ESG Policies

1. Please provide your ESG-related policies. Please provide a formal statement of your ESG-related policies if you have one.

CC&L’s Responsible Investing Policy, Stewardship & Engagement Policy, Voting Rights Policy and the TCFD Report are available on the firm’s website: Responsible Investing - CC&L Investment Management Ltd.

2. Are sustainable investing and ESG factors integrated into your investment process and portfolio management decisions? If yes, please provide details.

ESG factors using MSCI data have been integrated into CC&L’s quantitative model as systematic risk factors, as well as predictors of stock-specific risk since July 2020.

In 2021, the quantitative equity team incorporated MSCI carbon emissions data to manage carbon exposures for all quantitative strategies.

As a UN PRI signatory, CC&L’s Quantitative Equity team has committed to undertaking regular ESG research projects as ESG data improves over time.

Within the three pillars of ESG, MSCI ESG Ratings identify 10 themes and 37 key issues which are highlighted in the below table:

| 3 Pillars | 10 Themes | 37 ESG Key Issues | |

| Climate Change | Carbon Emissions Product Carbon Footprint | Financing Environmental Impact Climate Change Vulnerability | |

| Natural Resources | Water Stress | Biodiversity & Land Use | |

| Environment | Raw Material Sourcing | ||

| Pollution & Waste | Toxic Emissions & Waste Packaging Material & Waste | Electronic Waste | |

| Environmental Opportunities | Opportunities in Clean Tech Opportunities in Green Building | Opportunities in Renewable Energy | |

| Human Capital | Labour Management Health & Safety | Human Capital Development Supply Chain Labour Standards | |

| Social | Product Safety & Quality Chemical Safety Financial Product Safety | Privacy & Data Security Responsible Investment Health & Demographic Risk | |

| Product Liability | |||

| Governance | Stakeholder Opposition | Controversial Sourcing | |

| Social Opportunities | Access to Communications Access to Finance | Access to Health Care | |

| Opportunities in Nutrition & Health | |||

| Corporate Governance | Board Pay | Ownership Accounting | |

| Corporate Behaviour | Business Ethics | Corruption & Instability Financial System Instability | |

| Anti-Competitive Practices Tax Transparency |

3.a. Are you a signatory to the UNPRI?

Yes, CC&L has been a signatory to the UN PRI since 2015.

3.b. If you are signatory to other coalitions, please list them.

Canadian Coalition for Good Governance (CCGG)

CC&L is an advocate of good governance practices globally and is pleased to be a founding member of the CCGG since 2003. The members of CCGG manage approximately $6 trillion in combined assets with the purpose to provide a cohesive voice on behalf of investors on corporate governance issues related to Canadian public issuers.

International Corporate Governance Network (ICGN)

In July 2019, CC&L became a supporter of the ICGN through its affiliation with member CC&L Financial Group. This membership complements CC&L’s active involvement in the CCGG.

Task Force on Climate Related Financial Disclosures (TCFD)

In June 2021, CC&L endorsed the recommendations of the TCFD. In doing so, CC&L actively encourages investee companies to incorporate the TCFD recommendations in their future disclosures.

Climate Engagement Canada (CEC)

In 2021 CC&L became a founding participant in CEC as part of Connor, Clark & Lunn Financial Group. CEC is a Canadian finance-led collaborative initiative to drive dialogue between the financial community and Canadian corporations on climate-related risks, opportunities and the transition to a net zero economy.

Responsible Investment Association of Canada (RIA)

CC&L is a sustaining member of the RIA through its affiliation with member CC&L Financial Group.

3.c. Indicate any other international standards, industry guidelines, reporting frameworks, or initiatives that guide your responsible investing practices.

Please refer to the response to question 3 b) above.

CC&L participates in collaborative engagements and initiatives sponsored by other institutional investors, industry associations or advocacy groups. These collaborations allow CC&L to pool resources and speak with a stronger unified voice to protect the interests of shareholders in the companies in which it invests on behalf of its clients. Examples of collaborative initiatives that CC&L has participated in are available upon request.

4. Please describe how ESG oversight and integration responsibilities are structured at your firm, including the process for escalation of key ESG issues. Also, if applicable, describe how responsible investment objectives are incorporated into individual or team employee performance reviews and compensation mechanisms.

While CC&L does not have a dedicated ESG team, the CC&L Board of Directors has ultimate responsibility for the firm’s approach to Responsible Investing (RI). The Board established the CC&L ESG Committee, which is comprised of leaders from each of the firm’s investment teams, client solutions team and compliance team. The composition of the committee was purposefully created to facilitate the flow of information between the committee and the investment teams, as well as to foster dialogue across investment teams. The ESG Committee reports directly to the Board and its mandate is to oversee and coordinate firmwide RI activities.

The ESG Committee is required to meet at least quarterly; however, meetings and discussions are more frequent in practice. While each of the CC&L’s investment teams is responsible for ensuring the firm’s ESG policies are being implemented, the committee’s mandate is to oversee and coordinate firm-wide RI activities. And importantly, the committee is mandated to proactively make recommendations to the investment teams and the Board of ongoing improvements in all of the

following areas:

- Education of the firm’s teams including the internal communication of industry best practices

and gathering of team insights regarding RI, - ESG related policies and guidelines, including proxy voting and stewardship and engagement

policy, - Integration of ESG factors in investment processes,

- Stewardship and engagement practices, including proxy voting,

- ESG related policies and guidelines, including proxy voting and stewardship and engagement policy,

- Oversight of commitments under industry collaborative initiatives, including as a signatory to

the UN-backed Principles for Responsible Investing (PRI), - Review and evaluation of additional industry collaborative initiatives,

- External communication efforts including reporting to CC&L’s clients on RI issues,

The ESG Committee and investment teams are supported by the CC&L Financial Group’s Stewardship & Engagement (S&E) team, who assist with direct corporate engagement, collaborative initiatives, proxy voting and are 100% dedicated to ESG.

The key investment professionals are business owners in the firm and not directly rewarded for performance or revenues. The majority of their compensation is via equity ownership and the long-term success of the business. This aligns business owners’ financial rewards with CC&L’s clients’ long-term goals.

That said, the CC&L ESG Committee reports directly to the Board. Objectives and priorities for each calendar year are set out and the ESG Committee members, particularly the Chair, have performance objectives that are tied to these goals.

In addition, the S&E team’s incentive pay is tied to the achievement of ESG objectives.

The first step in an engagement is generally a dialogue with the company to understand the issue and voice any concerns. Where the outcome of this discussion does not satisfy the portfolio manager, various escalation steps may be considered including using our proxy voting rights in support of our engagement goals. Escalation activities will be undertaken at the discretion of the portfolio manager when the issue is deemed to be material and prior engagement efforts have not been successful. Escalation strategies are determined on a case-by-case basis and may include voting against directors, collaborating with other investors, reducing exposure and complete divestment.

5. How do you obtain ESG information/data (e.g. public information, third party research, reports and statements from the company, direct engagement with the company)? Please provide specific details of what information is obtained from each source, and how this information is acquired.

ESG factors, using MSCI ESG data, are integrated into CC&L’s quantitative investment process as systematic risk factors, as well as predictors of stock-specific risk. In addition, MSCI carbon data is used to manage carbon exposures for all quantitative strategies.

In addition, the global proxy research and voting services of Institutional Shareholder Services Inc. (ISS) are employed to help analyze and vote proxies on behalf of CC&L’s clients. ISS prepares the voting recommendations in accordance with the CC&L’s customized guidelines for all items for which it is entitled to vote.

6. What channels do you use to communicate ESG-related information to clients and/or the public? Do you produce thought leadership (written reports and publications)? If so, is the information available to the public? Please provide links, if applicable.

CC&L provides firm-level reports related to ESG activities. Additional ESG information is always available to clients upon request.

- As a signatory to the UN-backed PRI, CC&L reports on its ESG-related activities in accordance with the PRI reporting framework. CC&L’s PRI Transparency Reports are available in the following link: PUBLIC TRANSPARENCY REPORT - 2023 - Connor, Clark & Lunn Investment Management Ltd.

- CC&L’s proxy voting reports are prepared quarterly for each client and can be accessed on the client portal.

- CC&L’s first annual Responsible Investing Update was sent to clients in November 2019 and annually thereafter. These updates provide information on the firm’s ESG integration and active ownership activities. CC&L’s 2024 Responsible Investing update can be found in the following link: 2024 Responsible Investing Update

- As official supporters of the TCFD, CC&L published its own TCFD-aligned disclosures (provided in the link below) and will continue to advocate for further adoption of robust climate-related disclosures in its engagements with issuers. Climate-Related Disclosure - 2021

- CC&L reports portfolio-level carbon emission metrics for all of its long only equity portfolios in the quarterly reports. Other strategies will follow at a later date.

- All of CC&L’s RI policies are available to clients annually as part of the communication of governance documents and are also available on the firm’s website: Responsible Investing - CC&L Investment Management Ltd.

7. Do you have periodic reviews of your ESG process/approach to assess its effectiveness? If so, how frequent are the reviews? What are the results? What would cause you to disregard ESG issues in your investment/analysis decisions?

Yes, the ESG Committee sets out an annual project plan at the beginning of each calendar year for Board review and approval. Additional projects may arise throughout the year, however, and the Committee is flexible in adding new initiatives to their agenda as needed.

In 2022, CC&L’s ESG Committee undertook a market research project looking at RI practices to ensure CC&L is adhering to industry best practices and to identify areas where the firm can improve on its approach. The review consisted of discussions with clients and consultants, and an evaluation of market best practices.

Over the last year, the ESG Committee focused on the execution of the ESG market research recommendations that were proposed in 2022. The project looked at responsible investing best practices to identify areas where the firm can improve its approach and this led to recommendations for improvements in the following areas: ESG integration, proxy voting, engagement, communication, and training.

Climate

8. Describe how you identify, assess, and manage climate-related risks, and whether climate-related risks and opportunities are integrated into pre-investment analysis.

The quantitative equity team incorporates MSCI’s ESG rankings as systematic risk factors, as well as predictors of stock-specific risk, in the quantitative investment process. At the strategy level, all of CC&L’s quantitative strategies utilize carbon data from MSCI to manage carbon exposures.

9. Describe the climate-related risks and opportunities you have identified over the short, medium, and long term.

CC&L’s strategy towards climate risk focuses on both our integration activities, which tend to reflect a shorter-term time horizon, and the firm’s stewardship activities that reflect longer term advocacy. Integration of climate risk in the quantitative equity team’s strategies involves use of carbon data from MSCI to manage carbon exposure as well as integration of ESG Ratings from MSCI as systemic risk factors as well as predictors of stock-specific risk. MSCI’s ESG Ratings take into account key issues such as carbon footprint, product carbon footprint, financing environmental impact and climate change vulnerability.

Over the long term, CC&L has identified the transition to a net zero economy as a material risk that exists outside of the investment time horizon. The CC&L Financial Group Stewardship & Engagement (S&E) team provides support to the fundamental equity and fixed income team to proactively engage on this topic. While engagement is not specifically part of CC&L’s quantitative equity process, the ESG Committee has begun a project to augment the engagements carried out by the fundamental equity and fixed income teams with additional engagements by the S&E team, including greater attention to leveraging collaborative initiatives and considering the use of a third-party service. This will expand our scope of focus beyond Canada to global markets. This project is ongoing and expected to be completed in 2025.

10. Describe how you analyze the effectiveness of your investment strategy when taking into consideration different climate-related scenarios, including 1.5 degree and 2 degree Celsius warming scenarios.

At this time, we do not take into consideration different climate-related scenarios for our portfolios, including a 2° Celsius or lower scenario.

11. Do you track the carbon footprint of portfolio holdings? If yes, please describe the methodology and metrics used, and whether you have a set target for reducing the portfolio's footprint.

Yes

If yes, how frequently? Please provide the results as of December 31, 2023 and describe the methodology and metrics used, including whether you have set targets and/or a net zero objective for reducing the portfolio’s footprint, and comment on any related progress over the past year.

In 2024, CC&L began reporting portfolio-level carbon emission metrics for all of our long only equity portfolios in our quarterly reports. That said, the carbon footprint of our portfolios is an outcome of our investment approach and not something that any of our teams specifically targets. However, portfolio carbon exposure for all of our strategies is reported to the CC&L Investment Risk Committee on a monthly basis. Significant outliers are reported to the appropriate team leader for further

investigation.

At the strategy level, all of CC&L’s quantitative equity strategies utilize carbon data from MSCI to manage carbon exposures relative to the benchmark, with the expectation that over the long run, the portfolio's carbon exposure will be neutral relative to the benchmark.

Please refer to the attached ‘Appendix I - CC&L Q Emerging Markets Equity Strategy ESG Scores and ‘Appendix II - CC&L Carbon Reporting QEM’.

12. What are your firm's emissions as of December 31, 2023? Please provide scope 1 and scope 2 emissions, and, separately, scope 3 emissions if available. Please demonstrate how/whether you are taking steps to reduce these emissions.

The firm’s emissions as of December 31, 2024, are not yet available.

We believe that through our actions we can contribute to the vitality of our environment, and we are committed to undertaking initiatives that support ongoing environmental stewardship.

Over the last 12 months, the Environmental Stewardship Committee has focused on the following initiatives:

- Continued to measure, monitor and communicate the GHG emissions generated through our business activities in the previous year.

- Researched the sustainability practices of our travel so that individuals can consider this information in making travel choices.

- Provided education on low emission commuting solutions and centralized information on office service amenities to create awareness of environmentally friendly options.

- Delivered events and communication circulars to promote a culture of environmental consciousness and create volunteering opportunities such as Earth Day City Clean-Ups and Bike-to-Work Week.

13. For the mandate you manage for Queen’s, what percentage of equity holdings (if applicable) have credible net zero commitments? Please answer on both an equally-weighted and market cap-weighted basis.

CC&L does not have current statistics on the number of issuers that have made net zero commitments in its portfolios.

14. How do you assess the credibility of a company’s emission reduction targets?

Assessing the credibility of individual company’s emission reduction targets is not part of CC&L’s quantitative investment process.

15. What forward-looking metrics do you use to assess an investment’s alignment with global temperature goals?

CC&L does not currently utilize any forward-looking metrics to assess investment’s alignment with global temperature goals.

16. Has your firm produced a Task Force on Climate-Related Financial Disclosures (TCFD) report? If yes, please provide a link to the most recent report.

Please refer to the link Climate-Related Disclosure - 2021 for CC&L’s TCFD Report.

17. Has your firm produced a Sustainability Accounting Standards Board (SASB) report? If yes, please provide a link to the most recent report.

Not applicable.

Diversity

18. Please provide the composition of your senior leadership team and board of directors, including women and visible minorities. How do you encourage diversity of perspectives and experience?

- 34% of employees at CC&L are female.

- 23% of CC&L’s owners are female.

- 14% of the board of directors are female.

- 25% of CC&L’s Quantitative Equity Investment Team are female.

* CC&L Investment Management currently does not track minority, legally protected racial or ethnic groups, disability or protected veterans.

CC&L Financial Group’s approach to Diversity, Equity, Inclusion and Belonging (DEIB) is documented in CC&L Financial Group & Affiliate Diversity, Equity, Inclusion and Belonging Policy. The firm’s approach to DEIB is relevant to its practices and policies on recruitment and selection, compensation and benefits, professional development and training, promotions and social programs.

CC&L Financial Group and its affiliates are committed to workforce diversity, promoting equity and creating a culture of inclusion. To ensure people feel a sense of belonging, the firm strives to foster a culture that unites people of diverse backgrounds and perspectives, in an environment where everyone has the opportunity to achieve personal and professional success. CC&L Financial Group’s DEIB is aligned with the firm’s three overarching organizational goals of Community, Growth and Recognition.

DEIB contributes to the vitality and quality of the firm’s work environment and in turn this strengthens the business. It helps the organization identify, attract and retain high quality people. It enables those who work at the firm to be themselves and make their best contributions. It facilitates collaboration to solve business problems, and it helps create the conditions needed for learning from mistakes, questioning the status quo, incorporating varied views and fostering innovation.

Across CC&L Financial Group, Diversity means the welcoming and presence of aspects that make us different including (but not limited to) gender, age, religion, (dis)ability, sexual orientation, socioeconomic status, language, culture, education, personality, skill set, experience, and knowledge. Equity means promoting fairness in the firm’s policies, procedures, resources and decision making, so that everyone has the opportunity to succeed in their role. Inclusion means building a work environment that fosters collaboration, support and respect, where everyone’s thoughts, ideas and perspectives matter. Belonging is something people feel. CC&L Financial Group’s efforts strive to result in people feeling accepted, valued and connected with the company.

CC&L Financial Group has six objectives to promote DEIB:

- Understand where the organization is and seek to continuously improve.

- Research and keep current on themes related to DEIB and share this information with the organization. As part of this, make recommendations about industry initiatives and/or changes that the organization may want to consider as a business.

- Continually review the policies, procedures, and resources and identify improvements to support people to achieve their best.

- Recommend actions that support creating and nurturing an inclusive environment where everyone feels safe to bring their whole self.

- Deliver ongoing education, communications and events to discuss initiatives and promote a culture of celebration throughout the year.

- Partner with the CC&L Foundation to augment the impact of the DEIB initiatives.

CC&L understands that the existence of role-models, mentoring and peer support helps individuals to feel a sense of belonging and stronger work community. For example, there has been positive feedback about mentoring and stronger networks among some groups of people who share similar backgrounds, which has developed organically. For individuals who are interested, the firm encourages them to raise mentoring with their manager or reach out to peers to form affinity groups. In addition, CC&L offers webinars and networking opportunities for individuals to build professional

relationships.

CC&L and CC&L Financial Group pursue ongoing activities and initiatives to support these efforts in line with the CC&L Diversity, Equity, Inclusion & Belonging (DEIB) Policy.

In March 2021, the CC&L Foundation launched a scholarship program for students from diverse backgrounds. This scholarship will help alleviate some the financial barriers that limit access to higher education. CC&L believes that education contributes to the economic health of communities and empowers the next generation with the skills required to reach their potential. The firm recognizes that there are many dimensions to DEIB and have identified the following initial areas of support: Black students, Indigenous students, Female students, LGBTQ+ students and Disabled students. In addition to providing financial support, CC&L identifies volunteers from across the organization to act as mentors to the recipients of each scholarship.

CC&L also hosts webinars and networking opportunities for all employees for the purpose of supporting inclusion and mentorship. Recent examples include:

- In February 2024 CC&L hosted two webinars. One was to mark Black History Month, featuring Sean Mauricette, highlighting racial biases that persist, and strategies that benefit all and support a more inclusive and welcoming work environment. The second was to mark Lunar New Year, featuring Robert Sung, highlighting the significance and symbolism of this holiday and how it is celebrated across different Asian communities.

- In March 2024, CC&L hosted a presentation to celebrate International Women’s Day featuring Canadian Diversity Champion (Women of Influence) Fiona MacFarlane.

- In April and June 2024, CC&L hosted presentations to mark International Day of Pink and Pride Month, featuring guest speakers from PFLAG Canada (Stephanie Woolley and Anne Creighton) to share on allyship and how to support youth within the LGBTQ2+ community, and featuring staff speakers sharing on their experiences in these areas.

- In June 2024, CC&L provided staff with access to 4 Seasons of Reconciliation, which is a unique online course that promotes a renewed relationship between Indigenous Peoples and Canadians through transformative learning about truth and reconciliation.

There are several ongoing initiatives which are focused on company culture that enhance mentorship and peer support. Many of these ideas came from CC&L’s Women in Leadership initiative which started in 2021. For more details, please click here for the executive summary and detailed report of the Women in Leadership initiative.

The initiatives underway will benefit all staff, including women. Some examples are:

- Leadership development training for all staff to ensure that everyone has the foundational competencies related to self-leadership. This serves as a base for further leadership development opportunities that are specific to individual career paths, such as the areas of technical or people leadership. Staff are organized into cohorts during training where they have an opportunity to build cross-team relationships as they undergo education together.

- Fostering a culture of ongoing, real-time feedback through education and training for everyone at CC&L that was led by a third-party consulting business.

Launching a new career development program with updated materials and providing formal training to staff and leaders to ensure consistent application, clarity of roles in the career development process, optimal employee/career coach alignment and tracking as people create and progress on their career development plans. Within this framework, staff and their reporting manager can identify other peers or leaders in the firm who can act as career mentors in the career development plan.

Proxy Voting

19. Do you use an external proxy voting service such as ISS or Glass Lewis? If yes, please specify.

Yes, the global proxy research and voting services of Institutional Shareholder Services Inc. (ISS) are employed to help analyze and vote proxies on behalf of CC&L’s clients.

20. If the answer to the previous question is no, please describe your proxy voting guidelines.

Not applicable.

21. If you use an external proxy voting service, do you customize your guidelines for proxy voting? If yes, describe your customized guidelines. If you use the default service guidelines, describe how often and in which situations you deviate from the external proxy voting service recommendations.

Yes, the global proxy research and voting services of Institutional Shareholder Services Inc. (ISS) are employed to help analyze and vote proxies on behalf of CC&L’s clients. ISS prepares the voting recommendations in accordance with the firm’s customized guidelines for all items for which it is entitled to vote. CC&L will generally rely on these recommendations; however, certain situations will warrant additional review and may result in CC&L voting contrary to ISS’ recommendations.

Please refer to link provided below that guides CC&L’s approach to proxy voting.

22. What proportion of the time do you vote with or against management on shareholder resolutions, board appointments, and auditor appointments? What proportion of the time do you vote with or against management on ESG issues? How does this break down for climate, diversity, and remuneration issues?

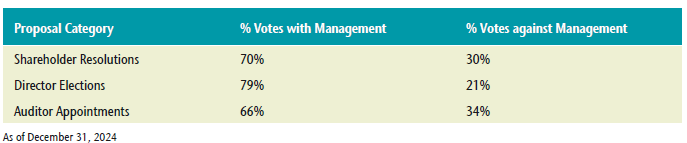

CC&L has a fiduciary duty to vote proxies both in a timely manner and in the best interests of clients. In 2024, from time-to-time CC&L voted with and against the management, below is breakdown of the same.

Proportion of time CC&L voted with/against the management on shareholder resolutions, board and auditor appointments:

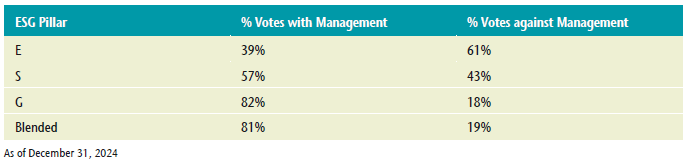

Proportion of time CC&L voted with/against the management on ESG issues:

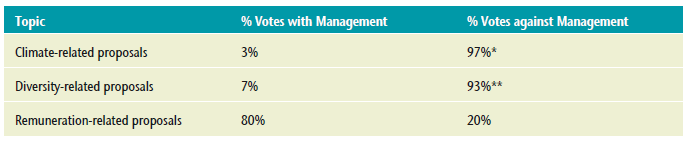

Proportion of time CC&L voted with/against the management on Climate, Diversity and

Remuneration issues:

Engagement

23. What are your engagement goals? Are these goals outcome/action-based (e.g. decreases in emissions or increases in number of women on the board) or means-based (reporting on emissions or number of women on the board)?

The quantitative equity investment team is not directly involved with engagement activities as engagement is not specifically part of CC&L’s quantitative equity process. That said, the S&E team and CC&L’s fundamental equity analysts and portfolio managers proactively engage with investee companies and collaborate with like-minded investors. The primary objectives of CC&L’s engagement activities are to improve and protect the long-term risk-adjusted performance of our portfolios and to improve the availability of decision-useful information available to investors. CC&L’s engagement activity currently focuses on the Canadian universe where CC&L believes they have the largest influence given their holdings across their fundamental and quantitative mandates. The outcomes benefit all of CC&L’s Canadian strategies, including their Canadian quantitative mandates.

In 2024, the ESG Committee reviewed the engagement activities and processes to determine how best to augment engagements carried out by investment teams with additional engagements by the CC&L Financial Group Stewardship & Engagement (S&E) team, including greater attention to leveraging collaborative initiatives and considering the use of a third-party service. This will expand the Firm’s scope of focus beyond Canada to global markets. This project is on-going and expected to be completed in 2025.

24. What is your policy around the escalation of engagement; how and why might this happen and what is the ultimate tool you might use (e.g. voting against board re-election, etc.)?

Should a company be unresponsive to CC&L’s engagement or concerns, the portfolio managers may consider various escalation strategies, such as using the firm’s voting rights in support of these engagement goals. Voting escalations may include voting against the election of certain directors in the annual general meeting following the engagement, voting against management’s recommendation on a proposal, or voting against management’s recommendation on a shareholder resolution. Escalation activities will be undertaken at the discretion of the portfolio manager when the issue is deemed to be material and prior engagement efforts have not been successful. CC&L doesn't have any restriction on the escalation measures that could be used.

That said, given the small exposures across a large number of holdings and the turnover in our quantitative portfolios, engagement with management of the companies we invest in is not an explicit part of our quantitative investment process. However, as mentioned, the ESG Committee is overseeing a project to enhance the firm’s approach to stewardship and engagement expanding the firm’s scope of focus beyond Canada to include global markets. This project is ongoing and expected to be completed in 2025.

25. Describe a specific example of your firm’s engagement with a company over the past year, including the outcome and any lessons learned.

Given the small exposures across a large number of holdings and the turnover in our quantitative portfolios, engagement with management of the companies we invest in is not an explicit part of our quantitative investment process.

Historically, our firm-level engagement activity has focused on the Canadian universe where we believe we have the largest influence given our holdings across our fundamental and quantitative mandates. The Canadian holdings across all of our quantitative mandates have benefited from the firm-level engagement activities. As mentioned above, the ESG Committee is overseeing a project to enhance the firm’s approach to stewardship and engagement that will expand the firm’s scope of focus beyond Canada to include global markets.

Engagement:

METHANEX

In October 2024, as part of Connor, Clark & Lunn Financial Group (CC&LFG), CC&L participated in a collaborative Climate Engagement Canada (CEC) engagement with Methanex Corporation (MX), a Canada-based methanol producer. The objectives were to encourage MX to set a long term GHG emissions reduction target, adopt a credible decarbonization strategy, and disclose details of its public policy engagement on climate. MX shared its progress towards achieving its 2030 GHG emissions reduction target but highlighted the lack of a supportive policy environment as a key barrier to setting a long-term emissions reduction target. Regarding its decarbonization strategy, MX provided updates on its ongoing CCUS project at its Medicine Hat facility in Alberta, expansion of its Low Carbon Solutions team, and outlined several low carbon methanol production opportunities. On public policy engagement, MX highlighted some of the recent initiatives conducted by its trade associations, including the Methanol Institute and Chemistry Industry Association of Canada (CIAC). The group encouraged MX to disclose additional details regarding its trade associations and lobbying efforts.

Outcome: CC&L followed up with MX to share resources related to best practices disclosures around scope 3 emissions and climate lobbying. CC&L will continue to monitor MX’s progress on the topics raised and is looking to arrange a follow-up CEC engagement in 2025.

VEREN, INC.

In November 2024, CC&L met with management at Veren, Inc. (VRN), a Canadian oil and gas exploration and production company, as part of CC&L’s wider 2024 ESG focus engagement program. The engagement objectives were for VRN to adopt a long-term Net Zero target, disclose material scope 3 emissions, and to improve the measurement and disclosure of biodiversity-related environment impacts. VRN shared updates on their sustainability progress, including that they had achieved their scope 1 and 2 2025 emissions reduction target ahead of schedule and expected to do the same for their water and land targets. VRN cited the lack of a supportive policy environment and uncertainty around Bill C-59 greenwashing risk as challenges to setting a long-term emissions target. VRN also noted that while the board has chosen to not disclose scope 3 emissions, the company had measured and assured these emissions and was prepared to report these if it became a regulatory requirement. Finally, VRN highlighted their key biodiversity initiatives and intent to increase reporting and target-setting in the near term. CC&L commended VRN on their progress against emission targets and empathized with uncertainty around Bill C-59 but encouraged the disclosure of scope 3 emissions and the adoption of an ISO-certified EMS for managing environmental risks.

Outcome: CC&L will continue to monitor VRN’s progress on the topics raised and is looking to arrange a follow-up engagement in 2025.

Disclaimer

This report may contain information obtained from third parties including: Merrill Lynch, Pierce, Fenner & Smith Incorporated (BofAML), S&P Global Ratings, and MSCI.

Source: Merrill Lynch, Pierce, Fenner & Smith Incorporated (BofAML), used with permission. BofAML permits use of the BofAML indices related data on an "As Is" basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the BofAML indices or any data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing, and does not sponsor, endorse, or recommend Connor, Clark and Lunn Investment Management, or any of its products.

This may contain information obtained from third parties, including ratings from credit ratings agencies such as S&P Global Ratings. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. MSCI makes no express or implied warranties or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. This report is not approved, reviewed or produced by MSCI.