Revenue and Cost Recoveries Glossary of Terms (PDF, 95 KB)

Revenue and Cost Recoveries Quick Guide (PDF, 460 KB)

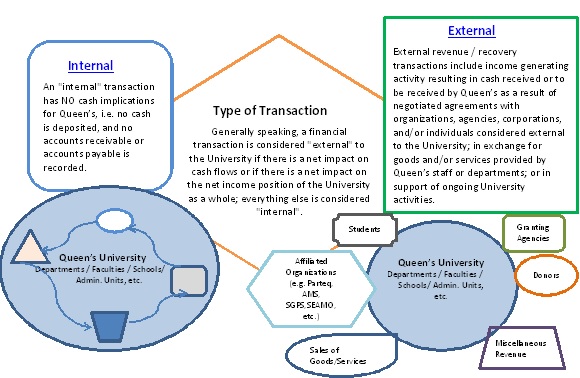

Type of Transaction

The Importance of Distinguishing Between Internal and External Transactions

All transactions, regardless of whether they are considered "internal" or "external", must comply with certain financial management objectives (e.g. timely recording of transactions and adequate supporting documentation).

The ability to track and report on "external" financial transactions separately from those considered "internal" is important for:

University external financial reporting, so that:

- revenues and expenses are not overstated due to the inclusion of "internal" financial transactions

- the Queen's annual financial statements are prepared in accordance with Canadian Generally Accepted Accounting Principles (GAAP)

Faculties and departments, so that:

- analysis can be done to assess how much of the reported revenue is being generated from increased cash flows versus the "reallocation" of existing cash flows among internal units.

For a closer look at this diagram please click here.

Internal Transactions

An internal transaction has NO cash implications for Queen's, (i.e. no cash is deposited, and no accounts receivable or accounts payable is recorded). Usually a journal entry is required.

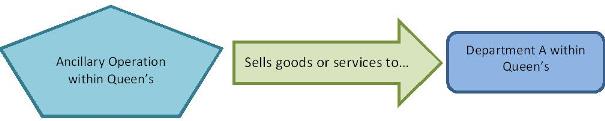

Internal Sales

Only ancillary operations (fund 20000) should record internal sales.

The sale of a good or service from an Ancillary Operation to a Queen's University department or unit where the price of the good or service includes a "mark-up" which provides for a recovery of other indirect costs incurred. There is no net impact on the cash flows or net income of the university.

The sale of a good or service between Queen's University departmental units where the price of the good or service includes a "mark-up" which provides for a recovery of other indirect costs incurred. This is no net impact on the cash flows or net income of the university.

Account 450101 has been created to be used exclusively to record internal sales. Regular expense accounts are to by used for the expense side of the transaction. Financial Services will ensure on an annual basis, as part of the year-end financial reporting process, that internal sales offset internal expenses for the purposes of the university's external financial statements.

There should be no entry to Accounts Receivable or Accounts Payable. The internal sale is recorded as a sale by the selling department and as a cost to the receiving department at the same time.

Transactions must be recorded in the fiscal period in which the goods are received or the services are rendered. The primary concerns are:

- Reporting Accuracy - when payments are from research grants or other restricted awards, attention must be paid to the fiscal period of the award.

- Compliance with funding limitations - where restricted funding includes an expiry date - as it does with most research awards - internal billing for goods or services to be delivered after the expiry date is a violation of award terms.

- Sound internal financial management - recording transactions on a timely basis supports a unit's ability to monitor and manage their financial resources.

Internal Sales are processed using either a journal entry or other internal administrative system. When billing for goods and/or services, records should include:

- a customer order

- a detailed record of services provided and the date of delivery

- a reasonable description of the goods or services should be provided - if the charges are not based on a price per unit, there should be an appropriate description of the level of services and the basis of arriving at the charge for that services

- the date or period the services was rendered

Internal Sales are not subject to HST. However, these sales normally include any taxes net of HST rebate that may have been paid or collected. For more information on HST, go to GST/HST

Examples

1. Ancillary Operation A sells services to internal university clients. The direct cost of the service is estimated by Ancillary Operation A to be $45/hour. Ancillary Operation A charges other departments/units $46/hour for the service to allow for a partial recovery of the unit's facility costs. Because the price of the service generates a contribution to indirect costs of $1/hour, this would be considered an internal sale. Examples of Internal Sales within the University are Food Services, Donald Gordon Centre bookings for university departments, etc.

2. Queen's Event Services runs conference registration for Queen's School of Business Undergraduate Program

| Payment Form | Fund | Department | Account | Amount | Description |

|---|---|---|---|---|---|

| Debit: | 20000 | 12001 | 604016 | 5,000 | Student Activities |

| Credit: | 20000 | 18101 | 450101 | (5,000) | Internal Sales & Service Revenue |

Internal Cost Recovery

Internal Cost Recovery is when one Queen's University department or unit recovers expenses from another Queen's University department or unit. There is no net impact on the cash flows or net income of the University.

The billing department should maintain records which clearly identify the original payment(s) made on behalf of the internal customer and for which recovery is being made.

The guiding principle should be that the information links the charges to the original payment such that a reviewer (e.g. auditor), would have no difficulty in identifying the original payment(s). Below are examples of the records that the billing department should maintain for some items that are commonly recovered:

- salaries and benefits, the name of the individual and the period in which salary was paid

- long distance telephone charges, the month in which the related invoices were paid by the department

- photocopying charges billed on a recovery basis, the unit charge, the number of copies and the period copiers were supplied - where there are detailed records of customer charges it is acceptable to identify only the month in the description

- other expense recoveries, the document number of the original payment

The "Recovery" transaction must not:

- be recorded in advance of the source transaction (i.e. payment of an invoice)

- be used to record a transfer of funding (i.e. revenue transfer) to another departmental unit or research project.

Internal Cost Recoveries are NOT subject to HST. However, these charges normally include any taxes net of HST rebate that may have been paid or collected. For more information on HST go to GST/HST.

The prime financial objectives for Internal Cost Recovery are:

- to record transactions in the correct period, and

- to maintain financial records which adequately support the legitimacy and appropriateness of the transactions

Examples

1. Fund 10000 Department 11170 is recovering photocopying charges from an Internal Fund 80501 Department 11170

| Payment Form | Fund | Department | Account | Program | Amount | Description |

|---|---|---|---|---|---|---|

| Debit: | 8501 | 11170 | 606001 | 1,000.00 | Printing/Photocopying | |

| Credit: | 10000 | 11170 | 606009 | (1,000.00) | ICR* - Printing Services |

2. PPS Fund 10000 Department 44301 is recovering maintenance charges from an Internal Fund 10000 Department 11540

| Payment Form | Fund | Department | Account | Program | Amount | Description |

|---|---|---|---|---|---|---|

| Debit: | 10000 | 11540 | 660009 | 5,000.00 | Physical Plant Expenses | |

| Credit: | 10000 | 44301 | 660019 | (5,000.00) | ICR* - Renovations & Alterations |

*ICR = Internal Cost Recovery

For a complete list of Accounts go to Account ID's

Revenue Transfers

Revenue Transfers are transactions that reallocate funds from one unit within Queen's to another unit within Queen's. Similar to Internal Revenues or Internal Cost Recoveries, there is no net impact on the cash flows or income of the university.

Examples include research startup or funds provided in support of an identified program or project.

Use Account 480001 to record Revenue Transfers. This account must be used for both sides of the Journal Entry.

This account should NOT be used if funds are being transferred to an entity outside of Queen's or to an Agency Fund. (a 9XXXX Fund)

Example

Revenue is allocated from Operating Fund 10000 Department 11540 to Fund 10000 Department 11600 Program 45001 to support a staff appreciation day in that department.

| Payment Form | Fund | Department | Account (same account is used for both sides of the transaction) | Program | Amount | Description |

|---|---|---|---|---|---|---|

| Debit: | 10000 | 11540 | 480001 | 1,000.00 | Revenue University Funds | |

| Credit: | 10000 | 11600 | 480001 | 45001 | (1,000.00) | Revenue University Funds |

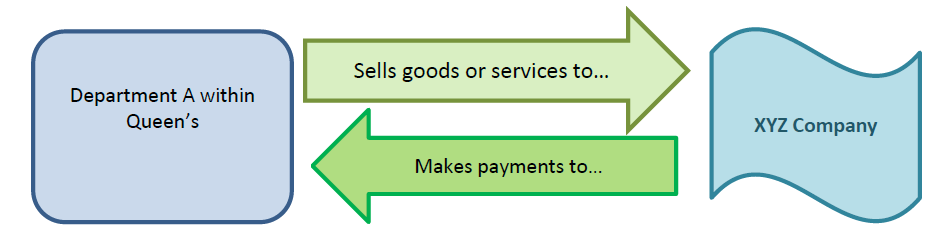

External Transactions

An External Revenue or External Recovery Transaction will have net cash implications to Queen's University. The transaction will eventually result in cash being deposited to University bank accounts. The transactions include income generating activity resulting in cash received or to be received by Queen's as a result of negotiated agreements with organizations, agencies, corporations, and/or individuals considered external to the University in exchange for goods and/or services provided by Queen's staff or departments, or in support of ongoing University activities.

External Revenue

External Revenue for Queen's are generated through funds received by departments from external sources in exchange for goods and services provided by departments, non-credit student fees, and miscellaneous fees, rentals, etc.

External Revenues for Queen's are generated through funds received by departments from external sources in exchange for goods and services provided by departments/units: non-credit student fees, miscellaneous fees, rentals, etc.

External Revenues are generated primarily through the following sources:

| Source | Description |

|---|---|

| Sales of Goods and/or Services | Funds received from external sources in exchange for goods and services provided by departments. This activity is recorded by the departments using the appropriate accounts. |

| Miscellaneous Revenue | These sources of income (i.e. miscellaneous fees, rentals, etc.) are not usually material in dollar value and are processed by the department generating the revenue. |

| Student Fees | Most student fees are processed through the PeopleSoft student system. Some non-credit student fees are processed by departments, using appropriate accounts. |

| Government Operating Grants | Most government operating grants are received and recorded through the Planning and Budget Office. |

| Donations | Donations should be recorded through the Advancement System and therefore directed to the Office of Advancement for processing. |

| Research Awards | Research awards should be directed to Research Accounting for processing. |

Whether providing goods and services to external customers on a sales or cost recovery basis, there are five key financial objectives that departments must consider:

- limit contractual liability

- set prices sufficient to cover all costs

- record transactions in the correct period

- collect amounts due, and

- correctly calculate sales taxes

1. Limit Contractual Liability

When transacting with external customers it is important that departments:

- avoid unreasonable requirements for indemnification (damages or a sum of money paid in compensation for loss or injury), and

- protect the university against loss associated with inadequate performance

2. Set Prices Sufficient to Recover All Costs

Queen's University generally does not have a "profit motive" as it is a not-for-profit organization, however, like a commercial enterprise, it must seek to keep its costs in line with its revenues.

For the most part the university has limited control over its revenues, the largest components of which are provincial government grants and student fees, the majority of which are controlled by the government. Therefore, the focus of the university is primarily on controlling costs. (i.e. Carrying out the mission of the university within its budget constraints.)

In the case of divisional income and some expense recoveries, the divisions are able to exercise control by:

- negotiating financial agreements under which the university will be compensated for all costs of goods and services - where the intention is to generate a profit to enhance the university mission (i.e. for self-funded units and ancillary operations), the ability to meet this objective must be determined with reference to all costs of the service (both direct and indirect)

- declining arrangements which do not cover all costs

As a public institution, Queen's should not undercut the market prices.

View next drop-down tab for continued steps.

For any service provided by the university, there are both direct and indirect costs. (Both of which divisions should seek to recover.)

Direct Costs

The "selling" department should ensure that, at a minimum, all direct costs of the service are reflected in the charge to the customer. Direct Costs are those which are traceable to the specific activity. For example, with respect to administrative costs, if the amount of administrative time is such that it is reasonably measurable, i.e. hours or percentage of time, then it is a traceable and, therefore, a Direct Cost.

Indirect Costs

Departments which price their services on the basis of Direct Costs only are underpricing since the objective of full cost recovery is not met. There are three levels of Indirect Costs which the "selling" department should consider:

- Departmental - Departmental costs which are not traceable to specific activities in the department, i.e. to research, instruction or a service. Indirect departmental costs include the salaries of chairs and administrative staff, regular telephone service, supplies not specifically charged out, etc.

- Faculty - Cost of faculty administration, i.e. the faculty office

- University-wide costs should be considered when determining Indirect Cost

Total Cost

The total cost of the service is the sum of Direct and Indirect Costs, and it is the Total Cost which should be used as the basis for the price of the service, whether charged on a cost or cost plus basis.

Taxes

Departments are responsible to charge and collect applicable taxes on External Revenues. For more info on taxes, please visit GST/HST.

3. Recording Transactions in the Correct Period

Charges must be recorded in the fiscal period for which the goods are received or the services are rendered.

Primary concerns are:

- Reporting Accuracy - External Revenue and any related operating expenses must be recorded in the university fiscal year in which they occur

- Compliance with funding limitations - Where restricted funding includes an expiry date (as it does with most Research Awards), billing for goods or services to be delivered after the expiry date is a violation of award terms.

As a general rule, there should be no pre-billing for deliveries to be made (or services to be provided) beyond the fiscal period. In addition, there should be no delay in billing beyond a fiscal period for goods delivered or services rendered in a previous fiscal period.

It is expected that all sales invoices and internal revenues and recovery transactions will be processed by the year-end-cutoff and, therefore, it should not be necessary to accrue income.

If an accrual over $100,000 is necessary, contact Financial Services for assistance. No amounts less than $100,000 will be accrued.

In some cases, the university receives funds for which there are external restrictions. In these cases, revenues can only be recorded when the related expenses are incurred. At year end (April 30), departments must inform Financial Services of any situations where cash received exceeds related expenditures because it will be necessary to defer the revenue. This will be done centrally using a central department. No amounts of less than $100,000 will be deferred.

4. Collect Amounts Due

For most invoices related to external revenue the terms of payment are due upon receipt of invoice.

The selling department is responsible for the collection of amounts due. Financial Services does not contact customers, or otherwise pursue outstanding Accounts Receivable.

Departments should record External Revenue activity in PeopleSoft using the appropriate revenue GL account. These are generally in the 45XXXX and 46XXXX series of accounts.

For a complete listing of Accounts, go to Account ID's

Example

Queen's University sells conference space to the Downtown Kingston BIA

| Payment Form | Fund | Department | Account | Program | Amount | Description |

|---|---|---|---|---|---|---|

| Debit: | 10000 | 18101 | 120113 | 4419 | 1315.32 | Downtown Kingston BIA Event |

| Credit: | 10000 | 18101 | 450013 | (1164.00) | Sale of Conference Space | |

| Credit: | 10000 | 18101 | 210080 | (151.32) | HST on Sale of Conf. Space |

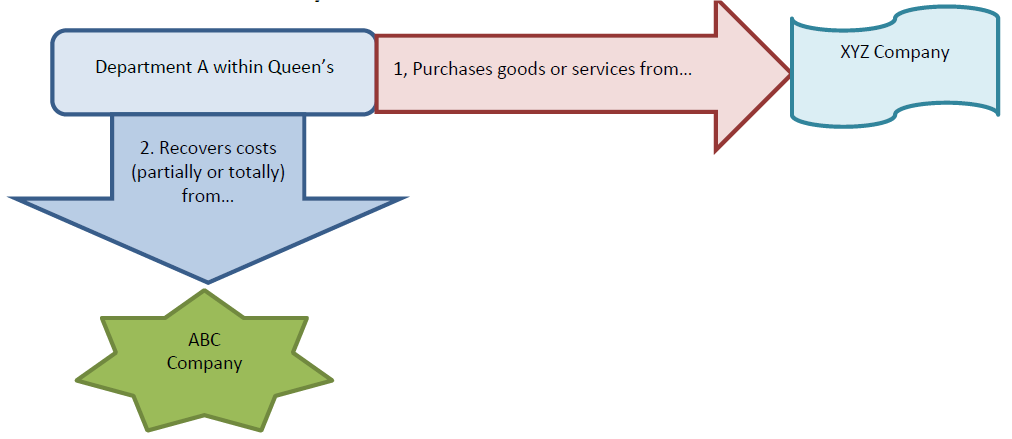

External Cost Recovery

An External Cost Recovery is when an initial expense is first incurred through an external party and then recovered partially or in full from an external source.

An External Cost Recovery is when an initial expense is incurred and then either partially or fully recovered from an external source/party.

Initial Expense = net cash outflow to the university

External Cost Recovery = net cash inflow to the university

Charges must be recorded in the fiscal period for which the goods are received or the services are rendered.

The primary concerns are:

- Reporting Accuracy - External Cost Recoveries and any related operating expenses must be recorded in the University fiscal year in which they occur.

- Compliance with Funding Limitations - Where restricted funding includes an expiry date (as it does with most Research Awards) billing for goods and services to be delivered after the expiry date is a violation of the Award Term.

Accruals

As a general rule, there should be no pre-billing for deliveries to be made (or services to be provided) beyond the fiscal period. In addition, there should be no delay in billing beyond a fiscal period for goods delivered or services rendered in a previous fiscal period. It is expected that all sales invoices and internal sales and recovery transactions will be processed by the year-end-cutoff and, therefore, it should not be necessary to accrue income. If an accrual over $100,000 is necessary, contact Financial Services for assistance. No amounts less than $100,000 will be accrued.

Departments are responsible to charge and collect applicable taxes on the initial expense. For more information on taxes, go to GST/HST.

For most invoices related to External Cost Recoveries the terms of payment are due upon receipt of the invoice.

The selling department is responsible for the collection of amounts due. Financial Services does not contact customers, or otherwise pursue outstanding Accounts Receivable.

There are two main strategies for the recording of External Cost Recoveries:

1. Expense Recovery - This is generally referred to as the "Expense Recovery" approach, and used when it is determined that the University is ultimately responsible for 100% of the cost by managed to offset the cost through partial or total recovery. Leave the total cost of the expense item at 100% and record the "recovery" monies received as a REVENUE item using the appropriate "490XXX" account.

Example: Expenses are recovered from KGH through the Revenue Recovery account. In this circumstance, the Revenue Account is used because Queen's is responsible to pay the full expense.

| Payment Form | Fund | Department | Account | Program | Amount | Description |

|---|---|---|---|---|---|---|

| Debit: | 10000 | 42098 | 100001 | 10,084.00 | Jan 2013 KGH #xxxxxx | |

| Credit: | 85000 | 13001 | 490011 | 13361 | (10,084.00) | Jan 2013 KGH Recovery |

2. Cost Sharing - This is generally referred to as the "Cost Sharing" approach and used when it is determined that the University, as a whole, is ultimately responsible for only part of the cost. Directly decrease the total cost of the expense item by recording the "recovery" monies received against the appropriate expense account, thereby reducing the total EXPENDITURES recorded for the department.

Example: Queen's Chemical Engineering shares the cost of maintaining a piece of equipment with RMC. Although Queen's pays the full cost of the maintenance, Queen's only budgets for the 50% share.

| Payment Form | Fund | Department | Account | Amount | Description |

|---|---|---|---|---|---|

| Debit: | 10000 | 15201 | 120119 | 5,300.00 | AR - External Sales |

| Debit: | 10000 | 15201 | 616002 | 5,300.00 | Equipment Maintenance |

| Credit: | 10000 | 42098 | 100001 | (10,600.00) | Cash |

*Only Queen's portion (50%) gets expensed.