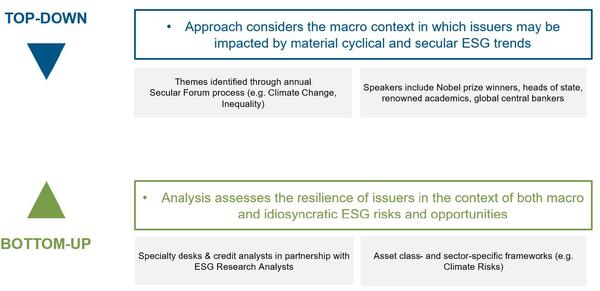

The integration of ESG factors into PIMCO’s investment process seeks to account for material ESG risks in both top-down macro positioning and bottom-up security evaluation. To the extent that ESG risks are material for particular sectors, issuers, etc., our fundamental credit views will reflect this. While ESG scores play a role in security selection for portfolios that follow sustainability strategies and guidelines, they are not a criterion for security selection in portfolios that do not follow sustainability strategies and guidelines. Additionally, integrating material ESG factors into the evaluation process does not mean that ESG information is the sole consideration for an investment decision; instead, PIMCO’s portfolio managers and analyst teams evaluate a variety of factors, which can include ESG considerations, to make investment decisions. By integrating material ESG factors into the evaluation process, PIMCO is increasing the total amount of information assessed to generate a more holistic view of an investment, in efforts to deliver the best performance outcomes for our clients.

See the “Important Information” section for additional details related to PIMCO sustainability strategies and guidelines.

ESG Integration: Firm-Wide Assets

At the firm level, PIMCO integrates material ESG factors into the investment research process where applicable to better assess issuer risks. Our process emphasizes rigorous analysis of broad secular trends, which are at the core of both global ESG trends and long-term asset returns. PIMCO has developed a robust platform specialized in supporting ESG-focused investment solutions based on our belief that ESG integration is essential to optimizing outcomes over the long-term. For this reason, our investment process evaluates ESG risk factors from both the top-down (i.e. macro) and bottom-up (i.e. security specific) where applicable.

From the top-down, the first and most important step in PIMCO’s process is to correctly identify the major long-term themes that will impact the global economy and financial markets. PIMCO believes that such analysis is fundamental to making sound investment decisions. The firm’s annual Secular Forums are devoted to identifying and analyzing these longer-term trends and the analysis of ESG-related issues fits directly into that process.

As illustrated below, PIMCO blends its macro analysis with detailed bottom-up work.

SOURCE: PIMCO. For Illustrative Purposes only.

The firm’s global research teams aim to evaluate ESG-related issues as part of their bottom-up analysis.

PIMCO aims to consider relevant risks and opportunities that could affect particular issuers or industries where appropriate, including those that are ESG-related. To facilitate the integration of ESG risk factors in our analysis and help to monitor ESG related risks, we are continually enhancing our proprietary research with specific ESG related attributes and dedicated scoring. In addition, we have hosted training sessions for our analysts on available scoring methodologies, ESG systems, data and tools.

ESG data and analysis, both internal and external, are readily available to all portfolio managers, traders and research analysts across the firm, which enables portfolio managers to make trading decisions that incorporate the material ESG risks of a given issuer.

3.a. Are you a signatory to the UNPRI?

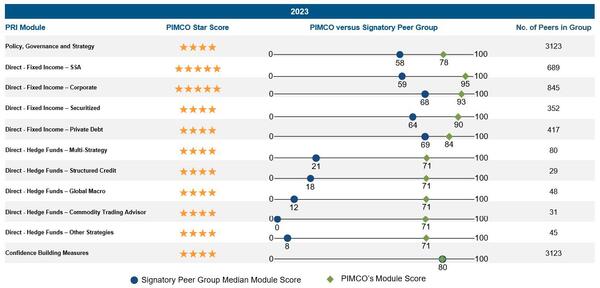

Yes. We believe that the Principles of Responsible Investment (“PRI”) is a leading force in the Environmental Social and Governance (“ESG”) conversation within the investment management industry. Based on our assessment of this organization and their standing within the industry, we became a PRI signatory in September 2011. As a PRI signatory, we participate in the PRI Transparency Reporting and Assessment process relating to signatory’s implementation of the six principles. PIMCO’s PRI Transparency Report is publicly available. In 2023 PIMCO scored strongly amongst signatory peers in relevant PRI Modules, as shown in the graphic below. Specific to 2023 PRI reports, we would note that the PRI’s assessment methodology was revised to reflect changes in the responsible investment industry, though module-level assessment methodology was consistent. As such, results from 2021 and beyond cannot be compared to previous years. Please also refer below for further information on PRI Scorecard methodology changes.

Results from PRI's 2023 reporting cycle. Reported as of October 2023. SOURCE: PIMCO, PRI.

PRI Assessment Reports are limited to signatories’ of the Principles for Responsible Investment (PRI), and consider a signatory’s responsible investment implementation across its overall investment process, among other factors. PRI Assessment scores are provided per module or asset class, with no overall organization score given. PIMCO’s scores reflect information and data reported by PIMCO to PRI in the 2023 reporting cycle (as of December 31, 2022). PRI Assessments awarded are based on a scale of 1-5 Stars. 1 Star being the lowest score, 5 Stars being the highest. For 2023 Methodology and an overview of the PRI Reporting Framework, please refer to the link.

For additional information regarding how PRI assesses signatory reporting, please refer to https://www.unpri.org/reporting-and-assessment/how-investors-are-assessed-on-their-reporting/3066.article Median scores for modules are calculated as the 50th percentile module percentage score.

PIMCO’s 2023 PRI Transparency Report is available on PRI’s website at https://ctp.unpri.org/dataportalv2/transparency and includes PIMCO’s responses to all mandatory indicators, as well as responses to voluntary indicators that PIMCO has agreed to make public. The PRI is an investor initiative in partnership with UNEP Finance Initiative and UN Global Compact.

The PRI’s 2023 Reports and Methodology

As part of the 2023 reporting year, the PRI’s indicator-level assessment methodology was revised to reflect changes in the responsible investment industry, though module-level assessment methodology was consistent with 2021. Key points include:

- Core indicators were assessed, with the exception of free-text responses, while plus indicators were not assessed

- For each indicator, scores from 0 to 100 points were assigned

- Indicator scores are weighted by a multiplier (low, medium, or high) in line with responsible investment practices and/or the PRI’s overall mission

- After multipliers have been applied, module scores are based on the total number of indicator points, which translates to a percentage score

- The percentage scores are then converted to a star score for each module

- Full details can be found in the PRI 2023 Assessment methodology for investors.

3.b. If you are signatory to other coalitions, please list them.

The following response is intended to address both parts b and c to Question 3 directly above.

As a leading global asset manager, PIMCO frequently receives requests to join different initiatives that support various causes and guidelines including sustainability efforts. Our sustainability team vets and reviews each potential opportunity to ensure it aligns with our sustainability philosophy and approach. We are involved with sustainability efforts globally, helping to define global sustainability standards, and encourage greater disclosure from issuers. Below is a list of our industry leadership with global affiliations and initiatives:

PIMCO Sustainability Industry Leadership

| Industry Leadership | Overview |

|

Principles for Responsible Investment PIMCO is a Signatory |

The UN-supported Principles for Responsible Investment (PRI) is the world's largest investor initiative focusing on integrating ESG factors into the investment processes. PIMCO is an active signatory of the PRI and engages in several work streams, including: - Member of the Advance Initiative's Advisory Committee, engaging companies to strengthen commitment, due diligence and remediation of human rights issues - Member of the Sovereign Debt Advisory Committee, focusing on the incorporation of ESG factors in the assessment of sovereign debt, and chairing the Sub-Sovereign Debt Advisory Committee |

|

Carbon Disclosure Project (CDP) PIMCO is a Signatory |

An organization that runs the disclosure system for stakeholders across the globe to manage the environmental impact of greenhouse gas emissions. CDP is backed by approximately 700 investors totaling over $140 trillion in assets. |

|

UN Global Compact PIMCO is a Member |

This is a principles-based framework for businesses aimed at advancing sustainable and responsible policies and practices. PIMCO supports the Ten Principles of the UN Global Compact with respect to human rights, labor, environment, and anti-corruption – and is committed to incorporating them into our strategy, culture, and day-to-day operations. PIMCO co-chairs the UN Global Compact’s CFO Coalition, which is an effort to create a movement of chief financial officers to address SDG investment and financing. |

|

ISSB Investor Advisory Group (IIAG) PIMCO is a Founding Member |

Under the umbrella of the Value Reporting Framework, this comprises asset owners and managers who recognize the need for consistent, comparable, and reliable disclosure of ESG information. The group participates in the ongoing standards development process and encourages companies to participate in the development process. |

|

Institutional Investors Group on Climate Change (IIGCC) PIMCO is a Member |

This is a leading investor coalition on climate change with more than 400 members across 27 countries, with over €65 trillion in assets. The IIGCC drives investor collaboration on climate change and takes action for a prosperous, low carbon future. |

|

Global Investors for Sustainable Development Alliance (GISD) PIMCO is a Member |

PIMCO is one of only roughly 30 members of the UN Secretary-General's GISD Alliance, which focuses on accelerating investment into sustainable development. In partnership with investors, governments, and multilateral institutions, the GISD will drive investment towards achieving the UN's Sustainable Development Goals. |

|

International Capital Markets Association (ICMA) PIMCO is a member of the Executive Committee |

The association promotes building internationally accepted standards of best practice in markets through the development of appropriate, broadly accepted guidelines, rule, recommendations, and standard documentation. In order to maintain and enhance the framework of cross-border issuing, trade, and investing in debt securities. The Executive Committee is responsible for the executive management and administration of the Association, including addressing all matters relating to the ICMA’s Principles: the Green Bond Principles (GBP), Social Bond Principles (SBP), and Sustainability Bond Guidelines (SBG). PIMCO is on the Executive Committee and one of the coordinators of the Sustainability-Linked Bonds Working Group. |

|

Transition Pathway Initiative (TPI) PIMCO is a Supporter |

A global asset owner-led initiative (including clients and investment consultants) that assesses companies’ preparedness for the transition to a low-carbon economy. TPI data and tools help inform our assessment of climate risks and engagement with bond issuers. |

|

Climate Bonds Initiative (CBI) PIMCO is a Partner |

A leading organization focused on fixed income and climate change solutions. CBI has been instrumental in supporting more robust data and standards to propel the green bond market, and remains heavily involved in shaping new green bond-related regulations. |

|

FAIRR PIMCO is a member |

A global network of investors addressing ESG issuer in protein supply chains, with over $70 trillion in member AUM. The aim of the initiative is to build a network of investors who are aware of the issues linked to intensive animal production and seek to minimize the risks within the broader food system. |

|

One Planet Asset Management Initiative PIMCO is a member |

Initiative created following the 2015 Paris Agreement in order to mitigate the effects of climate change. Aims to help Sovereign Wealth Funds foster a shared understanding of key principles, methodologies, and indicators related to climate change; identify climate-related risks and opportunities in their investments; and enhance their decision-making frameworks to better inform their priorities as investors and financial market participants. |

|

Investor Group on Climate Change (IGCC) PIMCO is a member |

Collaboration of Australian and New Zealand institutional investors focused on the impact of climate change on investments. Consists of over 100 members across Australia and New Zealand and represents $35 trillion of AUM around the world. IGCC members cover over 14.5 million people in Australia and New Zealand. |

|

Bank of England Climate Financial Risk Forum (CFRF) PIMCO is a member |

Aims to build capacity and share best practice across industry and financial regulators to advance our sector’s responses to the financial risks from climate change. Brings together senior representatives from across the financial sector, including banks, insurers, and asset managers and also includes observers from trade bodies to represent a broader range of firms and ensure the outputs of the CFRF are communicated to their members. |

|

Access to Nutrition Initiative PIMCO is a Signatory |

ATNI establishes partnerships with organizations committed to solving the world’s nutrition challenge, specifically working with food and beverage companies to improve their business practices. ATNI collaborates with investors, academics, non-profits, and foundations across the globe. |

|

Sustainable Bond Network (NASDAQ) PIMCO is an Advisory board member |

Connects issuers of sustainable bonds with investors looking to source detailed sustainable bond information for investment due diligence, selection, reporting and monitoring. Provides all the documents, data and qualitative information investors need, and holds data on allocation, impact, frameworks, certifications, targeted sustainable development goals and bonds. |

|

Milken Public Finance Advisory Council PIMCO is Member |

Aims to solidify the fragmented municipal securities market, lift public sector capacity for financial innovation, and develop policies, partnerships, and financial products to support essential and equitable public services that will accelerate post-COVID-19 economic recovery and job creation. |

|

The Partnership for Carbon Accounting Financials (PCAF) PIMCO is a Member of the Core Team |

PCAF is a global partnership of financial institutions that work together to develop and implement a harmonized approach to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments. The Core Team of PCAF governs the Global GHG Accounting and Reporting Standard for the Financial Industry and all its updates and expansions, with the ultimate goal of harmonizing GHG accounting and reporting across the financial industry. |

|

The ESG Integrated Disclosure Project (ESG IDP) PIMCO is a Member of the Executive Committee |

The ESG Integrated Disclosure Project (ESG IDP) Template provides borrowers with a harmonised and standardised means to report ESG information to their lenders. The Executive Committee oversees the use and development of the ESG IDP template, to support the consistent collection of data from sponsored and non-sponsored borrowers across the private and broadly syndicated credit markets. |

|

World Bank Private Sector Investment Lab PIMCO is Member |

PIMCO is one of just 15 financial institutions comprising the World Bank Private Sector Investment Lab, launched in 2023 and led by WB President Ajay Banga and UN Climate Envoy Mark Carney. The Lab is developing recommendations from members with respect to how the WB can more effectively crowd in private-sector finance in areas such as project guarantees and securitization. While much of the work focuses on climate change and the energy transition, the Lab’s scope includes the broad set of Sustainable Development Goals. |

|

Global Investor Commission on Mining 2030 PIMCO is an Investor Supporter |

Collaborative group that acknowledges the mining sector's significance in society and its transition towards a low-carbon economy. It emphasizes the necessity for the industry to address systemic risks that could jeopardize its social license to operate. Aims to establish best practices for increasing the production of essential minerals required for the transition, while ensuring social and environmental responsibility It is a multi-stakeholder with representation from companies and investors, communities and civil society, among others. |

As of 31 December 2024

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

Please refer to the response to question 3 b) above

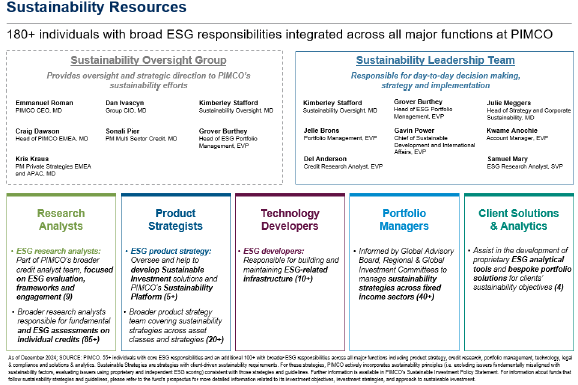

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

PIMCO’s sustainability team is not a separate business unit, but integrated across all functions of the firm from portfolio management to client-facing, executive office to product strategy, compliance to marketing. This ensures that ESG is integrated into PIMCO’s broad research process and includes staff at every point along the value chain. We believe it is important to have all of our expert analysts monitor the ESG risks that are relevant to their particular sector and universe of securities. This ensures that ESG risk factors and opportunities are integrated into our investment decision-making, as opposed to being an “add-on” separate from our financial analysis.

To help set the priorities for the firm’s sustainability platform, PIMCO has a focused Sustainability Leadership team in place that is responsible for leading firm-wide ESG integration, enhancing our sustainability capabilities and supporting the development of portfolios that follow sustainability strategies and guidelines. The group sets objectives and evaluates strategic initiatives on a continuous basis throughout the year. The Sustainability Leadership team is comprised of: Kimberley Stafford, Managing Director; Julie Meggers, Managing Director; Grover Burthey, Executive Vice President; Gavin Power, Executive Vice President; Del Anderson, Executive Vice President; Kwame Anochie, Executive Vice President; Jelle Brons, Executive Vice President; and Samuel Mary, Senior Vice President. The team meets bi-weekly with presentations and regular updates among the team leaders. In addition, the group has rotating members from the ESG Analyst team and Product Strategy Group and regularly invites external speakers to present their expertise in this field.

The Sustainability Oversight Group provides senior oversight and sponsorship for PIMCO’s global sustainable investing efforts. In its capacity, the group oversees several responsibilities, including the implementation of ESG integration and engagement principles in the firm’s broad investment process, and guiding external initiatives related to public policy and/ or industry partnerships.

Please see below for PIMCO’s sustainability team as of December 2024:

Specific to employees with direct sustainability responsibility, sustainability considerations are directly included in performance appraisal and objectives, among other factors. Sustainability considerations are integrated indirectly for all other investment staff as ESG assessments are the responsibility of individual portfolio managers/analysts. Key Performance Indicators for dedicated ESG trade floor employees can include: development of ESG frameworks, integration of ESG scoring across desks, engagement activity with issuers, market engagement to drive new issuance, internal teach-ins, trade ideas, performance of mandates that follow sustainability strategies and guidelines, etc.

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

PIMCO Proprietary ESG Research and Scoring

PIMCO has developed proprietary scoring frameworks across asset classes over the past decade. Our enhanced research process incorporates a detailed ESG asset assessment that complements the traditional ratings assigned by analysts. We have proprietary ESG scores for corporate issuers, sovereigns, securitized issuers and municipal issuers, in addition to PIMCO’s proprietary ESG labeled bond scoring framework to evaluate green, social and sustainability bond issuances.

Provided below are details on how PIMCO incorporates ESG into different asset types.

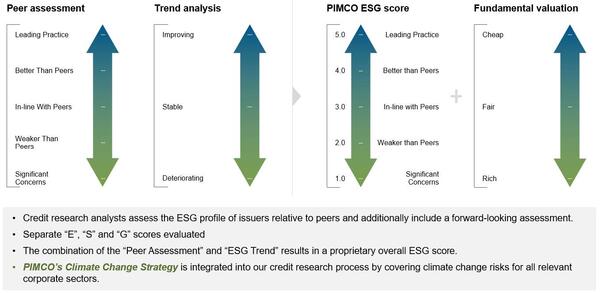

1. ESG Investing in Corporates

PIMCO’s team of credit research analysts generally assess the ESG profile of the issuers that they cover relative to peers with a goal of separating leading issuers from issuers who are not as advanced on their sustainability journey. Using industry-specific frameworks, analysts review their companies’ ESG performance based on information available in public filings, recent news and controversies, as well as through regular engagement with company management teams to assign separate scores for “E”, “S”, and “G.” In determining the efficacy of an issuer’s ESG practices, PIMCO will use its own proprietary assessments of material ESG issues. In the end, PIMCO’s resulting assessments are proprietary and distinct from those provided by ESG rating providers. To facilitate the integration of ESG risk factors in our analysis and help to monitor ESG related risks, we are continually enhancing our proprietary research with specific ESG related attributes and dedicated scoring. In addition, we have hosted training sessions for our analysts on available scoring methodologies, ESG systems, data and tools.

As illustrated below, scores seek to distinguish between “Leading Practice” issuers and those that raise “Significant Concerns.” They also include a forward-looking ESG trend assessment, which recognizes companies whose ESG performance is significantly improving or deteriorating.

Source: PIMCO. For Illustrative Purposes only.

These factors are combined to create a proprietary ESG score in which the relative weighting of the E, S, and G pillars, and the trend assessment, is based on the company’s business profile and differences in industry dynamics. For example, the environmental pillar has the highest weight for issuers in extractive industries (e.g. oil, gas and mining), the social pillar has the highest weight for pharmaceutical issuers, and the governance pillar has the highest weight for financial issuers. As the ESG landscape has evolved over time, the investment team continues to evolve and refine this approach accordingly.

Since 2016, PIMCO credit analysts have scored over 3,500 parent issuers on ESG performance. ESG issues are highlighted in their credit research notes, alongside PIMCO’s internal credit ratings and recommendations for portfolio managers to consider when they are evaluating investments for all PIMCO portfolios, including accounts that do not follow sustainability strategies and guidelines. ESG scores are updated regularly whenever relevant new information becomes available.

ESG data and analysis, both internal and external, are available to all portfolio managers, traders and research analysts across the firm.

2. ESG Investing in Sovereign Debt Markets

PIMCO’s in-depth, bottom-up sovereign risk analysis assesses financial, macroeconomic and ESG variables. ESG criteria have been an integral part of PIMCO’s sovereign ratings analysis since 2011 when we explicitly included variables that measure ESG factors into the PIMCO sovereign ratings model.

More recently, we have developed a standalone ESG scoring framework that both provides valuable input into our sovereign risk scenario assessments and serves as an input for relative value decisions in portfolios that follow sustainability strategies and guidelines. In addition to the traditional financial metrics used in sovereign credit analysis, we explicitly score the sovereign on each ESG component and compile a combined sovereign ESG score as shown in the following graphic:

Source: PIMCO. For Illustrative Purposes only.

3. ESG Investing in Structured Products

Agency and Non-Agency MBS

With PIMCO’s access to vast loan-level mortgage data, we developed a proprietary responsible investing scoring model for mortgages, based on a scale from 1 (weakest) to 5 (best), consistent with other PIMCO ESG scoring frameworks used for corporate credits, sovereigns and others.

PIMCO’s philosophy of responsible mortgage investing focuses on four objectives:

- Support homeownership. Homeownership is a key path to savings and wealth building for many across the world. Connecting borrowers with capital markets is an established and efficient way to ease the path to homeownership. Not all mortgages are used for homeownership; some mortgages are used for vacation home purchases or investment properties.

- Increase access for underserved communities. PIMCO believes a focus on underserved communities and lower income borrowers is a way to magnify the social benefit of home lending without sacrificing on loan quality.

- Promote responsible lending. It is critical to focus on ensuring borrowers are not put at added risk of financial distress due to burdensome debt loads.

- Discourage predatory lending. A governance-focused way to encourage good lending practices is to penalize or exclude lenders and servicers who engage in practices that are detrimental to homeowners (and in many cases detrimental to bondholders as well).

The mortgage market is not homogenous; there are agency mortgages and non-agency residential mortgages. We have built analytical frameworks for each part of the market.

For agency mortgage-backed securities (MBS), our ESG research model is based on pool-level characteristics and data we have collected over decades of studying mortgages. For non-government-guaranteed mortgages (non-agency MBS), our quantitative analysis is loan-level-based and again draws on a huge set of data PIMCO’s mortgage team has gathered since before the financial crisis.

Commercial Mortgage Backed Securities

In order to analyze Agency and Non-Agency CMBS, PIMCO developed a framework with a focus on Environmental criteria, specifically on industry standard Silver / Gold / Platinum LEED and Green certifications on properties to differentiate sustainably built structures. From a Social standpoint, analysts have been evaluating the health and safety measures taken post-COVID for the tenants, and from the Governance side, we are looking at the underlying ESG scores of the owners of the building.

Similar to the residential side, green securitizations remain a small part of the market issue by Fannie Mae and Freddie Mac. However, in their annual outlooks, there is an explicit shift to target more green loans, and so we expect Green labeled Agency CMBS to be a growing marketing going forward. We also look to promote underserved communities and affordable lending, such as through low-income multifamily loans issued by Fannie Mae and Freddie Mac.

Asset Backed Securities

Given the heterogeneous nature of ABS, we have developed a framework to make sure we are approaching analysis in the same manner across various ABS subsectors. PIMCO’s proprietary framework focuses on each pillar of E/S/G, leveraging the Social framework constructed for Non-Agency MBS and expanding upon it with the addition of Environmental and Governance criteria.

For the Environmental criteria, our framework emphasizes ABS that are promoting investment in renewable energy production, storage, and utilization. We look to capture the positive impact of electric vehicles, solar panels, power storage, and other green energy focused endeavors. On the Social side, our goal is to improve affordability and home ownership through responsible lending. We look to encourage responsible lending to consumers and small businesses, and identify and limit investment in predatory lending practices. Lastly, for Governance, we aim to avoid those with high risk servicer behavior such as recent servicer headline risk.

Collateralized Loan Obligations

For PIMCO’s CLO analysis, our analysts map existing loan-level ESG scoring to CLO collateral to produce CLO trust-level scoring. We supplement loan scoring with sector scoring for unscored CLO holdings. Here, we look to leverage the bottom-up ESG research of PIMCO credit analysts and the bank loan team to evaluate each loan collateralizing the transaction on all three metrics (E/S/G). With this loan-level analysis, PIMCO discourages overly-aggressive management and non-transparent structures when selecting what will be included in a portfolio that follows sustainability strategies and guidelines. Further, as CLOs are not a static pool of loans, we continue to monitor the underlying loans over time and are working to create pools that have positive ESG scores and stay that way.

4. ESG Investing in the U.S. Municipal Bond Market

We consider issuer-level ESG factors across municipal bond issuers to better understand the risks and opportunities inherent in our bond selections. The municipal market is vast and diverse, with issuers ranging from states and cities to enterprises such as higher education institutions, airports, and continuing care facilities. Analysts use proprietary frameworks to evaluate material ESG risks specific to each municipal sector, as well as identify ESG leaders within each sector.

Analysts review municipal issuers’ exposure to ESG factors through information available in public filings, recent news, and third-party data sources. These factors are then combined to create a proprietary ESG score utilizing the relative weighting of the E, S, and G pillars, and the expected trend going forward for that issuer. Issuers who have significant exposure to material ESG risks and lack mitigating factors to combat those risks would typically have lower ESG scores, while issuers who are exposed to fewer risks and are leaders in making progress on ESG issues, such as through greenhouse gas reduction measures, would typically have higher ESG scores.

Environmental risk includes exposure to physical climate risks as well as risks associated with the transition off fossil fuels, such as significant tax base reliance on the fossil fuel industry. Additional environmental risks could include exposure to water stress or environmental compliance concerns for sewer utilities. Typical social risks involve vulnerability of the tax base, which could be due to factors like a declining population or high poverty levels for cities and counties, or low graduation rates for higher education sectors. Governance risks generally include an assessment of how the issuer has managed its long-term liabilities such as debt and pensions, as well as overall management practices.

5. ESG Labeled Bond Scoring Framework

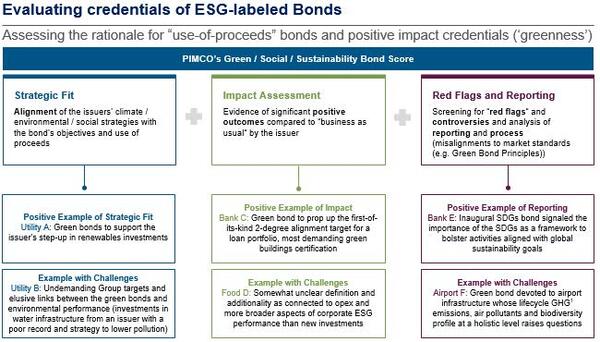

ESG labeled bonds, including green, social, and sustainability bonds, need to fit PIMCO’s credit selection and portfolio construction process of top-down drivers (sector and regional selection, expectations on global growth and technical factors), bottom-up drivers (credit strength, business model, covenants etc.) and valuation to qualify for investment. ESG Bonds refer to green, social, sustainability or sustainability linked bonds based on issuer as explained by the issuer through use of a framework and/or legal documentation. Labeled bonds are often verified by a third party that certified the bond will fund projects with eligible benefits or includes sustainability-linked covenants. Green Bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance, in part or in full, new and/or existing eligible Green Projects. Social Bonds are use-of-proceeds bonds earmarked to finance new and existing projects or activities with positive social impacts. Sustainability Bonds are use-of-proceeds bonds earmarked to finance new and existing projects or activities with positive environmental and social impacts. Sustainability-Linked Bonds (SLBs) are structurally linked to the issuer’s achievement of climate or broader sustainability goals, such as through a step-up in coupon if key performance indicators (KPIs) are not met. We look to invest in ESG labeled bonds that have attractive valuations that are in line to comparable (by coupon, maturity, seniority etc.) non-ESG bonds issued by the same company, given the strong focus on environmental sustainability objectives. We assess sustainable bond instruments both prior to and after issuance, mapping them across a spectrum based on strategic fit, potential impact, red flags, and reporting, resulting in PIMCO’s impact score for ESG bonds. PIMCO’s ESG labeled bond scores aid the investment process and security selection, allowing for stronger differentiation among sustainable bond issuers and frameworks.

The following graphic demonstrates our proprietary framework that assesses Green / Social / Sustainability instruments both prior to and after issuance, mapping them across a spectrum based on strategic fit, potential impact, red flags and reporting, resulting in PIMCO’s proprietary score for green, social, sustainability or sustainability-linked bonds.

SOURCE: PIMCO. For illustrative purposes only

1 UN Sustainable Development Goals

2 Greenhouse gas

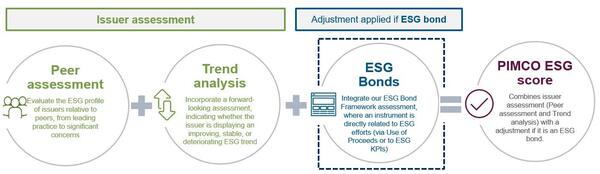

Building off of PIMCO’s standard issuer-level ESG score, which incorporates a peer assessment and trend analysis, PIMCO’s ESG bond score contributes a positive adjustment to the issuer ESG score for a potentially higher PIMCO ESG score. The magnitude of the adjustment is dependent on the quality of the ESG bond per PIMCO’s proprietary ESG Bond Framework assessment, detailed above. The below illustrates how ESG bonds are incorporated into PIMCO’s proprietary ESG scores.

SOURCE: PIMCO. For illustrative purposes only

ESG Bonds refers to green, social, sustainability or sustainability linked bonds based on issuer as explained by the issuer through use of a framework and/or legal documentation. Labeled bonds are often verified by a third party that certified the bond will fund projects with eligible benefits or includes sustainability-linked covenants. Green Bonds are any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance, in part or in full, new and/or existing eligible Green Projects. Social Bonds are use-of-proceeds bonds earmarked to finance new and existing projects or activities with positive social impacts. Sustainability Bonds are use-of-proceeds bonds earmarked to finance new and existing projects or activities with positive environmental and social impacts. Sustainability-Linked Bonds (SLBs) are structurally linked to the issuer’s achievement of climate or broader sustainability goals, such as through a step-up in coupon if key performance indicators (KPIs) are not met. Not all ESG bonds are eligible for positive adjustment.

Third Party ESG Research

At PIMCO we regularly evaluate ESG data providers which may add additional input into our in-house analysis conducted by our credit, sovereign and mortgage analyst teams. The firm relies primarily on internal research for decision-making; however, PIMCO also screens substantial amounts of external data sets. PIMCO currently utilizes MSCI as our primary external data provider but we also use Reprisk, TruCost, Bloomberg, CDP, SBTi, TPI, risQ, Maplecroft, Haver, and Freedom House, among other sources. ESG data generally flows directly into our proprietary IT systems, enabling portfolio managers and credit analysts to use this information efficiently. Further, data in our systems is not only limited to subscriptions to data providers. We also look at data and rankings available across different platforms including data sourced from the NGO sector. Examples of sources here include: Forest 500; Forest and Finance; Sustainability Policy Transparency Toolkit (SPOTT); the Ocean Health Index; and Exploring Natural Capital Opportunities, Risks and Exposure (ENCORE). We have also reviewed data sets from the Natural History Museum, Global Forest Watch, Yale and the World Bank.

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

Firm Level Sustainability Reporting

As a PRI signatory, we participate in the annual PRI questionnaire on the implementation of the six principles. PIMCO’s answers to this questionnaire are publicly available.

In addition, PIMCO also actively publishes research reports, videos and publications about sustainable investment. PIMCO professionals have written thought pieces regarding sustainability topics and these can also be found on our sustainability website. For more details, please refer to https://www.pimco.ca/en-ca/investments/esg-investing.

Reporting for PIMCO Funds that do not follow sustainability strategies and guidelines

PIMCO typically does not provide ESG focused reporting for PIMCO portfolios that do not follow sustainability strategies and guidelines.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

Sustainability Improvements and Initiatives

At PIMCO, we are focused on evolving and enhancing our sustainability processes and capabilities. PIMCO’s Sustainability Leadership team provides strategic guidance for further developing the firm’s sustainability thinking and capabilities. The group sets objectives and evaluates initiatives and priorities on a continuous basis throughout the year. Similar to the long-term orientation of PIMCO’s investment process, the firm’s Sustainability Leadership team establishes long-term strategic objectives. Please see below for key recent sustainability milestones:

- Thematic sustainability engagements – In 2024, PIMCO’s global team of 80+ credit research analysts engaged with 1,517 corporate bond issuers across industries and regions on sustainability topics. The Credit Research Team engages to drive progress on sustainability commitments, impact bond issuance, climate risk mitigation and other central sustainability topics. Moreover, PIMCO’s credit research analysts engage regularly with the companies that they cover, discussing topics with company management teams related to corporate strategy, leverage, and balance sheet management, as well as sustainability-related topics such as climate change targets and environmental plans, human capital management, inclusion and diversity, and board qualifications and composition.

- Expanded structured products framework – PIMCO has developed proprietary tools that enhance the analytical capabilities for structured products at both the portfolio-level and security-level. PIMCO has incorporated carbon emissions data into RMBS and agency-CMBS frameworks and has also developed an auto-ABS ESG assessment for issuers that is based on EV concentration and EU taxonomy alignment when applicable. PIMCO leverages a proprietary engagement interface, COMET, to track structured product engagement, and remains focused on the possibility of aggregating structured product engagement interaction with that of other asset classes.

- Climate risks mapping - Enhanced our proprietary mapping of climate risks (both physical and transition risks) to portfolio-level corporate holdings and developed a proprietary climate risk scoring methodology that evaluates sectors’ exposure to relevant climate risks over different time horizons: cyclical (six to twelve months), secular (three to five years) and super secular (more than five years); across different types of physical risks (acute vs. chronic); and transition risks (policy, technology, market and reputation).

- Enhancements of proprietary thematic frameworks – PIMCO has rolled-out our portfolio decarbonization framework to help interested investors seeking to target long-term decarbonization objectives in their portfolios. Natural capital has also been an area of focus – We have formalized our framework, which leverages COP15’s Kunming-Montreal Global Biodiversity Framework, guidance established by the Taskforce on Nature-related Financial Disclosures (TNFD), and targets related to the Natural Capital set by Science Based Targets Networks (SBTN).

- Continued to contribute to industry initiatives and partnerships - As a leading global investment manager, we partner with a number of key industry groups to help drive a coordinated global sustainability approach. For example, we are members of the Partnership for Carbon Accounting Financials (PCAF) - global partnership of financial institutions that work together to develop and implement a harmonized approach to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments. PIMCO is a Core team member as well as the Sponsor of the Securitized Products/Covered Bonds working group and a co-chair for the Transition Finance working group.

Portfolio ESG Decisions

As previously mentioned, the PIMCO Canada Canadian CorePLUS Bond Trust does not pursue specified sustainability strategies and guidelines.

Climate

8. Describe how you identify, assess, and manage climate-related risks, and whether climate-related risks and opportunities are integrated into pre-investment analysis.

The following response is intended to address Questions 8 and 9.

PIMCO believes that climate-related factors may have material impacts on issuers’ credit quality (now and over the long term), affecting the full range of fixed income and related asset classes e.g. mortgage-backed securities, corporate credit, sovereigns and municipalities. While the PIMCO Canada Canadian CorePLUS Bond Trust is not managed to any particular climate risk targets, climate risk is integrated into the firm’s overall investment process through top down and bottom up research.

We view the energy transition and global temperature rise as of utmost importance for fixed income investors, considering the ever-growing evidence of meaningful economic impacts and credit risks. In the last few years alone, markets saw the consequences of climate-related catastrophes including deadly wildfires, hurricanes, typhoons and other anomalies across the globe. Climate risk (including transition risk) is integrated into the firm’s overall investment process and at the portfolio level through our ESG assessments. Furthermore, we support a number of climate-related organizations (e.g. IGCC), as well as the Paris Agreement and we have developed a number of internal proprietary tools to assess climate change-related risks in our portfolios.

At the overall firm investment process level, PIMCO has incorporated climate change analysis into the secular forum where we form our five year investment views. As part of the forum process, we invite external speakers that provide their views on a wide range of topics. With respect to sustainability, we have invited external analysts and scholars, such as experts focused on long-term climate change or responsible investment trends, to share their expertise on financial and economic issues that are germane to the outlook. For example, PIMCO has had Anne-Marie Slaughter from the New America Foundation, Daniel Yergin from the IHS Markit, former Secretary of Defence and Director of the CIA Leon Panetta, and Dr. Michael Greenstone from the Massachusetts Institute of Technology discuss climate change from a geopolitical and policy perspective in past forums.

At the portfolio level, PIMCO’s climate change framework is integrated into our investment process through PIMCO’s ESG assessments. We use a proprietary methodology and analysis that reflect fixed income’s specific features, and we actively engage with issuers on climate change mitigation and readiness. In PIMCO’s portfolios that follow sustainability strategies and guidelines, we embed climate change into our three-step approach of exclusion, evaluation, and engagement.

The investment implications of climate change, in both the short and long term, stem primarily from two main types of risks: transition risks (e.g., business risks prompted by the energy transition, such as tighter regulations on carbon emissions) and physical risks (e.g., how climate change affects natural resources upon which the issuer depends). We endorse the SDGs as the holistic reference framework to assess these wide ranging risks.

Our transition risk scores are typically favorable for the most carbon-efficient issuers and for those proactively seeking to align with the Paris Agreement, the global accord to limit the global temperature rise by 2100 to 1.5°C – 2°C above preindustrial levels. This includes companies reporting in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), which was created by the Financial Stability Board (FSB) to foster best practices.

Our sector-based and bottom-up analysis involves a focus on issuers’ carbon emissions intensity using production-based metrics, such as emissions per barrel equivalent for oil and gas companies. A lifecycle methodology enables some comparison within the sector and over time, as well as in relation to climate scenarios and our forward-looking view. For instance, PIMCO’s fundamental analysis of credits in the energy sector closely examines companies’ exposure to different types of energy sources, environmental and regulatory risks to their business activities, the relative cost positions of companies and their commitments, and steps taken to diversify into lower-carbon sources of energy. Ultimately, we look to map the extent to which long-term climate risks are reflected in our credit views and bond prices, and, if they are not, what this could mean for issuers’ credit quality considering bond characteristics (e.g., duration) over time. For portfolio construction, we evaluate credits based on attractive valuations and strong climate scores.

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

Please refer to the response to Question 8 above.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate-related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

PIMCO would note that while we have conducted climate risk scenario analysis for bespoke client requests and selected funds that follow sustainability strategies and guidelines, this analysis in not typically implemented for the Fund in scope.

Please note that more generally, PIMCO incorporates several climate scenarios into our research and risk evaluation process and reporting tools, both at company and portfolio level.

- Our scenario analysis has placed a particular emphasis on transition risks (policy, legal, technology and market risks linked to the transition to a low-carbon economy, including the 1.5°–2°C scenario) given data availability and quality.

- At present, our analysis notably draws on methodologies and database developed by central banks, such as the Bank of England or via the NGFS, to assess the impact on portfolios. Issuers with higher exposure to transition risk will suffer negative bond price impact should an extreme climate transition occur, while those with lower exposure may see a price increase.

- Our evaluation of climate physical risk builds on forward looking models that help assess corporate issuer’s exposure to certain hazards under certain climate scenarios (e.g. Representative Concentration Pathways or RCP 8.5).

Please refer to the above response to Question 8 or details on how we monitor and evaluate climate risks.

11. Do you track the carbon footprint of portfolio holdings? If yes, please describe the methodology and metrics used, and whether you have a set target for reducing the portfolio's footprint.

No. The PIMCO Canada Canadian CorePLUS Bond Trust does not pursue specified sustainability strategies or guidelines.

12. What are your firm's emissions as of December 31, 2023? Please provide scope 1 and scope 2 emissions, and, separately, scope 3 emissions if available. Please demonstrate how/whether you are taking steps to reduce these emissions.

PIMCO is in the process of auditing its firm-wide carbon footprint, looking at critical areas including energy, electricity, and overall resource management.

Also, we do audit our carbon footprint, internally by Allianz and through an external auditor.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments? Please answer on both an equally-weighted and market cap-weighted basis.

Not applicable.

14. How do you assess the credibility of a company’s emission reduction targets?

At a firm-wide level, PIMCO’s global credit analysts and portfolio managers spend a significant amount of time conducting calls and in-person meetings with issuers’ senior management. In addition to financial matters, they also address material sustainability issues such as carbon emissions.

PIMCO utilizes ESG data providers which may add additional input into our in-house analysis. The firm relies primarily on internal research for decision-making; however, PIMCO also screens substantial amounts of external data sets. With regard to assessing the credibility of a company’s emissions reduction target, PIMCO utilizes external data providers such as SBTi, and TPI to determine if an issuer’s carbon emissions reduction target is in alignment with the science-based targets initiative.

See the response to Question 5 for more details on the firm’s ESG research processes and the response to Questions 22-24 for more details on the PIMCO ESG engagement practices.

Please note the PIMCO Canada Canadian CorePLUS Bond Trust does not follow sustainability strategies and guidelines and thus the portfolio is not optimizing for stronger carbon metrics relative to a market average.

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

Please note the PIMCO Canada Canadian CorePLUS Bond Trust does not follow sustainability strategies and guidelines, but rather integrates material ESG factors inclusive of environmental risks broadly into the research process across fixed income assets, where applicable.

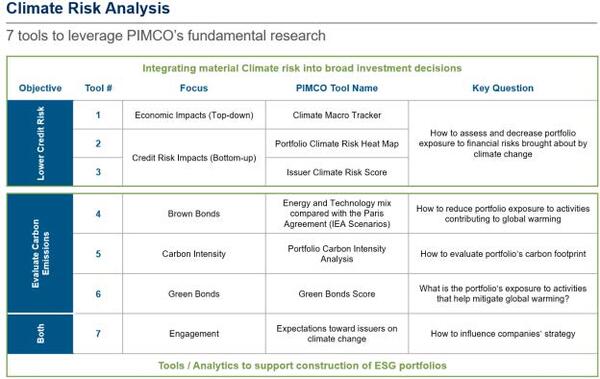

To help analysts evaluate climate risk, PIMCO’s ESG specialists designed seven proprietary tools (see figure below), drawing on our decades of experience in fixed income analysis. The insights these tools provide are intended to help portfolio managers to better manage and mitigate climate-related credit risks and align portfolios that follow sustainability strategies and guidelines with the Paris Agreement targets – as always, working within specific portfolio objectives and guidelines. (The Paris Agreement is the global accord to limit the global temperature rise by year 2100 to 1.5°C – 2°C above preindustrial levels.) These analytical frameworks serve the whole spectrum of PIMCO’s portfolios that follow sustainability strategies and guidelines and portfolios that do not follow sustainability strategies and guidelines and enable PIMCO’s portfolios that follow sustainable guidelines to align with the recommendations of the TCFD.

Source: PIMCO. The above is presented for illustrative purposes only, as a general example of PIMCO’s research capability

Below we detail the tools we believe to be most relevant to funds such as the PIMCO Canada Canadian CorePLUS Bond Trust.

Tool #1: Climate Macro Tracker

To ensure we have a robust long-term, top-down perspective on climate risk, PIMCO designed and developed our own Climate Macro Tracker. This tool monitors the broad momentum in climate change across key themes and scenarios, and measures the gap between the real-world metrics and global climate goals.

Along with the challenges and risks, we also keep an eye on climate-related macro trends (regulations, energy, and technology, for example) likely to create business and investment opportunities.

Tool #2: Portfolio Climate Risk Heat Map

When evaluating climate-related risks and opportunities of specific sectors and issuers, we begin with two broad categories: 1) transition risks (e.g., tighter regulations on carbon emissions) and 2) physical risks (e.g., how the rising intensity and frequency of extreme weather events affects critical assets and natural resources used by the issuer). The Portfolio Climate Risk Heat Map, gives a high-level overview of exposure to climate risk (both transition and physical) among relevant sectors and assets. Looking across the range of risks in a portfolio helps a portfolio manager assess and fine-tune exposures.

Tool #3: Issuer Climate Risk Score

PIMCO’s Issuer Climate Risk Score assesses climate change risks for a wide range of relevant sectors and issuers.

As with the heat map (Tool #2), the climate risk scores are divided into transition risks and physical risks. Our transition risk scores are typically favorable for the most carbon-efficient issuers and for those proactively seeking to align with the Paris Agreement in light of their respective business and geographical contexts. The transition risk score draws on metrics such as the issuer’s current and future carbon emissions using a lifecycle approach and recognized methods such as the science-based target approach, as well as business mix outlook (e.g., revenues, capital expenditures) considering technology pathways enabling issuers to align with the limits on rising temperatures.

16. Has your firm produced a Task Force on Climate-Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

PIMCO has an inaugural Global TCFD report that details PIMCO’s processes to identify, assess and manage climate-related risks and opportunities.

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

As a founding member of the Sustainability Accounting Standards Board (SASB), PIMCO broadly recognizes and incorporates SASB standards into our frameworks.

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

Please refer to the latest Inclusion and Diversity Report which can be downloaded from the following web link, PIMCO Inclusion and Diversity, for details on the firm’s employee diversity composition and diversity initiatives.

Proxy Voting

19. Do you use an external proxy voting service such as ISS or Glass Lewis? If yes, please specify.

In relation to our equity securities, PIMCO has contracted with Institutional Shareholder Services (“ISS”) to assist in researching, voting, recordkeeping and reporting in relation to proxies. While PIMCO has adopted ISS’ Proxy Guidelines, our equity portfolio managers are responsible for evaluating ISS research recommendations and making a determination regarding elections. With respect to the voting of proxies relating to fixed income securities, PIMCO’s fixed income credit research group is generally responsible for researching and issuing recommendations as to how to vote the proxies.

20. If the answer to the previous question is no, please describe your proxy voting guidelines.

The following response is intended to address Questions 20 - 21.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Advisers Act. PIMCO evaluates all proxies in accordance with this policy unless we do not have client authorization to do so. It should be noted that it is unusual for the firm to engage in proxy voting for fixed income strategies.

As a bondholder, PIMCO generally does not consider proxy voting to be a primary form of engagement for sustainability purposes. For this reason, sustainability and ESG factors are not explicitly considered in PIMCO’s Voting Policy; we do, however, take the following factors into account when deciding how to vote proxies: (i) the long-term benefit to shareholders of promoting corporate accountability and responsibility; (ii) management’s responsibility with respect to special interest issues; (iii) any economic costs and restrictions on management; (iv) the responsibility to vote proxies for the greatest long-term shareholder value.

Where PIMCO does engage in proxy voting, our policy seeks to confirm that voting and consent rights are exercised in clients’ best interests and take into consideration potential conflicts of interest that may arise. To the extent PIMCO has authority, each proxy is evaluated, and each consent is evaluated, on a case-by-case basis, taking into account relevant facts and circumstances. For equity securities, PIMCO has retained an Industry Service Provider (“ISP”) to provide recommendations as to how to vote proxies and to cast votes as PIMCO’s agent on behalf of clients in accordance with its recommendations, unless otherwise instructed by PIMCO. With respect to the voting of proxies relating to fixed income securities, PIMCO’s fixed income credit research group is generally responsible for researching and issuing recommendations as to how to vote the proxies.

Portfolio Management and/or Credit Analyst personnel are responsible for monitoring and providing direction on voting and consent events where PIMCO has been granted discretionary authority to vote by Clients. Operations is responsible for providing all necessary documentation to the appropriate investment professionals responsible for reviewing and determining proxy and consent elections.

In relation to voting for equity securities, relevant ISP guidelines include sustainability considerations aligned to an account’s investment objectives and/or selected strategy. The research and voting recommendations that ISP provides to PIMCO are consistent with the applicable guidelines.

PIMCO’s Global Proxy Voting Policy Summary is available by contacting your PIMCO representative.

21. If you use an external proxy voting service, do you customize your guidelines for proxy voting? If yes, describe your customized guidelines. If you use the default service guidelines, describe how often and in which situations you deviate from the external proxy voting service recommendations.

Please refer to our response to question 20.

22. What proportion of the time do you vote with or against management on shareholder resolutions, board appointments, and auditor appointments? What proportion of the time do you vote with or against management on ESG issues? How does this break down for climate, diversity, and remuneration issues?*

PIMCO does not report aggregate firm historical proxy voting information. Except to the extent required by applicable law (including with respect to the filing of any Form N-PX for U.S. registered Funds) or otherwise approved by PIMCO, PIMCO will not disclose to third parties how it voted a proxy on behalf of a client. However, upon request from an appropriately authorized individual, PIMCO will disclose to its clients or the entity delegating the voting authority to PIMCO for such clients (e.g., trustees or consultants retained by the client), how PIMCO voted such client’s proxy.

Engagement

23. What are your engagement goals? Are these goals outcome/action-based (e.g. decreases in emissions or increases in number of women on the board) or means-based (reporting on emissions or number of women on the board)?

The following response is intended to address Questions 23 through 25.

As a leading fixed income manager, PIMCO has the scale and access to engage issuers on matters that we believe are essential when pursuing compelling risk-adjusted returns. We believe PIMCO’s size, history, and involvement across industry initiatives, provides a platform to engage with issuers all who are both leading and continuing to evolve in their approach to sustainability. This extends beyond corporates, into structured credit, sovereigns, municipals, and alternatives, where applicable.

PIMCO aims to work across the variety of market participants seeking a more resilient and sustainable future. We use our platform to collaborate with civil society, multilateral organizations, academic researchers and scientific and policy experts. We view these forums as important areas of dialogue and industry innovation as we face secular shifts globally. These multifaceted efforts provide a distinctive market perspective that is unique to PIMCO.

We view our relationships with issuers as partnerships, and pursue outcomes which ultimately seek to benefit our clients through risk mitigation or performance improvement at the Issuer. We believe that working with issuers to support enhancing their operational practices and address negative externalities can have a significant impact – especially for issuers with higher exposure to ESG related risks.

At PIMCO, the purpose of our engagement is to gain investment insights and pursue outcomes aimed at reducing risks and/or generating opportunities, ultimately for the benefit of our clients. We prioritize issuers across the platform where we have meaningful financial and ESG risk exposure, focusing on what we believe to be material topics.

We believe that active management can greatly benefit from engagement, particularly when it comes to mitigating potential regulatory and long-term ESG risks. By offering best practices for issuers to consider, we aim to enhance their risk management strategies and strive to increase their competitive advantage, strengthen their credibility through increased transparency, and avoid potential controversies. We hold the view that consistent issuer engagement is essential for a thorough understanding of the investment’s risk-reward scenario, which is critical to making informed buy or sell decisions.

In terms of our approach: our engagement is designed to leverage the full scale of our global team of 80+ credit analysts and build upon our firm's decades of experience working constructively with issuers. Our engagement structure is built on two key mechanisms: bilateral engagement and collaborative engagement.

Our bilateral engagements, conducted by our credit research analysts, portfolio managers, and ESG analysts, allow us to address ESG risks platform wide. We remain guided by three key principles:

- Think like a treasurer: We seek to identify issuers which can benefit from engagement, then develop a set of core engagement objectives tailored to each issuer.

- Engage like a partner: We believe that successful bondholder engagement is based on collaboration, productive dialogue and mutual agreement on objectives.

- Hold to account as a lender: Our engagement process measures progress against an issuer’s stated target or industry benchmarks. At the outset of the process, we determine appropriate remedies if underperformance is material and are willing to divest if necessary.

In practice, topics that PIMCO analysts discuss with issuers can be guided by:

- Addressing material ESG risks: We look to engage regularly with issuers to focus on ESG factors which may be material to risks and opportunities for the company, such as supply chain management, climate strategy and target setting.

- Expanding ESG-labeled bond universe: We seek to engage with issuers to encourage new ESG bonds, such as green, social, sustainability and sustainability-linked bond issuance utilizing our published best practice guidance for corporate, sovereign and municipal sustainable bond issuance.

- Improving data quality and disclosure: We work closely with issuers to improve the ESG-related data and increase their ESG disclosures.

- Thematic engagement priorities: PIMCO’s thematic engagement priorities include decarbonization and transition plans, physical risks from climate change, nature, human rights, workforce management, balance sheet management and internal controls and critical risk management.

PIMCO’s ESG analyst team leads our engagement efforts, in coordination with the broader credit research team. Members of the ESG analyst team include Grover Burthey, Head of ESG Portfolio Management and the ESG analyst team, Samuel Mary, ESG integration analyst and climate specialist, and Meredith Block, ESG research analyst. Our goal is to holistically integrate engagement activity into the ongoing discussions led by our credit research and portfolio management teams while broadening the scope of questions beyond credit-specific considerations to include sustainability concerns as well.

In this regard, engagement at PIMCO is designed to leverage the full scale of our global team of credit analysts and build upon our firm’s decades of experience working collaboratively with issuers to encourage business practices which are favorable to our investment objectives.

24. What is your policy around the escalation of engagement; how and why might this happen and what is the ultimate tool you might use (e.g. voting against board re-election, etc.)?

Please refer to our response to Question 23.

25. Describe a specific example of your firm’s engagement with a company over the past year, including the outcome and any lessons learned.

Please refer to our response to Question 23.

Disclosures

While we are pleased to furnish the information requested, we are also doing so on the basis that you understand and agree that we do not and are not providing impartial investment advice (as we have a financial interest in being hired) and are not giving any advice in a fiduciary capacity in our response or related interactions, and that we will not receive a fee or other compensation in connection with the response and related interactions, unless, of course, we are retained to provide discretionary investment management services. Further, you agree that you will not rely on the information we have furnished in response to your request as a recommendation or fiduciary investment advice in connection with any investment decision that you make. Our responses are designed to highlight the quality of our investment management services without regard to any specific investment strategy.

Please note the PIMCO Canada Canadian CorePLUS Bond Trust does not pursue specified sustainability strategies or guidelines.