ESG Policies

1. Please provide your ESG-related policies. Please provide a formal statement of your ESG-related policies if you have one.

ESG Integration Policy

TDAM have recently adopted internal ESG Integration Policy and Procedures, effective on October 31, 2024.

TDAM ESG Integration Policy & Procedures is a new Policy created to guide the process by which Portfolio Managers at TDAM consider material environmental, social and governance factors in making investment decisions. This policy also guides disclosures related to the consideration of material ESG factors.

Stewardship Policy

TDAM have recently adopted internal TDAM Stewardship Policy & Procedures, effective on October 31, 2024.

TDAM Stewardship Policy & Procedures is a new Policy created to guide TDAM's firm wide approach to Investee engagement meetings in respect of considering material environmental, social and governance issues. Its applicable to engagement meetings by portfolio managers, equity analysts, credit analysts, and sustainable investment research analysts. For more information, please refer to TDAM's Sustainable Investing Approach document which is available on our ESG Resources website.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

TDAM recognizes that a broad range of financial and non-financial considerations may be relevant in making investment decisions. For funds that do not explicitly focus on ESG factors as part of their fundamental investment objectives or principal investment strategies, TDAM may integrate ESG factors where financially material or relevant into the investment decision-making process. It is up to each individual portfolio manager to determine whether, and to what extent, ESG considerations are to be incorporated into the financial analysis within their own investment processes, and in a manner that aligns with the fundamental investment objectives of each fund. As a result, the consideration of ESG factors may play a limited role in the investment decision-making process, meaning that ESG factors are not weighted heavily in the determination of whether to purchase, hold or sell a security in a fund’s portfolio. Certain strategies and asset classes do no integrate ESG, including but not limited to index-tracking funds and certain third-party sub-advised strategies.

Details are provided below of how certain asset classes consider material ESG factors as part of their respective investment processes.

Fundamental Equities

TDAM’s Fundamental Equity team believes that the consideration of material ESG factors as part of its financial analysis and investment decision-making process assists with obtaining a robust view of the risks associated with a particular investment. As part of their overall research process, Fundamental Equity analysts may meet with companies about their business structure, strategic direction, risk management, cost drivers and revenue prospects.

Quantitative Equities

TDAM’s Quantitative Equity team seeks to exploit market inefficiencies using a combination of their researchers’ custom-built models and insights from their portfolio managers. While quantitative models facilitate objective decision-making as well as broad coverage of equity markets, no single model can cover the full complexity of the factors driving stock markets. The team is tasked with designing portfolios and identifying emerging sources of risk that may not yet be sufficiently captured by quantitative approaches. In building quantitative models, the Quantitative Equity team seeks to produce the most effective alpha and risk forecasts. Material ESG factors and methodologies are considered as part of these research and development efforts.

Fixed Income

TDAM’s Credit Research team evaluates material ESG factors as part of a comprehensive credit review process for both corporate and government issuers. In addition to evaluating the financial and business strength of issuers, an ESG assessment is conducted for every issuer included on TDAM's credit approved list. To gain a complete picture of a company’s credit quality, the team also engages with management to understand how issuers are addressing material risks. These processes inform an ESG Risk Score for the issuer, which is integrated into the internal credit rating. Our analysis is regularly updated and incorporated into research reports that are reviewed by TDAM’s Credit Committee.

ALTERNATIVE ASSETS

Private Debt

TDAM’s Private Debt Origination and Research team evaluates material ESG factors as part of a comprehensive credit rating review for approved issuers. To understand the relevant factors used to fully assess each credit rating, including how issuers address material ESG exposures, the team engages with issuer management teams and conducts extensive due diligence and research. These assessments are reviewed by TDAM’s Credit Committee. The Private Debt Origination and Research team utilizes the fixed income process, as described above, to inform an ESG Risk Score which is integrated into the internal credit rating.

Canadian and Global Real Estate

Across our real estate platform, our approach to sustainability is aligned with our culture, which focuses on risk management, disciplined processes, sustainable returns, and material ESG risks and opportunities. We integrate ESG practices in our real estate investment and portfolio management processes, including acquisitions, developments, capital planning, third-party due diligence and ongoing operations. The goal is to deliver stable, growing income streams, create value, and mitigate risks over the long term.

Global Infrastructure

TD Greystone Infrastructure Strategy promotes climate change mitigation and occupational health and safety characteristics through its active asset management practices.2 This includes engagement with the management teams of portfolio companies, with the objective of improving social and environmental practices and operational performance and efficiency. TD Greystone Infrastructure Strategy also assesses the ongoing governance of the investee companies included in the portfolio.

Mortgages

TDAM may integrate ESG factors where financially material or relevant into the investment process to mitigate risks and identify opportunities within the TD Greystone Mortgage Fund. Material ESG issues are evaluated within the context of our risk management framework.

For more information, please refer to TDAM's latest Sustainable Investing Report which is available on our ESG Resources website.

3.a. Are you a signatory to the UNPRI?

Yes.

3.b. If you are signatory to other coalitions, please list them.

TDAM is a member or supporter of, or signatory to, the following organizations:

- 2005: Canadian Coalition for Good Governance (CCGG)

- 2007: Carbon Disclosure Project (CDP)

- 2008: UN Principles for Responsible Investment (PRI)

- 2016: Global Real Estate Sustainability Benchmark (GRESB)

- 2019: Responsible Investment Association (RIA)2

- 2019: Climate Action 100+ (CA100+)

- 2019: Signatory to the 2021 Global Investor Statement to Governments on the Climate Crisis

- 2021: 30% Club Canada Investor Group

- 2021: Climate Engagement Canada (CEC)

- 2021: International Corporate Governance Network (ICGN)

- 2021: Task Force on Climate Related Financial Disclosures (TCFD)

- 2022: Advance – PRI's human rights engagement initiative

- 2022: Coalition for Environmentally Responsible Economics (CERES)

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

We continue to advance our ESG processes and contribute to industry dialogue more broadly. In 2022, we introduced ESG scoring and metrics in our quarterly performance reviews for our active equity and alternative asset investment strategies. In 2023, similar quarterly performance reporting went into production for our fixed income strategies and was formally implemented for Q1 2024 performance review meetings.

- Active Equity, Including Quantitative Strategies: Quarterly performance reviews include portfolio-level ESG quality scores, carbon metrics, as compared to their respective benchmark(s), and controversies or headline risk reviews, which provide an additional layer of risk analysis. These internal quarterly performance review meetings serve as a forum for the CIO to discuss performance, inclusive of ESG metrics, and where internal teams such as asset allocation, investment risk and product can discuss their questions for the respective portfolio manager.

- Alternative Assets: Alternative assets, such as our direct real estate and infrastructure holdings and commercial mortgage loans are typically less liquid and are marked to market on a less frequent basis than public investments. In 2023, TDAM continued its quarterly ESG working group meetings with its Canadian real estate managers that are responsible for the asset, property and development management of over 95% of the TD Greystone Canadian Real Estate Fund by AUM. Additionally, annual ESG engagements were conducted with each of the underlying fund managers for TD Greystone Global Real Estate Fund, as well as for assets held within TD Greystone Global Infrastructure Fund.

ESG-related updates and ESG performance for alternative investment strategies are also reviewed at each monthly meeting of the alternative investment team. For example, updates on a new acquisition's ESG risk profile, GRESB scores or response rates, findings from TD Greystone Mortgage Fund borrower surveys, and updates on ongoing ESG due diligence for transactions are part of ESG performance monitoring at these meetings.

Significant developments took place in 2023 with respect to sustainability disclosure standards. One key industry development was the release of the ISSB's first two sustainability disclosure standards – IFRS S1, General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2, Climate-related Disclosures (IFRS S2). Many are looking to the ISSB to bring much needed global alignment around ESG disclosure standards. Given this, TDAM provided feedback to the Canadian Coalition for Good Governance (CCGG) on their response to the ISSB's consultation on upcoming agenda and work plan priorities.

TDAM also participated in consultations on ESG-related disclosures with several other regulatory and standard setting bodies in 2023. This included engagement with the Alberta Securities Commission (ASC) on the baseline and national adoption of reporting requirements, as well as engagement with the Monetary Authority of Singapore (MAS) on climate, taxonomy, and regulation. We also provided feedback to the CCGG, Portfolio Management Association of Canada (PMAC), Investment Company Institute (ICI), PRI and Responsible Investment Association (RIA) on each of their responses to the Canadian Securities Administrators (CSA) consultation on proposed amendments to corporate governance and diversity disclosures. We continue to monitor these developments and look forward to greater standardization of ESG disclosures, as greater transparency is a positive for investors as they look to better understand the risk-return profile of their portfolios.

As ESG-related disclosure standards advance and evolve globally, we will continue to collaborate with our investee companies as part of this journey. While the need for further ESG disclosures is becoming increasingly apparent, we encourage companies to go beyond disclosures and build sustainable strategies, policies and targets that are attainable and that can ultimately demonstrate results. While each sector faces a different set of ESG dynamics, we would like additional progress across the following critical issues that formed TDAM’s 2023 ESG focus areas: (i) general ESG performance; (ii) climate change; (iii) human capital; (iv) human rights; and (v) biodiversity, which we discuss in detail in the Stewardship section of this report.

TDAM uses a variety of external resources to support its sustainable investment activities firm-wide (e.g., ESG integration, engagement, proxy voting and thought leadership). This includes, consultants on the real asset side, sell side research on equities and fixed income, ESG research and ratings from providers such as: Bloomberg (provides a wide variety of financial, industry, market data); MSCI and Sustainalytics (qualitative and quantitative data on ESG factors); Fitch, S&P, DBRS (rating agencies that provide credit opinions, credit ratings, and some industry and company data); Moody's analytics (provides detailed reported and adjusted financial data on companies); Trepp (provides data and analytics on commercial mortgage back securities); guidance documents; publications from the PRI; materials from our proxy provider (including sustainability policy research); and resources from industry organizations and think tanks such as CCGG, Coalition for Environmentally Responsible Economics and other Responsible Investing (RI) publications.

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

Governance of sustainable investing starts with TDAM’s Chief Executive Officer (CEO), who is responsible for establishing and maintaining progress on overall strategic priorities for TDAM. TDAM’s Chief Investment Officer (CIO) and the Head of the Sustainable Investment team have executive accountability for ESG within the firm’s investment function as part of their broader sustainable investing responsibilities.

TDAM’s Sustainable Investment Team

The mandate of TDAM’s Sustainable Investment team includes supporting the investment teams and providing subject matter expertise; leading the firm’s proxy voting activities, including developing the firm’s proxy voting guidelines; leading the firm’s ESG-specific engagement efforts, including dedicated engagements with companies on our annual focus list; providing research and thought leadership, often in collaboration with colleagues from the investment team; advising on the development of proposed ESG-focused funds; acting as ESG subject matter experts within the firm and conducting knowledge sharing sessions with other teams across the firm; and leading the firm’s climate change-related investment R&E activities. In 2023, the team added two new positions: a Vice President, specializing in corporate governance, and an Analyst supporting the team on research and analytics.

TDAM’s Sustainable Investment Committee

TDAM has a dedicated Sustainable Investment Committee that oversees the firm’s overall sustainable investing strategy and integration efforts. The committee facilitates discussion around ESG issues, engagements, and policy direction. The Sustainable Investment Committee includes members of the investment management, external distribution, and investment risk teams. The Sustainable Investment Committee meets on a quarterly basis, in addition to ad hoc meetings, where necessary. Items that require additional discussion are escalated to TDAM’s Operating Committee and TDAM’s Risk Committee.

The Sustainable Investment Committee strives to ensure that the sustainable investment approach is implemented in accordance with the applicable mandate(s) and clearly communicated across the business.

The work of the Sustainable Investment Committee is communicated to senior management, including the CEO, CIO, and portfolio managers, all of whom serve critical roles in advancing sustainability across the firm and within applicable portfolios that TDAM manages.

The purpose of TDAM’s Sustainable Investment Committee is to:

- Establish TDAM’s firm-wide sustainable investing approach, policies, objectives, and commitments to applicable strategies.

- Provide advice and oversight of TDAM’s sustainable investing approach and policies.

- Define sustainable investing objectives, track progress and monitor effectiveness of stated approaches and commitments.

- Act as a liaison with TD to align, as appropriate, with TD’s ESG policies given TDAM’s fiduciary responsibility to its clients, and investment obligations and objectives.

The Sustainable Investment Committee has sub-committees that oversee the workings of underlying functions where relevant, such as the Proxy Voting Sub-Committee, and the Alternatives Sustainable Investment Committee. The Sustainable Investment Committee supports the creation of working groups on different areas of implementation on an as needed basis. The Sustainable Investment Committee is chaired by the Head of Sustainable Investment team, with the CIO as an ex-officio member.

Proxy Voting Sub-Committee

Proxy voting at TDAM is overseen and governed by a dedicated Proxy Voting Sub-Committee. The Proxy Voting Sub-Committee is responsible for reviewing and approving TDAM’s proxy voting guidelines and its custom voting instructions on ESG issues, identifying key or emerging proxy issues, and deliberating and deciding on any deviations or overrides of TDAM’s vote recommendations. The Proxy Voting Sub-Committee is comprised of members from TDAM’s public equities and ESG teams, including the CIO, Head of Equities and Head of Sustainable Investment team.

Note: Only include Alternative Investments Sustainable Investment Committee if your questionnaire cover Alternatives.

Alternative Investments Sustainable Investment Committee

TDAM's Alternative Investments Sustainable Investment Committee acts as a sub-committee of the TDAM Sustainable Investment Committee, allowing for an approach that is tailored for private markets and real assets. In 2023, as a result of the private debt investment team's integration with the alternative investments team, senior private debt representation was added to the Alternative Investments Sustainable Investment Committee.

The mandate of the committee is to:

- Provide advice and oversight of TDAM's alternative investments ESG approach, strategies, policies, objectives, and commitments.

- Define and approve alternative asset class ESG priorities.

- Track progress and monitor effectiveness of stated objectives and commitments.

- Review and approve updates that will be provided on an as-needed basis to the TDAM Sustainable Investment Committee, which the Alternative Investments Sustainable Investment Committee reports into.

Act as a decision-making body for significant alternative investments-focused ESG initiatives and budgetary approvals.

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

TDAM uses a variety of external resources to support its sustainable investment activities firm-wide (e.g., ESG integration, engagement, proxy voting and thought leadership). This includes, consultants on the real asset side, sell side research on equities and fixed income, ESG research and ratings from providers such as: Bloomberg (provides a wide variety of financial, industry, market data); MSCI and Sustainalytics (qualitative and quantitative data on ESG factors); Fitch, S&P, DBRS (rating agencies that provide credit opinions, credit ratings, and some industry and company data); Moody's analytics (provides detailed reported and adjusted financial data on companies); Trepp (provides data and analytics on commercial mortgage back securities); guidance documents; publications from the PRI; materials from our proxy provider (including sustainability policy research); and resources from industry organizations and think tanks such as the Canadian Coalition for Good Governance, Coalition for Environmentally Responsible Economics and other Responsible Investing (RI) publications.

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

TDAM provides several public disclosures related to sustainable investing. This includes annual publication of our Sustainable Investment Report, Task Force on Climate-Related Financials Disclosures Report, as well as our Quarterly Proxy Voting Reports. We also publish updates to our Proxy Voting Guidelines on an annual basis, ahead of proxy season. Our proxy voting disclosure platform also provides near real-time disclosure of TDAM's proxy voting records. Furthermore, we also regularly publish thought leadership papers and contribute to research pieces on several ESG related topics.

The following documents are available on our ESG Resources website:

- TD Asset Management Sustainable Investing Approach

- TD Asset Management Sustainable Investment Report

- TD Asset Management Proxy Voting Guidelines

- TD Asset Management Proxy Voting Policy & Procedures

- Proxy Voting Dashboard

- Annually Proxy Voting Reports

- Task Force on Climate-Related Financial Disclosures Report

Additionally, other ESG materials such as thought leadership papers, blogs, and podcasts can be found on our Sustainable Investing website and our Insights website.

TDAM strives to meet the needs of our clients, including on ESG matters. In general, reporting can be tailored to client preferences. TDAM can report fund-level ESG scoring and carbon metrics, however for clients with more granular needs, TDAM can produce customized reports on request. When our clients set their own climate objectives and targets, we work with those clients and strive to deliver solutions to support such objectives.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

TDAM provided an acceptable answer but prefers not to make it public.

Climate

8. Describe how you identify, assess, and manage climate-related risks, and whether climate-related risks and opportunities are integrated into pre-investment analysis.

TDAM provided an acceptable answer but prefers not to make it public.

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

TDAM provided an acceptable answer but prefers not to make it public.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate-related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

TDAM provided an acceptable answer but prefers not to make it public.

11. Do you track the carbon footprint of portfolio holdings? If yes, how frequently? Please provide the results as of December 31, 2023 and describe the methodology and metrics used, including whether you have set targets and/or a net zero objective for reducing the portfolio’s footprint, and comment on any related progress over the past year.

TDAM provided an acceptable answer but prefers not to make it public.

12. What are your firm's emissions as of December 31, 2023? Please provide scope 1 and scope 2 emissions, and, separately, scope 3 emissions if available. Please demonstrate how/whether you are taking steps to reduce these emissions.

TDAM provided an acceptable answer but prefers not to make it public.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments? Please answer on both an equally-weighted and market cap-weighted basis.

TDAM provided an acceptable answer but prefers not to make it public.

14. How do you assess the credibility of a company’s emission reduction targets?

TDAM provided an acceptable answer but prefers not to make it public.

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

TDAM provided an acceptable answer but prefers not to make it public.

16. Has your firm produced a Task Force on Climate-Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

TDAM provided an acceptable answer but prefers not to make it public.

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

TDAM provided an acceptable answer but prefers not to make it public.

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

TDAM provided an acceptable answer but prefers not to make it public.

Proxy Voting

19. Do you use an external proxy voting service such as ISS or Glass Lewis? If yes, please specify.

TDAM provided an acceptable answer but prefers not to make it public.

20. If the answer to the previous question is no, please describe your proxy voting guidelines.

TDAM provided an acceptable answer but prefers not to make it public.

21. If you use an external proxy voting service, do you customize your guidelines for proxy voting? If yes, describe your customized guidelines. If you use the default service guidelines, describe how often and in which situations you deviate from the external proxy voting service recommendations.

TDAM provided an acceptable answer but prefers not to make it public.

22. What proportion of the time do you vote with or against management on shareholder resolutions, board appointments, and auditor appointments? What proportion of the time do you vote with or against management on ESG issues? How does this break down for climate, diversity, and remuneration issues?

Proxy voting is a central part of our stewardship toolbox, and we approach this responsibility with a commitment to long-term value on behalf of our investors. There have been no material changes to the philosophy governing proxy voting, but TDAM reviews its proxy voting guidelines at least annually. For more information and TD Asset Management's latest proxy voting guidelines, please go to the following (Link).

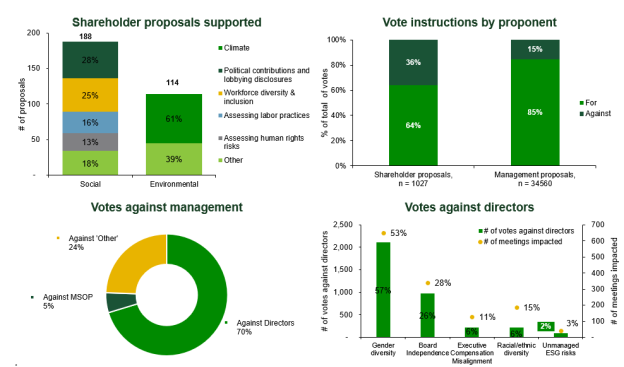

Yes, TDAM's proxy voting policy addresses ESG issues. For fiscal year 2023, TDAM voted on 35,615 proposals, voting against 14% of management proposals and voting against 42% of shareholder proposals.

- Management proposals: The majority of the votes against management (69%) were votes against directors. 53% of adverse director votes related to a lack of board diversity. Another 37% of adverse director votes related to a lack of board independence, with additional companies impacted in 2023 as TDAM shifted our expectation from a majority of independent directors to two-thirds independence. Misalignment of executive compensation also fueled 6% of votes against directors and often accompanied a vote against management’s Say-on- Pay proposals. In addition, 3% of votes against directors was sparked by companies having more than a third of their board with lengthy board tenures (over 15 years). Overboarded directors also impacted TDAM votes, which caused 3% of adverse director votes.

- Shareholder proposals: Support for shareholder proposals spanned various environmental and social issues. TDAM supported 189 social shareholder proposals, of which 24% related to political contribution and lobbying disclosures, 16% pertained to human rights assessments and another 15% addressed workforce diversity. TDAM also supported 94 environmental shareholder proposals, of which 81% were related to climate change. In cases where we found a shareholder proposal overly prescriptive or misaligned with our proxy voting guidelines, we did not vote in support of the proposal.

Historical 2022

For fiscal year 2022, TDAM voted on 35,649 proposals, voting against8 15% of management proposals and supporting 64% of shareholder proposals.

- Votes against management: The majority of the votes against management (62%) were votes against directors largely due to a lack of board diversity. Another 26% of adverse director votes related to a lack of board independence. Misalignment of executive compensation also fueled a significant part of votes against directors and often accompanied a vote against

- Votes in support of shareholder proposals: Support for shareholder proposals spanned various environmental and social issues. TDAM supported 188 social shareholder proposals, of which 28% related to political contribution and lobbying disclosures, and another 25% addressed workforce diversity. TDAM also supported 114 environmental shareholder proposals, of which 61% were related to climate change.

8 Votes “against,” as used in this section, include both votes against and votes withheld.

For the period between November 1, 2021, to October 31, 2022, TDAM voted on 34,656 proposals. Please see the below Proxy Voting Activities.

Note: Against Directors = votes against individual director nominees; MSOP = Management Say on Pay proposals. Some directors may have received against/withhold votes due to more than one rationale (e.g., lack of gender diversity and lack of racial or ethnic diversity on the board). For more information, please refer to the TD Asset Management Proxy Voting Guidelines available on our ESG Resources website.

Source: TD Asset Management.

Engagement

23. What are your engagement goals? Are these goals outcome/action-based (e.g. decreases in emissions or increases in number of women on the board) or means-based (reporting on emissions or number of women on the board)?

TDAM provided an acceptable answer but prefers not to make it public.

24. What is your policy around the escalation of engagement; how and why might this happen and what is the ultimate tool you might use (e.g. voting against board re-election, etc.)?

TDAM provided an acceptable answer but prefers not to make it public.

25) Describe a specific example of your firm’s engagement with a company over the past year, including the outcome and any lessons learned.

TDAM provided an acceptable answer but prefers not to make it public.

Disclosures

The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax or trading strategies should be evaluated relative to each individual's objectives and risk tolerance.

This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. These materials have not been reviewed by and are not registered with any securities or other regulatory authority in jurisdictions where we operate.

Any general discussion or opinions contained within these materials regarding securities or market conditions represent our view or the view of the source cited. Unless otherwise indicated, such view is as of the date noted and is subject to change. Information about the portfolio holdings, asset allocation or diversification is historical and is subject to change.

This document may contain forward-looking statements (“FLS”). FLS reflect current expectations and projections about future events and/or outcomes based on data currently available. Such expectations and projections may be incorrect in the future as events which were not anticipated or considered in their formulation may occur and lead to results that differ materially from those expressed or implied. FLS are not guarantees of future performance and reliance on FLS should be avoided.

All products contain risk. Important information about the pooled funds is contained in their respective offering circular, which we encourage you to read before investing. Please obtain a copy. Pooled fund units are not deposits as defined by the Canada Deposit Insurance Corporation or any other government deposit insurer and are not guaranteed by The Toronto-Dominion Bank. Investment strategies and current holdings are subject to change. TD Pooled Funds are managed by TD Asset Management Inc.

TD Bank Group means The Toronto-Dominion Bank and its affiliates, who provide deposit, investment, loan, securities, trust, insurance and other products and services.

TD Global Investment Solutions represents TD Asset Management Inc. ("TDAM") and Epoch Investment Partners, Inc. ("TD Epoch"). TDAM and TD Epoch are affiliates and wholly-owned subsidiaries of The Toronto-Dominion Bank.

® The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.